正在加载图片...

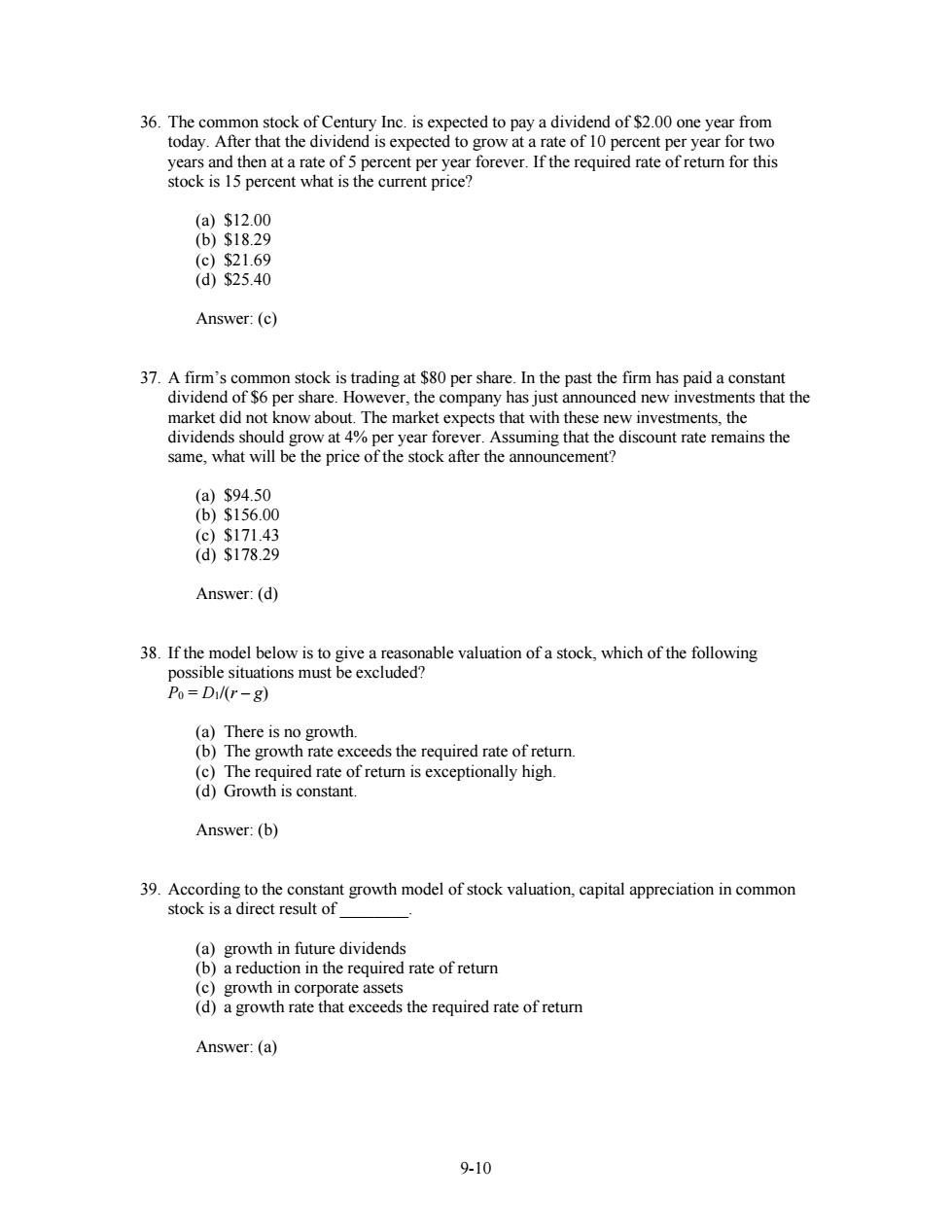

36.The common stock of Century Inc.is expected to pay a dividend of $2.00 one year from today.After that the dividend is expected to grow at a rate of 10 percent per year for two years and then at a rate of 5 percent per year forever.If the required rate of return for this stock is 15 percent what is the current price? (a)$12.00 (b)$18.29 (c)$21.69 (d)$25.40 Answer:(c) 37.A firm's common stock is trading at $80 per share.In the past the firm has paid a constant dividend of $6 per share.However,the company has just announced new investments that the market did not know about.The market expects that with these new investments,the dividends should grow at 4%per year forever.Assuming that the discount rate remains the same,what will be the price of the stock after the announcement? (a)$94.50 (b)$156.00 (c)$171.43 (d)$178.29 Answer:(d) 38.If the model below is to give a reasonable valuation of a stock,which of the following possible situations must be excluded? Po=Di/(r-g) (a)There is no growth. (b)The growth rate exceeds the required rate of return. (c)The required rate of return is exceptionally high. (d)Growth is constant. Answer:(b) 39.According to the constant growth model of stock valuation,capital appreciation in common stock is a direct result of (a)growth in future dividends (b)a reduction in the required rate of return (c)growth in corporate assets (d)a growth rate that exceeds the required rate of return Answer:(a) 9-109-10 36. The common stock of Century Inc. is expected to pay a dividend of $2.00 one year from today. After that the dividend is expected to grow at a rate of 10 percent per year for two years and then at a rate of 5 percent per year forever. If the required rate of return for this stock is 15 percent what is the current price? (a) $12.00 (b) $18.29 (c) $21.69 (d) $25.40 Answer: (c) 37. A firm’s common stock is trading at $80 per share. In the past the firm has paid a constant dividend of $6 per share. However, the company has just announced new investments that the market did not know about. The market expects that with these new investments, the dividends should grow at 4% per year forever. Assuming that the discount rate remains the same, what will be the price of the stock after the announcement? (a) $94.50 (b) $156.00 (c) $171.43 (d) $178.29 Answer: (d) 38. If the model below is to give a reasonable valuation of a stock, which of the following possible situations must be excluded? P0 = D1/(r – g) (a) There is no growth. (b) The growth rate exceeds the required rate of return. (c) The required rate of return is exceptionally high. (d) Growth is constant. Answer: (b) 39. According to the constant growth model of stock valuation, capital appreciation in common stock is a direct result of ________. (a) growth in future dividends (b) a reduction in the required rate of return (c) growth in corporate assets (d) a growth rate that exceeds the required rate of return Answer: (a)