正在加载图片...

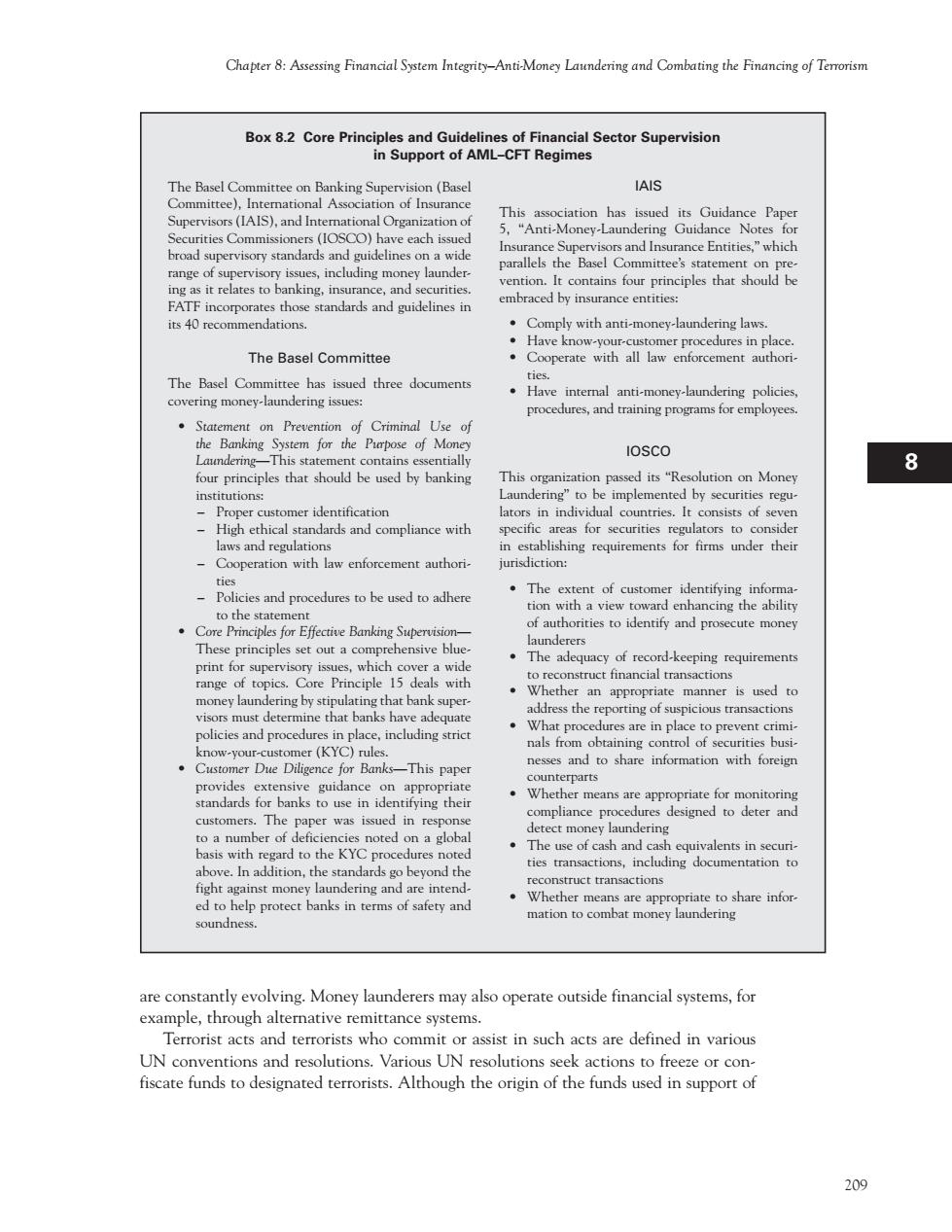

Chapter 8:Assessing Financial Sytem Integrity-Anti-Money Laundering and Combating the Financing of Temorism Box 8.2 Core Principles and Guideli s of Financial Sector Supervision in Support of AML-CFT Regimes The Basel Co mittee on Ba king Supervision (Basel IAIS ange of,incuding money launder kngmrncCndsCtie .Comply with anti-money-launde ing laws The Basel Committee nce of Criminal Use of contains IoSco 8 four principles that should be ued by banking on Mone tion tries.It and compliance with Cooperation with law enforcement authori- jurisdiction: .The These principles set out a comprehensive blue 。The adequacy of reco d-keeping requirements print for that bank supe .cn the of no nesses and to share information with foreign This paper s are appropriate for m onitoring designed to deter and noted on a global he K procedures note The use of cash and cash n t inst money laundering and are intend help protect banks in tem of safety and Whether means are appropriare to hare info are constantly evolving.Money launderers may also operate outside financial systems,for ough alte acts and assist in such acts are defined in variou UN and res tions Var acti used in support o 209209 Chapter 8: Assessing Financial System Integrity—Anti-Money Laundering and Combating the Financing of Terrorism 1 I H G F E D C B A 12 11 10 9 8 7 6 5 4 3 2 are constantly evolving. Money launderers may also operate outside financial systems, for example, through alternative remittance systems. Terrorist acts and terrorists who commit or assist in such acts are defined in various UN conventions and resolutions. Various UN resolutions seek actions to freeze or confiscate funds to designated terrorists. Although the origin of the funds used in support of Box 8.2 Core Principles and Guidelines of Financial Sector Supervision in Support of AML–CFT Regimes The Basel Committee on Banking Supervision (Basel Committee), International Association of Insurance Supervisors (IAIS), and International Organization of Securities Commissioners (IOSCO) have each issued broad supervisory standards and guidelines on a wide range of supervisory issues, including money laundering as it relates to banking, insurance, and securities. FATF incorporates those standards and guidelines in its 40 recommendations. The Basel Committee The Basel Committee has issued three documents covering money-laundering issues: • Statement on Prevention of Criminal Use of the Banking System for the Purpose of Money Laundering—This statement contains essentially four principles that should be