正在加载图片...

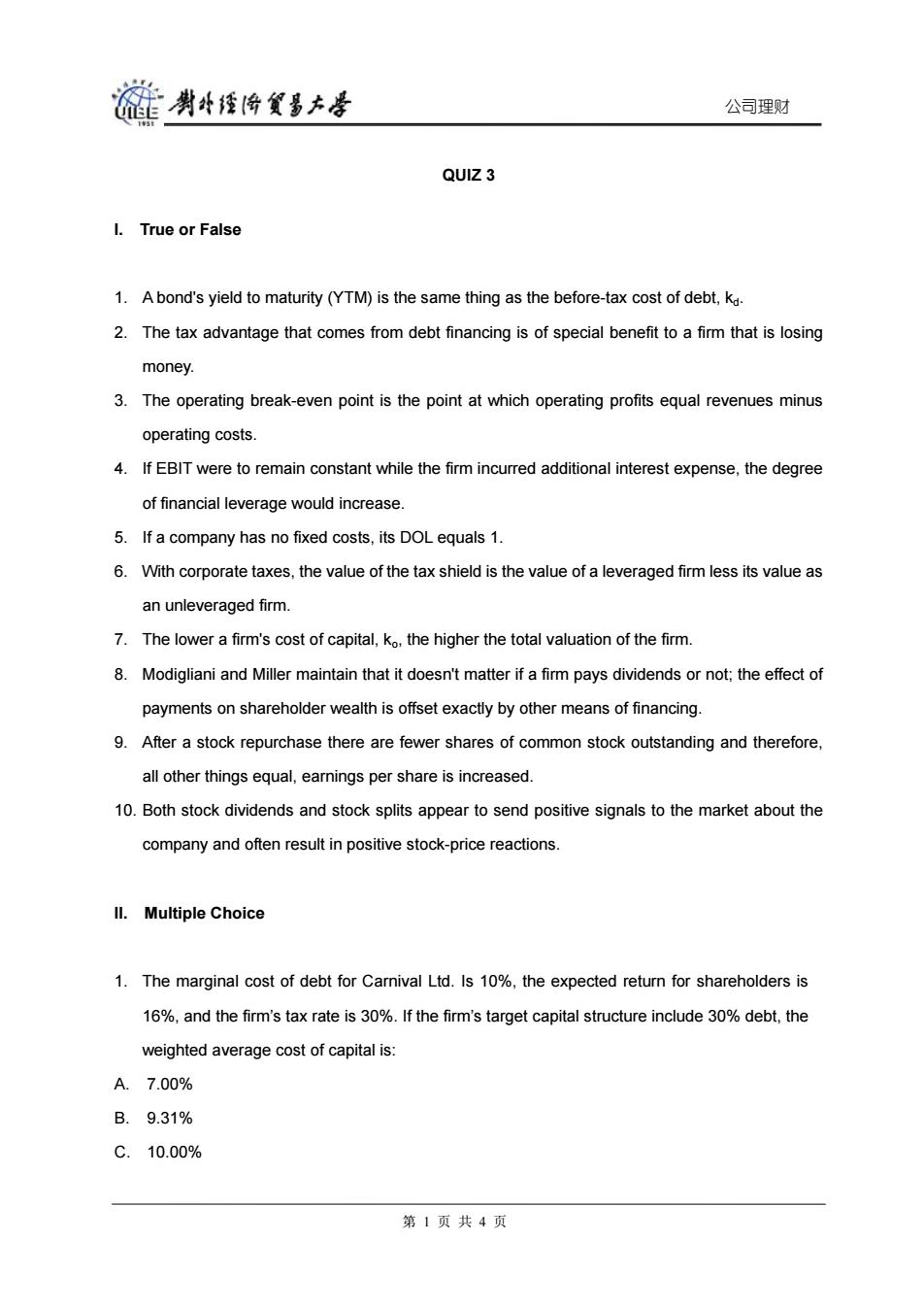

旋剥经降贸墨去号 公司理财 QUIZ 3 I.True or False 1.A bond's yield to maturity (YTM)is the same thing as the before-tax cost of debt,kd. 2.The tax advantage that comes from debt financing is of special benefit to a firm that is losing money. 3.The operating break-even point is the point at which operating profits equal revenues minus operating costs. 4.If EBIT were to remain constant while the firm incurred additional interest expense,the degree of financial leverage would increase 5.If a company has no fixed costs,its DOL equals 1. 6.With corporate taxes,the value of the tax shield is the value of a leveraged firm less its value as an unleveraged firm. 7.The lower a firm's cost of capital,ko,the higher the total valuation of the firm. 8.Modigliani and Miller maintain that it doesn't matter if a firm pays dividends or not;the effect of payments on shareholder wealth is offset exactly by other means of financing. 9.After a stock repurchase there are fewer shares of common stock outstanding and therefore, all other things equal,earnings per share is increased. 10.Both stock dividends and stock splits appear to send positive signals to the market about the company and often result in positive stock-price reactions. Il.Multiple Choice 1.The marginal cost of debt for Carnival Ltd.Is 10%,the expected return for shareholders is 16%,and the firm's tax rate is 30%.If the firm's target capital structure include 30%debt,the weighted average cost of capital is: A.7.00% B.9.31% C.10.00% 第1页共4页公司理财 QUIZ 3 I. True or False 1. A bond's yield to maturity (YTM) is the same thing as the before-tax cost of debt, kd. 2. The tax advantage that comes from debt financing is of special benefit to a firm that is losing money. 3. The operating break-even point is the point at which operating profits equal revenues minus operating costs. 4. If EBIT were to remain constant while the firm incurred additional interest expense, the degree of financial leverage would increase. 5. If a company has no fixed costs, its DOL equals 1. 6. With corporate taxes, the value of the tax shield is the value of a leveraged firm less its value as an unleveraged firm. 7. The lower a firm's cost of capital, ko, the higher the total valuation of the firm. 8. Modigliani and Miller maintain that it doesn't matter if a firm pays dividends or not; the effect of payments on shareholder wealth is offset exactly by other means of financing. 9. After a stock repurchase there are fewer shares of common stock outstanding and therefore, all other things equal, earnings per share is increased. 10. Both stock dividends and stock splits appear to send positive signals to the market about the company and often result in positive stock-price reactions. II. Multiple Choice 1. The marginal cost of debt for Carnival Ltd. Is 10%, the expected return for shareholders is 16%, and the firm’s tax rate is 30%. If the firm’s target capital structure include 30% debt, the weighted average cost of capital is: A. 7.00% B. 9.31% C. 10.00% 第 1 页 共 4 页