正在加载图片...

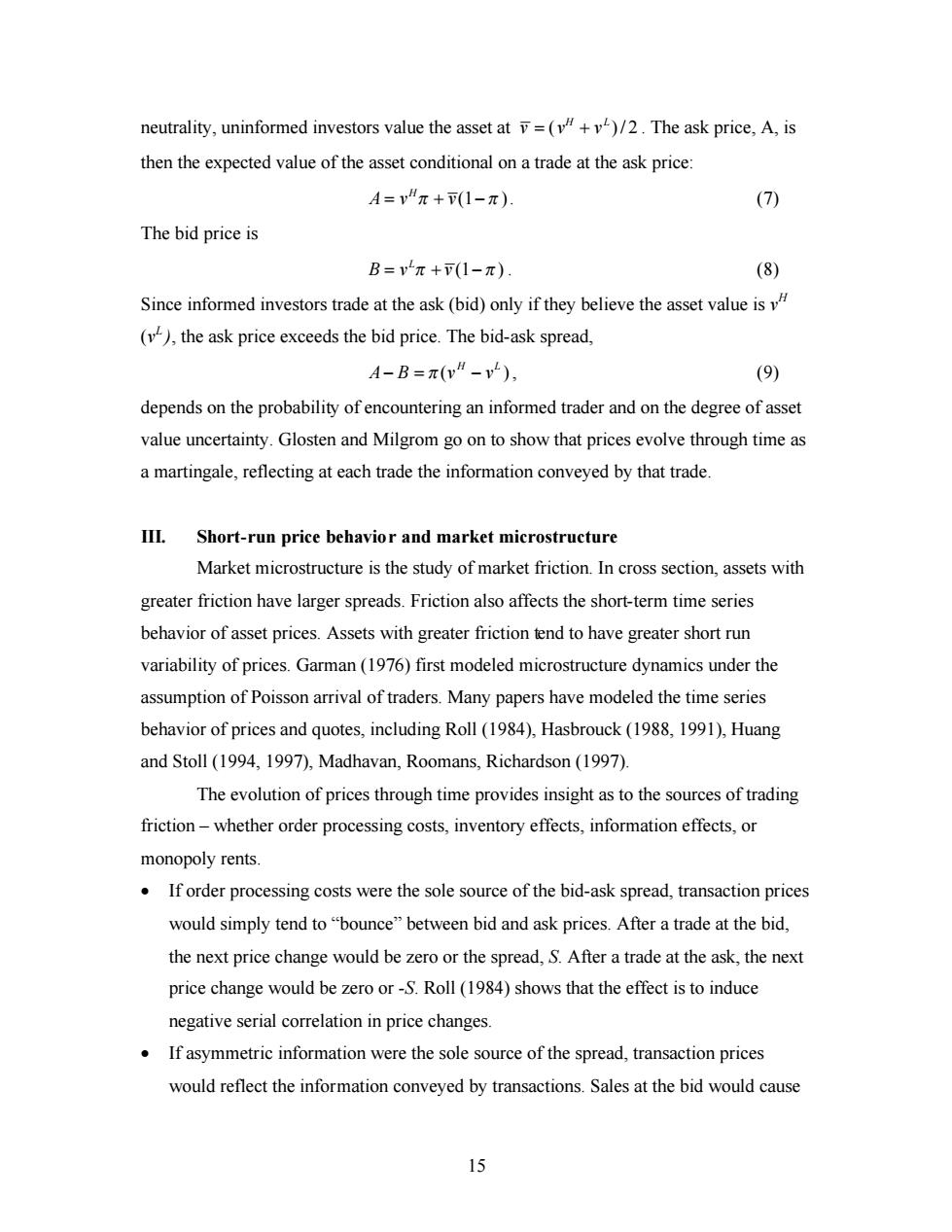

neutrality,uninformed investors value the asset at=(+)/2.The ask price,A,is then the expected value of the asset conditional on a trade at the ask price: A=vπ+(1-π). (7) The bid price is B=vπ+下(1-π) (8) Since informed investors trade at the ask(bid)only if they believe the asset value is (v,the ask price exceeds the bid price.The bid-ask spread, A-B=π(vH-), (9) depends on the probability of encountering an informed trader and on the degree of asset value uncertainty.Glosten and Milgrom go on to show that prices evolve through time as a martingale,reflecting at each trade the information conveyed by that trade. III.Short-run price behavior and market microstructure Market microstructure is the study of market friction.In cross section,assets with greater friction have larger spreads.Friction also affects the short-term time series behavior of asset prices.Assets with greater friction tend to have greater short run variability of prices.Garman(1976)first modeled microstructure dynamics under the assumption of Poisson arrival of traders.Many papers have modeled the time series behavior of prices and quotes,including Roll (1984),Hasbrouck(1988,1991),Huang and Stoll (1994,1997),Madhavan,Roomans,Richardson(1997). The evolution of prices through time provides insight as to the sources of trading friction-whether order processing costs,inventory effects,information effects,or monopoly rents. If order processing costs were the sole source of the bid-ask spread,transaction prices would simply tend to"bounce"between bid and ask prices.After a trade at the bid, the next price change would be zero or the spread,S.After a trade at the ask,the next price change would be zero or-S.Roll(1984)shows that the effect is to induce negative serial correlation in price changes. If asymmetric information were the sole source of the spread,transaction prices would reflect the information conveyed by transactions.Sales at the bid would cause 1515 neutrality, uninformed investors value the asset at ( )/2 H L vvv = + . The ask price, A, is then the expected value of the asset conditional on a trade at the ask price: (1 ) H A = v v p p + - . (7) The bid price is (1 ) L B = v v p p + - . (8) Since informed investors trade at the ask (bid) only if they believe the asset value is v H (v L ), the ask price exceeds the bid price. The bid-ask spread, ( ) H L A- B = - p v v , (9) depends on the probability of encountering an informed trader and on the degree of asset value uncertainty. Glosten and Milgrom go on to show that prices evolve through time as a martingale, reflecting at each trade the information conveyed by that trade. III. Short-run price behavior and market microstructure Market microstructure is the study of market friction. In cross section, assets with greater friction have larger spreads. Friction also affects the short-term time series behavior of asset prices. Assets with greater friction tend to have greater short run variability of prices. Garman (1976) first modeled microstructure dynamics under the assumption of Poisson arrival of traders. Many papers have modeled the time series behavior of prices and quotes, including Roll (1984), Hasbrouck (1988, 1991), Huang and Stoll (1994, 1997), Madhavan, Roomans, Richardson (1997). The evolution of prices through time provides insight as to the sources of trading friction – whether order processing costs, inventory effects, information effects, or monopoly rents. · If order processing costs were the sole source of the bid-ask spread, transaction prices would simply tend to “bounce” between bid and ask prices. After a trade at the bid, the next price change would be zero or the spread, S. After a trade at the ask, the next price change would be zero or -S. Roll (1984) shows that the effect is to induce negative serial correlation in price changes. · If asymmetric information were the sole source of the spread, transaction prices would reflect the information conveyed by transactions. Sales at the bid would cause