正在加载图片...

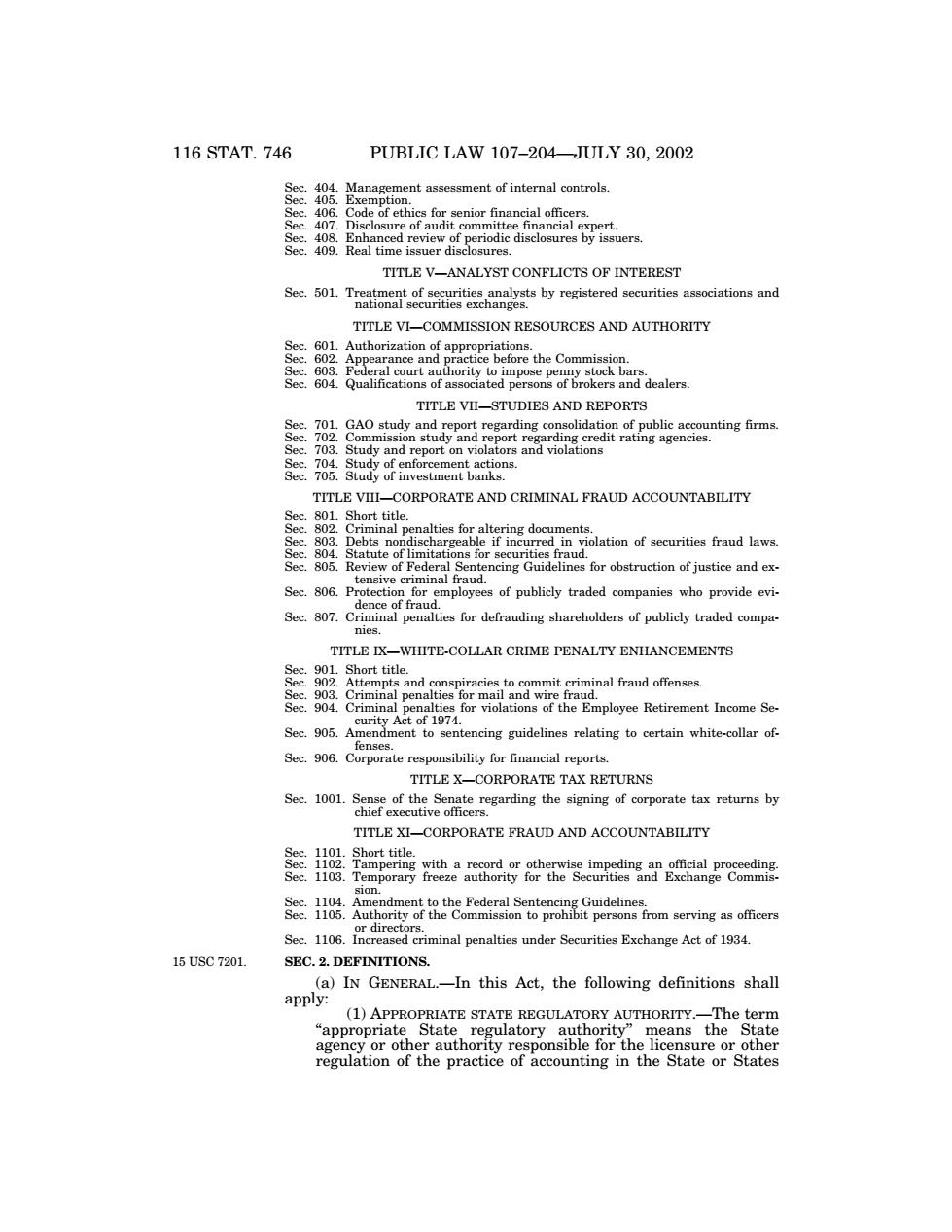

116STAT.746 PUBLIC LAW 107-204-JULY 30,2002 nent of internal controls tte TITLE V-ANALYST CONFLICTS OF INTEREST TITLE VI-COMMISSION RESOURCES AND AUTHORITY 601 rization tions of asse ed brokers and dealer TITLE VI-STUDIES AND REPORTS TITLE VI RPORATE AND CRIMINAL FRAUD ACCOUNTABILITY olation of securities fraud laws tencing Guideli品 for obstruction of justice and ex Sec.86.Prot of publicly traded companies who provideevi TITLE IX-WHITE-COLLAR CRIME PENALTY ENHANCEMENTS rt titl al fraud offens Sec.905.Am respon ibility for Sec.1001 X RETURNS fcorporate tax returns by TITLE XI-CORPORATE FRAUD AND ACCOUNTABILITY 1103 Sec.1106.Inereased eriminal penalties under Securities Exchange Act of 1934. 15U8C7201. SEC.2.DEFINITIONS. INGR this Act,the following definitions sha116 STAT. 746 PUBLIC LAW 107–204—JULY 30, 2002 Sec. 404. Management assessment of internal controls. Sec. 405. Exemption. Sec. 406. Code of ethics for senior financial officers. Sec. 407. Disclosure of audit committee financial expert. Sec. 408. Enhanced review of periodic disclosures by issuers. Sec. 409. Real time issuer disclosures. TITLE V—ANALYST CONFLICTS OF INTEREST Sec. 501. Treatment of securities analysts by registered securities associations and national securities exchanges. TITLE VI—COMMISSION RESOURCES AND AUTHORITY Sec. 601. Authorization of appropriations. Sec. 602. Appearance and practice before the Commission. Sec. 603. Federal court authority to impose penny stock bars. Sec. 604. Qualifications of associated persons of brokers and dealers. TITLE VII—STUDIES AND REPORTS Sec. 701. GAO study and report regarding consolidation of public accounting firms. Sec. 702. Commission study and report regarding credit rating agencies. Sec. 703. Study and report on violators and violations Sec. 704. Study of enforcement actions. Sec. 705. Study of investment banks. TITLE VIII—CORPORATE AND CRIMINAL FRAUD ACCOUNTABILITY Sec. 801. Short title. Sec. 