正在加载图片...

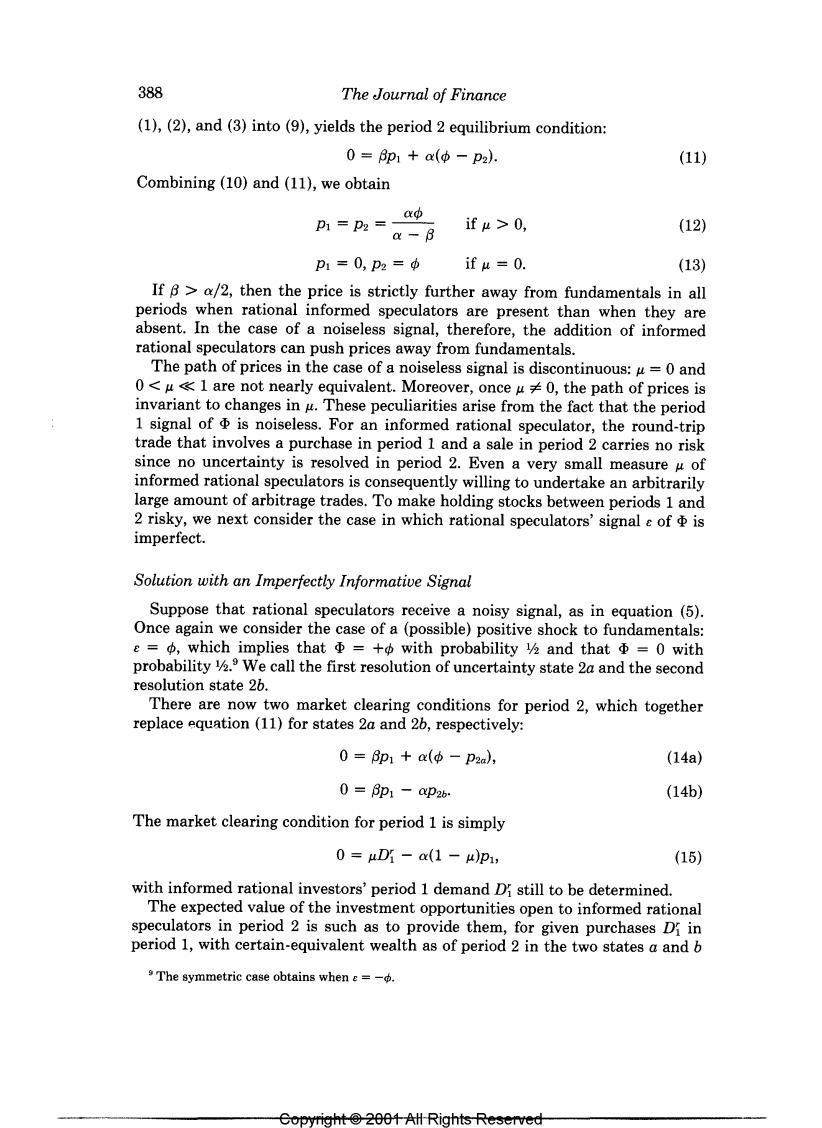

388 The Journal of Finance (1),(2),and(3)into(9),yields the period 2 equilibrium condition: 0=p1+a(中-p2) (11) Combining (10)and (11),we obtain D1 =p2 =ap &-B if4>0, (12) P1=0,p2=φ if u=0. (13) If B>a/2,then the price is strictly further away from fundamentals in all periods when rational informed speculators are present than when they are absent.In the case of a noiseless signal,therefore,the addition of informed rational speculators can push prices away from fundamentals. The path of prices in the case of a noiseless signal is discontinuous:u=0 and 0<u<1 are not nearly equivalent.Moreover,once u0,the path of prices is invariant to changes in u.These peculiarities arise from the fact that the period 1 signal of is noiseless.For an informed rational speculator,the round-trip trade that involves a purchase in period 1 and a sale in period 2 carries no risk since no uncertainty is resolved in period 2.Even a very small measure u of informed rational speculators is consequently willing to undertake an arbitrarily large amount of arbitrage trades.To make holding stocks between periods 1 and 2 risky,we next consider the case in which rational speculators'signal e of is imperfect. Solution with an Imperfectly Informative Signal Suppose that rational speculators receive a noisy signal,as in equation (5). Once again we consider the case of a(possible)positive shock to fundamentals: e=中,which implies thatΦ=+中with probability and thatΦ=0with probability 12.We call the first resolution of uncertainty state 2a and the second resolution state 26. There are now two market clearing conditions for period 2,which together replace equation (11)for states 2a and 26,respectively: 0=p1+a(中-p2a), (14a) 0=p1-p2b (14b) The market clearing condition for period 1 is simply 0=uD-(1-4p, (15) with informed rational investors'period 1 demand Di still to be determined. The expected value of the investment opportunities open to informed rational speculators in period 2 is such as to provide them,for given purchases Di in period 1,with certain-equivalent wealth as of period 2 in the two states a and b The symmetric case obtains when e=-. Copyraht e 2001 All Riahts Reserved