正在加载图片...

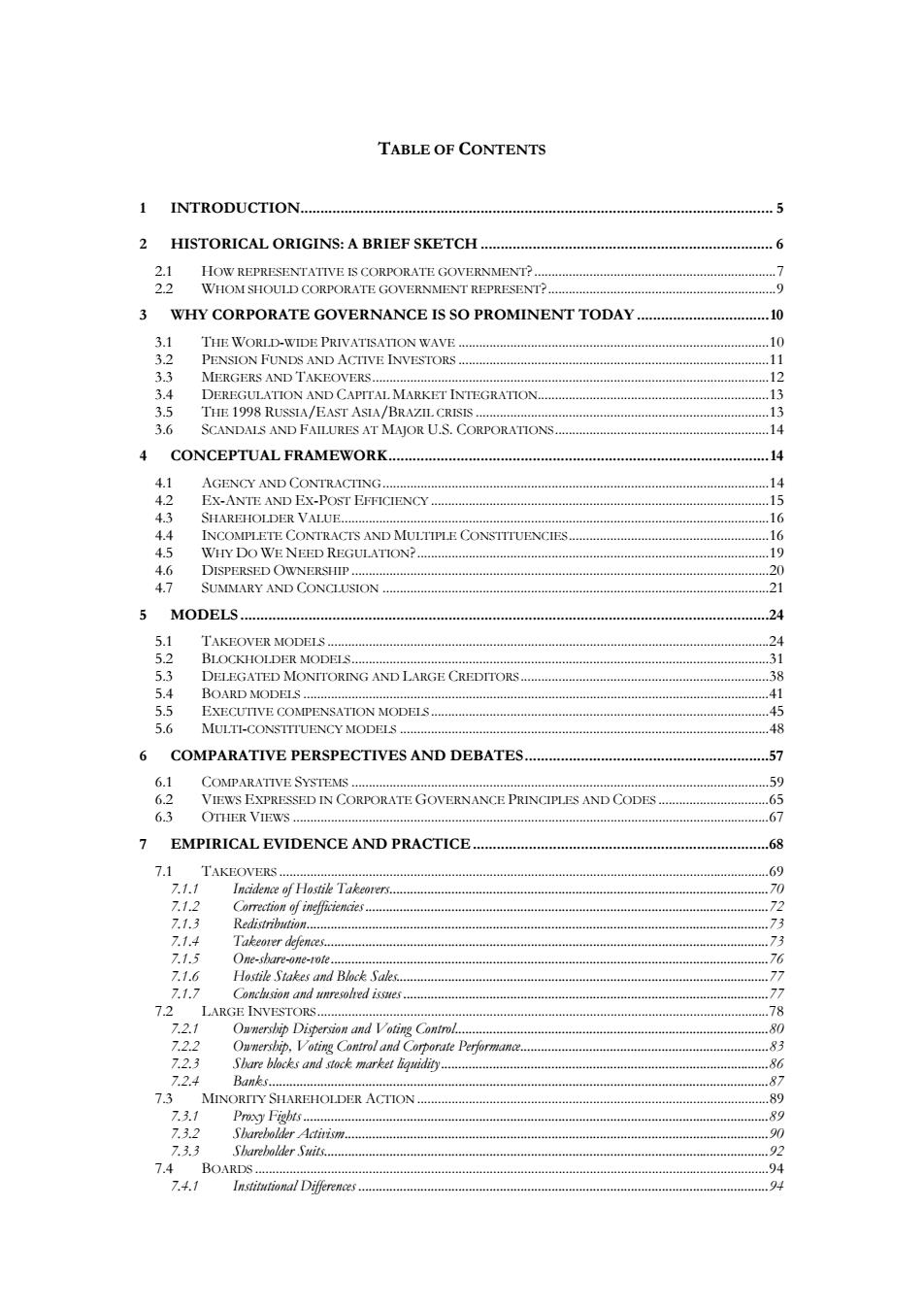

TABLE OF CONTENTS 1 INTRODUCTION.… .5 2 HISTORICAL ORIGINS:A BRIEF SKETCH.................. 6 2.1 HOW REPRESENTATIVE IS CORPORATE GOVERNMENT?........ .7 2.2 WHOM SHOULD CORPORATE GOVERNMENT REPRESENT?. 9 3 WHY CORPORATE GOVERNANCE IS SO PROMINENT TODAY...........0 3.1 THE WORLD-WIDE PRIVATISATION 3.2 PENSION FUNDS AND ACTIVE INVESTORS .11 3.3 MERGERS AND TAKEOVERS..... 3.4 DEREGULATION AND CAPITAL MARKET INTEGRATION. 12 13 3.5 THE 1998 RUSSIA/EAST ASIA/BRAZILCRISIS13 3.6 SCANDALS AND FAILURES AT MAJOR U.S.CORPORATIONS........................14 4 CONCEPTUAL FRAMEWORK........... 14 4.1 AGENCY AND CONTRACTING............ 444444 .14 4.2 EX-ANTE AND EX-POSTEFFICIENCY....15 4.3 SHAREHOLDER VALUE........ 16 4.4 INCOMPLETE CONTRACTS AND MULTIPLE CONSTTTUENCIES.... 4444444444444444444444444 .16 4.5 WHY DO WE NEED REGULATIONP.. 19 4.6 DISPERSED OWNERSHIP 20 4.7 SUMMARY AND CONCLUSION ...... .21 5 MODELS 24 5.1 TAKEOVER MODELS...... 24 5.2 BLOCKHOLDER MODELS........... 31 5.3 DELEGATED MONITORING AND LARGE CREDITORS 38 5.4 B0 ARD MODELS… .41 5.5 EXECUTIVE COMPENSATION MODELS............. 45 5.6 MULTI-CONSTTTUENCY MODELS ............. 48 6 COMPARATIVE PERSPECTIVES AND DEBATES .57 6.1 COMPARATIVE SYSTEMS. 59 6.2 VIEWS EXPRESSED IN CORPORATE GOVERNANCE PRINCIPLES AND CODES..... 65 6.3 OTHER VIEWS.. .67 EMPIRICAL EVIDENCE AND PRACTICE .…68 7.1 TAKEOVERS..... .69 7.1.1 ncidence0fH0.slie☑ke0le.………..70 7.1.2 7.1.3 Recpspppbppiop3 7.1.4 Takeo1 er defences.…… .73 7.1.5 One-share-one-rote... 76 7.1.6 Hostile Stakes and Block Sales. 7.1.7 77 7.2 LARGE INVESTORS.18 7.2.1 Ownership Dispersion and Voting Control. .80 7.2.2 Ownership.Voting Control and Corporate Performance.. 83 7.2.3 Sbare blocks and stock market liquidity. 86 7.2.4 Bahk 87 7.3 MINORITY SHAREHOLDER ACTION......89 73.1 Poxy Fiobts 8 7.3.2 Sbarebolder Activism..... .90 7.3.3 Sbarebolder Suits.. 92 7.4BOARDS. .94 7.4.1 Institutional Differences...... 94TABLE OF CONTENTS 1 INTRODUCTION...................................................................................................................... 5 2 HISTORICAL ORIGINS: A BRIEF SKETCH ......................................................................... 6 2.1 HOW REPRESENTATIVE IS CORPORATE GOVERNMENT?......................................................................7 2.2 WHOM SHOULD CORPORATE GOVERNMENT REPRESENT?..................................................................9 3 WHY CORPORATE GOVERNANCE IS SO PROMINENT TODAY .................................10 3.1 THE WORLD-WIDE PRIVATISATION WAVE ..........................................................................................10 3.2 PENSION FUNDS AND ACTIVE INVESTORS ..........................................................................................11 3.3 MERGERS AND TAKEOVERS...................................................................................................................12 3.4 DEREGULATION AND CAPITAL MARKET INTEGRATION...................................................................13 3.5 THE 1998 RUSSIA/EAST ASIA/BRAZIL CRISIS .....................................................................................13 3.6 SCANDALS AND FAILURES AT MAJOR U.S. CORPORATIONS..............................................................14 4 CONCEPTUAL FRAMEWORK...............................................................................................14 4.1 AGENCY AND CONTRACTING................................................................................................................14 4.2 EX-ANTE AND EX-POST EFFICIENCY ..................................................................................................15 4.3 SHAREHOLDER VALUE............................................................................................................................16 4.4 INCOMPLETE CONTRACTS AND MULTIPLE CONSTITUENCIES..........................................................16 4.5 WHY DO WE NEED REGULATION?......................................................................................................19 4.6 DISPERSED OWNERSHIP .........................................................................................................................20 4.7 SUMMARY AND CONCLUSION ................................................................................................................21 5 MODELS ....................................................................................................................................24 5.1 TAKEOVER MODELS ................................................................................................................................24 5.2 BLOCKHOLDER MODELS.........................................................................................................................31 5.3 DELEGATED MONITORING AND LARGE CREDITORS........................................................................38 5.4 BOARD MODELS .......................................................................................................................................41 5.5 EXECUTIVE COMPENSATION MODELS ..................................................................................................45 5.6 MULTI-CONSTITUENCY MODELS ...........................................................................................................48 6 COMPARATIVE PERSPECTIVES AND DEBATES.............................................................57 6.1 COMPARATIVE SYSTEMS .........................................................................................................................59 6.2 VIEWS EXPRESSED IN CORPORATE GOVERNANCE PRINCIPLES AND CODES ................................65 6.3 OTHER VIEWS ..........................................................................................................................................67 7 EMPIRICAL EVIDENCE AND PRACTICE..........................................................................68 7.1 TAKEOVERS ..............................................................................................................................................69 7.1.1 Incidence of Hostile Takeovers..............................................................................................................70 7.1.2 Correction of inefficiencies.....................................................................................................................72 7.1.3 Redistribution......................................................................................................................................73 7.1.4 Takeover defences.................................................................................................................................73 7.1.5 One-share-one-vote...............................................................................................................................76 7.1.6 Hostile Stakes and Block Sales............................................................................................................77 7.1.7 Conclusion and unresolved issues ..........................................................................................................77 7.2 LARGE INVESTORS...................................................................................................................................78 7.2.1 Ownership Dispersion and Voting Control...........................................................................................80 7.2.2 Ownership, Voting Control and Corporate Performance........................................................................83 7.2.3 Share blocks and stock market liquidity...............................................................................................86 7.2.4 Banks.................................................................................................................................................87 7.3 MINORITY SHAREHOLDER ACTION ......................................................................................................89 7.3.1 Proxy Fights .......................................................................................................................................89 7.3.2 Shareholder Activism...........................................................................................................................90 7.3.3 Shareholder Suits.................................................................................................................................92 7.4 BOARDS .....................................................................................................................................................94 7.4.1 Institutional Differences .......................................................................................................................94