正在加载图片...

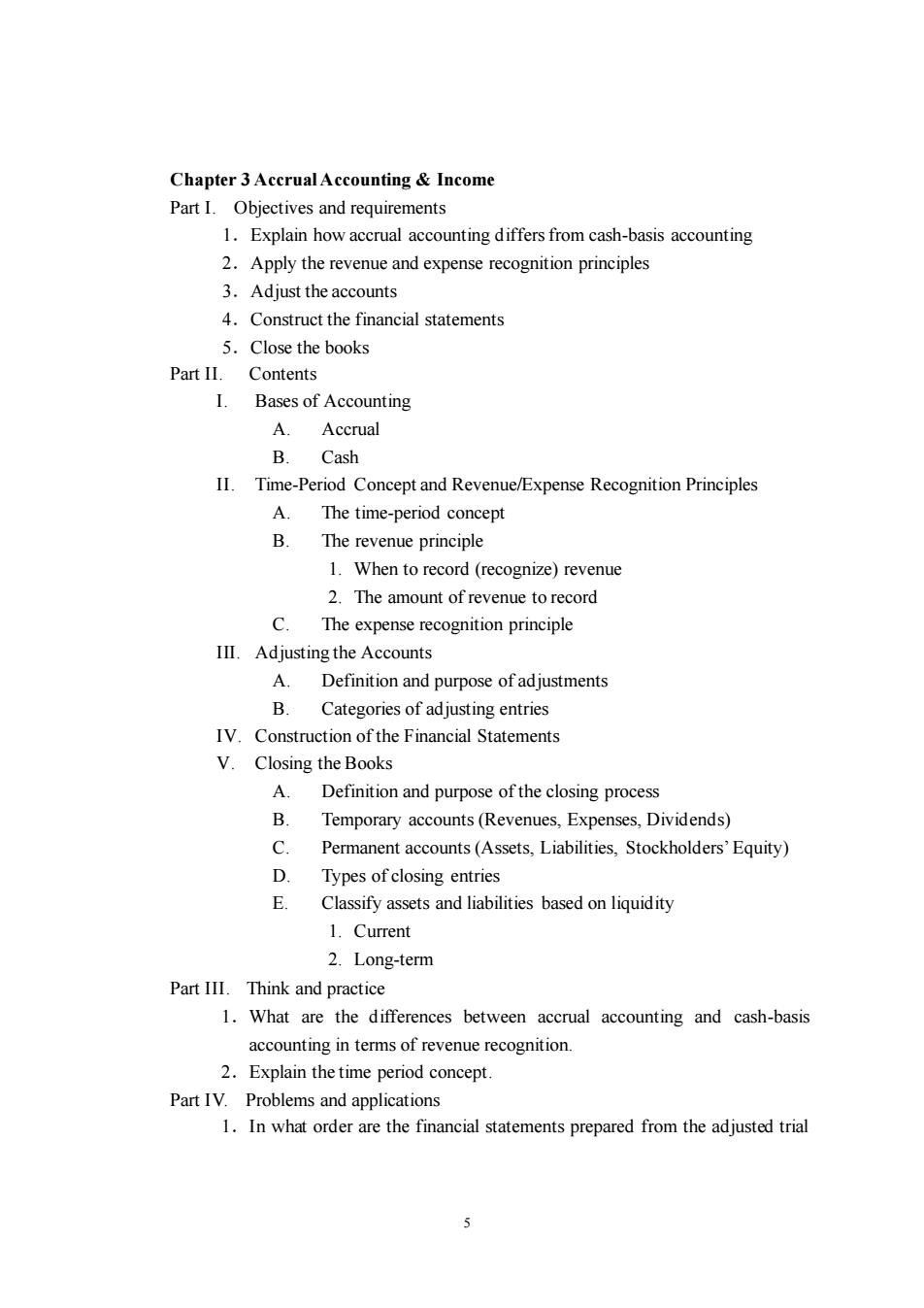

Chapter 3 Accrual Accounting Income Part I.Objectives and requirements 1.Explain how accrual accounting differs from cash-basis accounting 2.Apply the revenue and expense recognition principles 3.Adiust the accounts 4.Construct the financial statements 5.Close the books Part II. Contents I.Bases of Accounting Accrual B Cash II.Time-Period Concept and Revenue/Expense Recognition Principle A The time-period concept B The revenue principle 1.When to record(recognize)revenue 2.The amount of revenue to record The expense recognition principle III.Adjusting the Accounts A Definition and purpose ofadjustments B Categories of ad justing entries IV.Construction of the Financial Statements V.Closing the Books A Definition and purpose of the closing process Temporary accounts (Revenues.Expenses,Dividends) Permanent accounts(Assets,Liabilities,Stockholders'Equity) D Types of closing entries E Classify assets and liabilities based on liquidity 1.Current 2.Long-term Part III.Think and practice 1.What are the differences between accrual accounting and cash-basis accounting in terms of revenue recognition. 2.Explain the time period concept Part IV.Problems and applications 1.In what order are the financial statements prepared from the adjusted trial 5 5 Chapter 3 Accrual Accounting & Income Part I. Objectives and requirements 1.Explain how accrual accounting differs from cash-basis accounting 2.Apply the revenue and expense recognition principles 3.Adjust the accounts 4.Construct the financial statements 5.Close the books Part II. Contents I. Bases of Accounting A. Accrual B. Cash II. Time-Period Concept and Revenue/Expense Recognition Principles A. The time-period concept B. The revenue principle 1. When to record (recognize) revenue 2. The amount of revenue to record C. The expense recognition principle III. Adjusting the Accounts A. Definition and purpose of adjustments B. Categories of adjusting entries IV. Construction of the Financial Statements V. Closing the Books A. Definition and purpose of the closing process B. Temporary accounts (Revenues, Expenses, Dividends) C. Permanent accounts (Assets, Liabilities, Stockholders’ Equity) D. Types of closing entries E. Classify assets and liabilities based on liquidity 1. Current 2. Long-term Part III. Think and practice 1.What are the differences between accrual accounting and cash-basis accounting in terms of revenue recognition. 2.Explain the time period concept. Part IV. Problems and applications 1.In what order are the financial statements prepared from the adjusted trial