802. Criminal penalties for altering documents. Sec. 803. Debts nondischargeable if incurred in violation of securities fraud laws. Sec. 804. Statute of limitations for securities fraud. Sec. 805. Review of Federal Sentencing Guidelines for obstruction of justice and extensive criminal fraud. Sec. 806. Protection for employees of publicly traded companies who provide evidence of fraud. Sec. 807. Criminal penalties for defrauding shareholders of publicly traded companies. TITLE IX—WHITE-COLLAR CRIME PENALTY ENHANCEMENTS Sec. 901. Short title. Sec. 902. Attempts and conspiracies to commit criminal fraud offenses. Sec. 903. Criminal penalties for mail and wire fraud. Sec. 904. Criminal penalties for violations of the Employee Retirement Income Security Act of 1974. Sec. 905. Amendment to sentencing guidelines relating to certain white-collar offenses. Sec. 906. Corporate responsibility for financial reports. TITLE X—CORPORATE TAX RETURNS Sec. 1001. Sense of the Senate regarding the signing of corporate tax returns by chief executive officers. TITLE XI—CORPORATE FRAUD AND ACCOUNTABILITY Sec. 1101. Short title. Sec. 1102. Tampering with a record or otherwise impeding an official proceeding. Sec. 1103. Temporary freeze authority for the Securities and Exchange Commission. Sec. 1104. Amendment to the Federal Sentencing Guidelines. Sec. 1105. Authority of the Commission to prohibit persons from serving as officers or directors. Sec. 1106. Increased criminal penalties under Securities Exchange Act of 1934. SEC. 2. DEFINITIONS. (a) IN GENERAL.—In this Act, the following definitions shall apply: (1) APPROPRIATE STATE REGULATORY AUTHORITY.—The term ‘‘appropriate State regulatory authority’’ means the State agency or other authority responsible for the licensure or other regulation of the practice of accounting in the State or States 15 USC 7201. VerDate 11-MAY-2000 18:56 Aug 07, 2002 Jkt 099139 PO 00204 Frm 00002 Fmt 6580 Sfmt 6581 E:\PUBLAW\PUBL204.107 APPS24 PsN: PUBL204