正在加载图片...

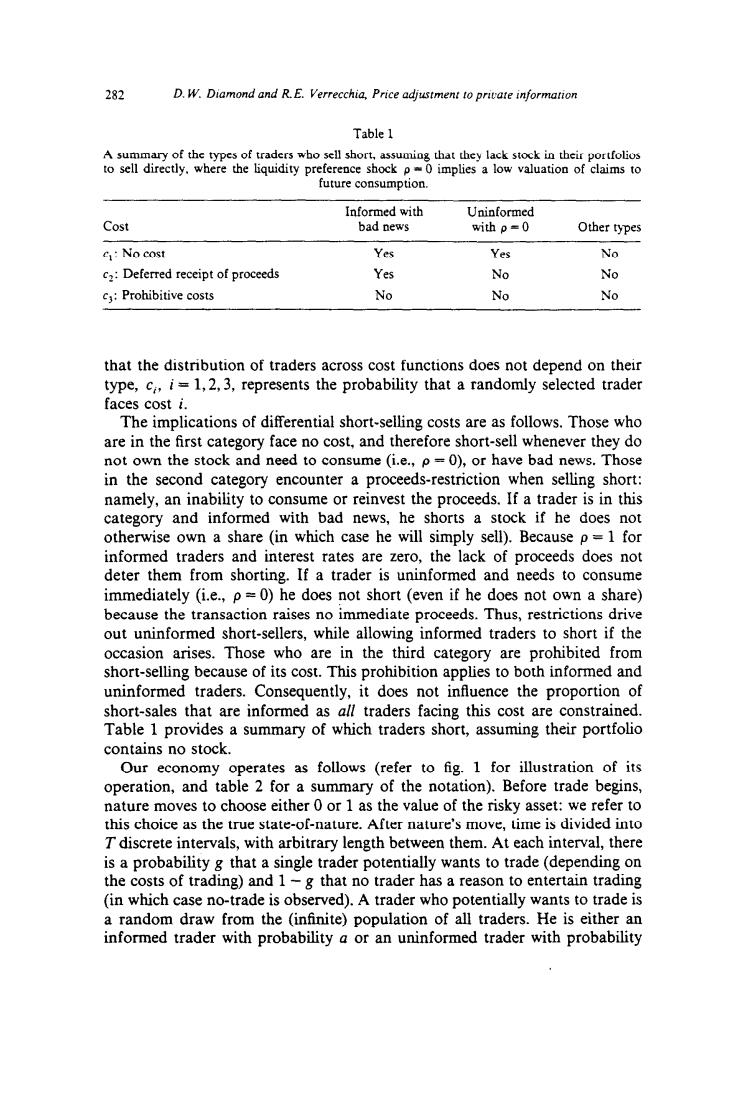

282 D.W.Diamond and R.E.Verrecchia,Price adjustment to private information Table 1 A summary of the types of traders who sell short,assuming that they lack stock in their portfolios to sell directly.where the liquidity preference shock p0 implies a low valuation of claims to future consumption Informed with Uninformed Cost bad news with p=0 Other types C:No cost Yes Yes No C2:Deferred receipt of proceeds Yes No No C:Prohibitive costs No No No that the distribution of traders across cost functions does not depend on their type,c,i=1,2,3,represents the probability that a randomly selected trader faces cost i. The implications of differential short-selling costs are as follows.Those who are in the first category face no cost,and therefore short-sell whenever they do not own the stock and need to consume (i.e.,p=0),or have bad news.Those in the second category encounter a proceeds-restriction when selling short: namely,an inability to consume or reinvest the proceeds.If a trader is in this category and informed with bad news,he shorts a stock if he does not otherwise own a share (in which case he will simply sell).Because p=1 for informed traders and interest rates are zero,the lack of proceeds does not deter them from shorting.If a trader is uninformed and needs to consume immediately (i.e.,p=0)he does not short (even if he does not own a share) because the transaction raises no immediate proceeds.Thus,restrictions drive out uninformed short-sellers,while allowing informed traders to short if the occasion arises.Those who are in the third category are prohibited from short-selling because of its cost.This prohibition applies to both informed and uninformed traders.Consequently,it does not influence the proportion of short-sales that are informed as all traders facing this cost are constrained. Table 1 provides a summary of which traders short,assuming their portfolio contains no stock. Our economy operates as follows (refer to fig.1 for illustration of its operation,and table 2 for a summary of the notation).Before trade begins, nature moves to choose either 0 or 1 as the value of the risky asset:we refer to this choice as the true state-of-nature.After nature's move,time is divided into T discrete intervals,with arbitrary length between them.At each interval,there is a probability g that a single trader potentially wants to trade(depending on the costs of trading)and 1-g that no trader has a reason to entertain trading (in which case no-trade is observed).A trader who potentially wants to trade is a random draw from the (infinite)population of all traders.He is either an informed trader with probability a or an uninformed trader with probability282 D. W. Diamond and R. E. Verrecchia, Pnce adjustment to prtcate information Table 1 A summary of the types of traders who sell short, assuming that they lack stock in their portfolios to sell directly, where the liquidity preference shock p = 0 implies a low valuation of claims to future consumption. cost Informed with bad news Uninformed with p=O Other types c,: No cost c2: Deferred receipt of proceeds cj: Prohibitive costs Yes Yes No Yes No No No No No that the distribution of traders across cost functions does not depend on their type, ci, i = 1,2,3, represents the probability that a randomly selected trader faces cost i. The implications of differential short-selling costs are as follows. Those who are in the first category face no cost, and therefore short-sell whenever they do not own the stock and need to consume (i.e., p = 0), or have bad news. Those in the second category encounter a proceeds-restriction when selling short: namely, an inability to consume or reinvest the proceeds. If a trader is in this category and informed with bad news, he shorts a stock if he does not otherwise own a share (in which case he will simply sell). Because p = 1 for informed traders and interest rates are zero, the lack of proceeds does not deter them from shorting. If a trader is uninformed and needs to consume immediately (i.e., p = 0) he does not short (even if he does not own a share) because the transaction raises no immediate proceeds. Thus, restrictions drive out uninformed short-sellers, while allowing informed traders to short if the occasion arises. Those who are in the third category are prohibited from short-selling because of its cost. This prohibition applies to both informed and uninformed traders. Consequently, it does not influence the proportion of short-sales that are informed as all traders facing this cost are constrained. Table 1 provides a summary of which traders short, assuming their portfolio contains no stock. Our economy operates as follows (refer to fig. 1 for illustration of its operation, and table 2 for a summary of the notation). Before trade begins, nature moves to choose either 0 or 1 as the value of the risky asset: we refer to this choice as the true state-of-nature. After nature’s move, time is divided into T discrete intervals, with arbitrary length between them. At each interval, there is a probability g that a single trader potentially wants to trade (depending on the costs of trading) and 1 - g that no trader has a reason to entertain trading (in which case no-trade is observed). A trader who potentially wants to trade is a random draw from the (infinite) population of all traders. He is either an informed trader with probability a or an uninformed trader with probability