正在加载图片...

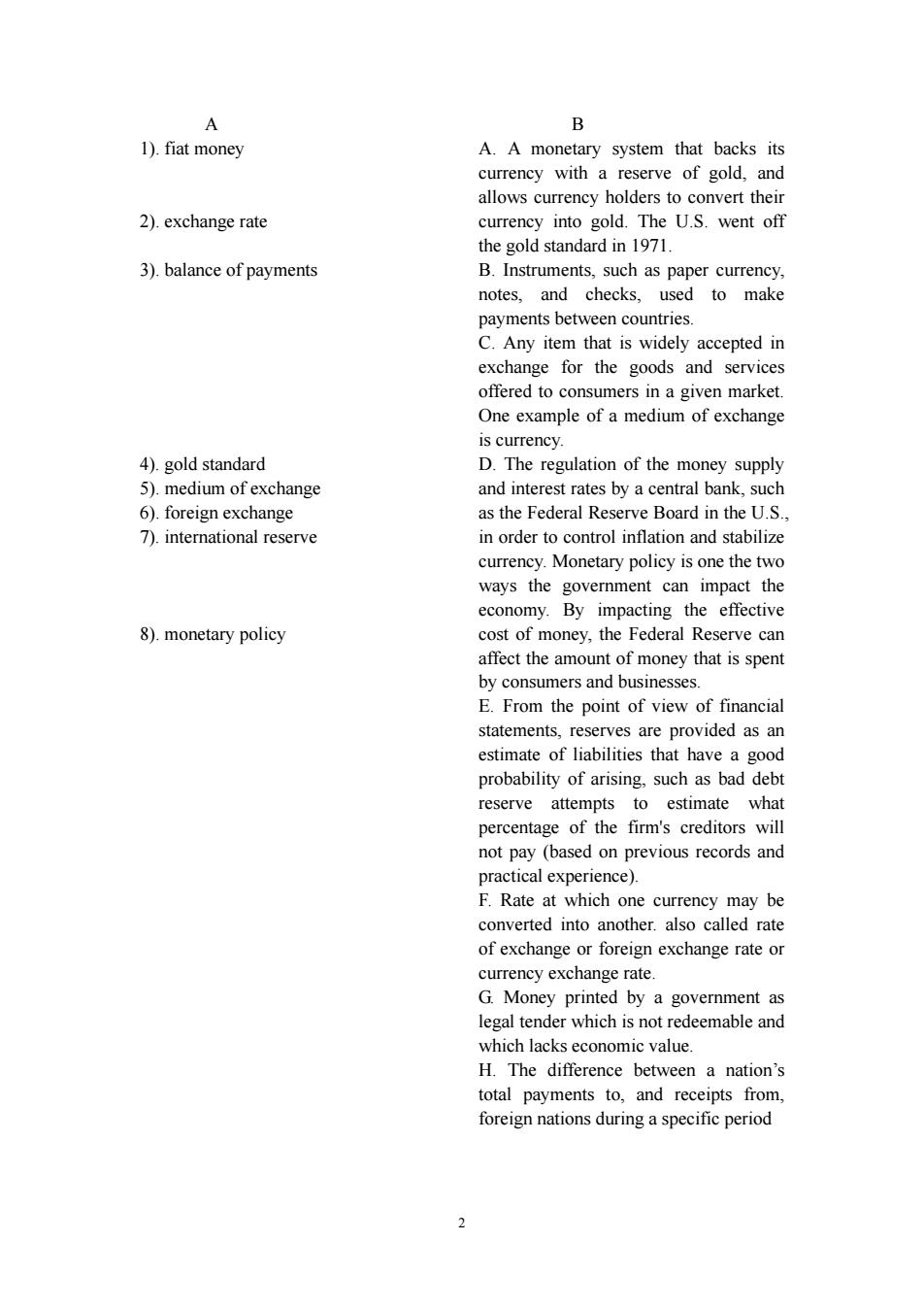

A B 1).fiat money A.A monetary system that backs its currency with a reserve of gold,and allows currency holders to convert their 2).exchange rate currency into gold.The U.S.went off the gold standard in 1971. 3).balance of payments B.Instruments,such as paper currency, notes,and checks,used to make payments between countries. C.Any item that is widely accepted in exchange for the goods and services offered to consumers in a given market. One example of a medium of exchange is currency. 4).gold standard D.The regulation of the money supply 5).medium of exchange and interest rates by a central bank,such 6).foreign exchange as the Federal Reserve Board in the U.S., 7).international reserve in order to control inflation and stabilize currency.Monetary policy is one the two ways the government can impact the economy.By impacting the effective 8).monetary policy cost of money,the Federal Reserve can affect the amount of money that is spent by consumers and businesses. E.From the point of view of financial statements,reserves are provided as an estimate of liabilities that have a good probability of arising,such as bad debt reserve attempts to estimate what percentage of the firm's creditors will not pay (based on previous records and practical experience). F.Rate at which one currency may be converted into another.also called rate of exchange or foreign exchange rate or currency exchange rate. G.Money printed by a government as legal tender which is not redeemable and which lacks economic value. H.The difference between a nation's total payments to,and receipts from, foreign nations during a specific period 22 A 1). fiat money 2). exchange rate 3). balance of payments 4). gold standard 5). medium of exchange 6). foreign exchange 7). international reserve 8). monetary policy B A. A monetary system that backs its currency with a reserve of gold, and allows currency holders to convert their currency into gold. The U.S. went off the gold standard in 1971. B. Instruments, such as paper currency, notes, and checks, used to make payments between countries. C. Any item that is widely accepted in exchange for the goods and services offered to consumers in a given market. One example of a medium of exchange is currency. D. The regulation of the money supply and interest rates by a central bank, such as the Federal Reserve Board in the U.S., in order to control inflation and stabilize currency. Monetary policy is one the two ways the government can impact the economy. By impacting the effective cost of money, the Federal Reserve can affect the amount of money that is spent by consumers and businesses. E. From the point of view of financial statements, reserves are provided as an estimate of liabilities that have a good probability of arising, such as bad debt reserve attempts to estimate what percentage of the firm's creditors will not pay (based on previous records and practical experience). F. Rate at which one currency may be converted into another. also called rate of exchange or foreign exchange rate or currency exchange rate. G. Money printed by a government as legal tender which is not redeemable and which lacks economic value. H. The difference between a nation’s total payments to, and receipts from, foreign nations during a specific period