used by banking institutions: – Proper customer identification – High ethical standards and compliance with laws and regulations – Cooperation with law enforcement authorities – Policies and procedures to be used to adhere to the statement • Core Principles for Effective Banking Supervision— These principles set out a comprehensive blueprint for supervisory issues, which cover a wide range of topics. Core Principle 15 deals with money laundering by stipulating that bank supervisors must determine that banks have adequate policies and procedures in place, including strict know-your-customer (KYC) rules. • Customer Due Diligence for Banks—This paper provides extensive guidance on appropriate standards for banks to use in identifying their customers. The paper was issued in response to a number of deficiencies noted on a global basis with regard to the KYC procedures noted above. In addition, the standards go beyond the fight against money laundering and are intended to help protect banks in terms of safety and soundness. IAIS This association has issued its Guidance Paper 5, “Anti-Money-Laundering Guidance Notes for Insurance Supervisors and Insurance Entities,” which parallels the Basel Committee’s statement on prevention. It contains four principles that should be embraced by insurance entities: • Comply with anti-money-laundering laws. • Have know-your-customer procedures in place. • Cooperate with all law enforcement authorities. • Have internal anti-money-laundering policies, procedures, and training programs for employees. IOSCO This organization passed its “Resolution on Money Laundering” to be implemented by securities regulators in individual countries. It consists of seven specific areas for securities regulators to consider in establishing requirements for firms under their jurisdiction: • The extent of customer identifying information with a view toward enhancing the ability of authorities to identify and prosecute money launderers • The adequacy of record-keeping requirements to reconstruct financial transactions • Whether an appropriate manner is used to address the reporting of suspicious transactions • What procedures are in place to prevent criminals from obtaining control of securities businesses and to share information with foreign counterparts • Whether means are appropriate for monitoring compliance procedures designed to deter and detect money laundering • The use of cash and cash equivalents in securities transactions, including documentation to reconstruct transactions • Whether means are appropriate to share information to combat money laundering