正在加载图片...

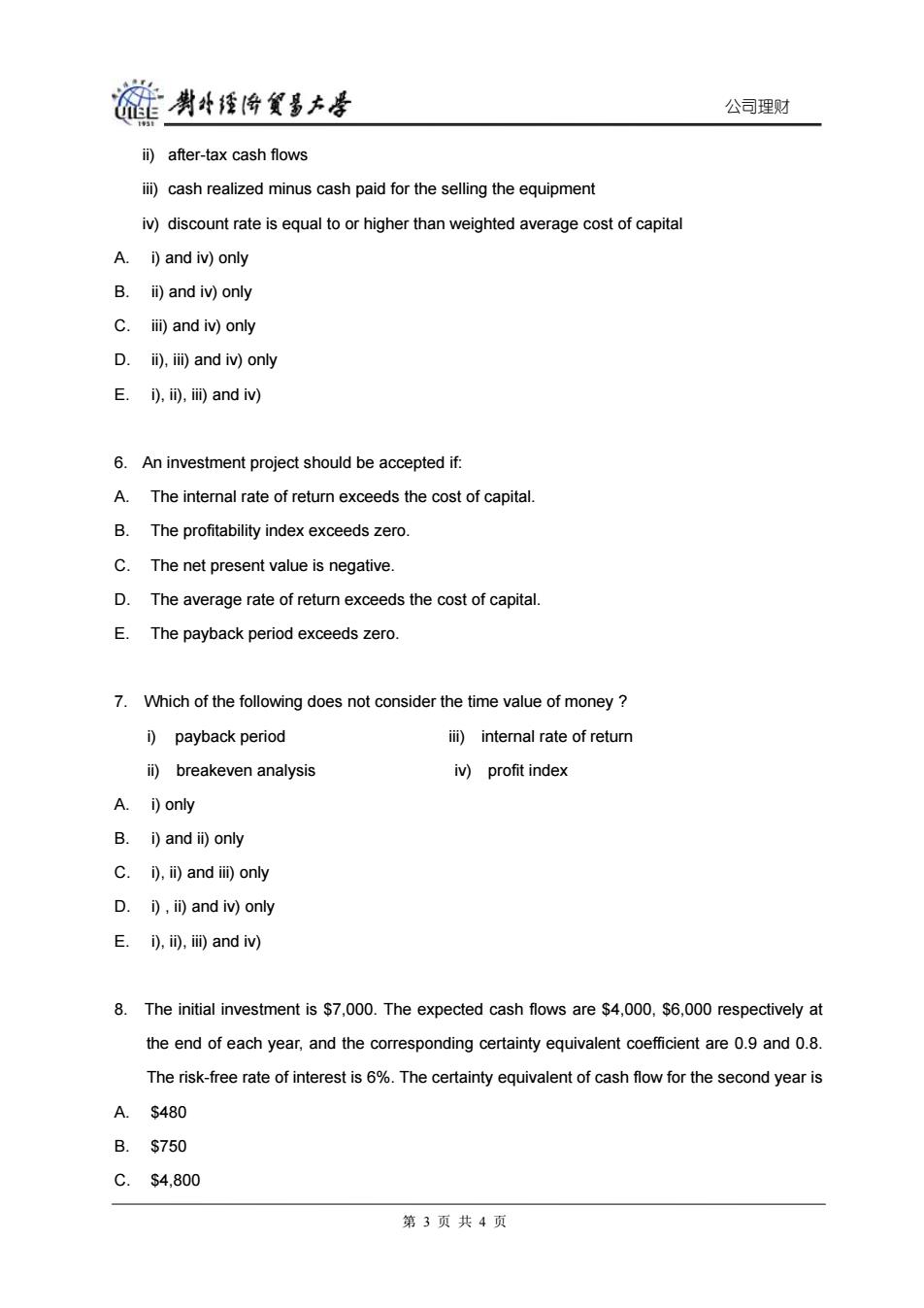

莲费科经倚食男大号 公司理财 ii)after-tax cash flows ii)cash realized minus cash paid for the selling the equipment iv)discount rate is equal to or higher than weighted average cost of capital A.i)and iv)only B.ii)and iv)only C.iii)and iv)only D.ii),iii)and iv)only E.i),ii),ii)and iv) 6.An investment project should be accepted if: A.The internal rate of return exceeds the cost of capital B.The profitability index exceeds zero. C.The net present value is negative. D.The average rate of return exceeds the cost of capital. E.The payback period exceeds zero. 7.Which of the following does not consider the time value of money i)payback period iii)internal rate of return ii)breakeven analysis iv)profit index A.i)only B.i)and ii)only C.i),ii)and ii)only D.i),ii)and iv)only E.i),ii),iii)and iv) 8.The initial investment is $7,000.The expected cash flows are $4,000,$6,000 respectively at the end of each year,and the corresponding certainty equivalent coefficient are 0.9 and 0.8. The risk-free rate of interest is 6%.The certainty equivalent of cash flow for the second year is A.$480 B.$750 C.$4,800 第3页共4页公司理财 ii) after-tax cash flows iii) cash realized minus cash paid for the selling the equipment iv) discount rate is equal to or higher than weighted average cost of capital A. i) and iv) only B. ii) and iv) only C. iii) and iv) only D. ii), iii) and iv) only E. i), ii), iii) and iv) 6. An investment project should be accepted if: A. The internal rate of return exceeds the cost of capital. B. The profitability index exceeds zero. C. The net present value is negative. D. The average rate of return exceeds the cost of capital. E. The payback period exceeds zero. 7. Which of the following does not consider the time value of money ? i) payback period iii) internal rate of return ii) breakeven analysis iv) profit index A. i) only B. i) and ii) only C. i), ii) and iii) only D. i) , ii) and iv) only E. i), ii), iii) and iv) 8. The initial investment is $7,000. The expected cash flows are $4,000, $6,000 respectively at the end of each year, and the corresponding certainty equivalent coefficient are 0.9 and 0.8. The risk-free rate of interest is 6%. The certainty equivalent of cash flow for the second year is A. $480 B. $750 C. $4,800 第 3 页 共 4 页