正在加载图片...

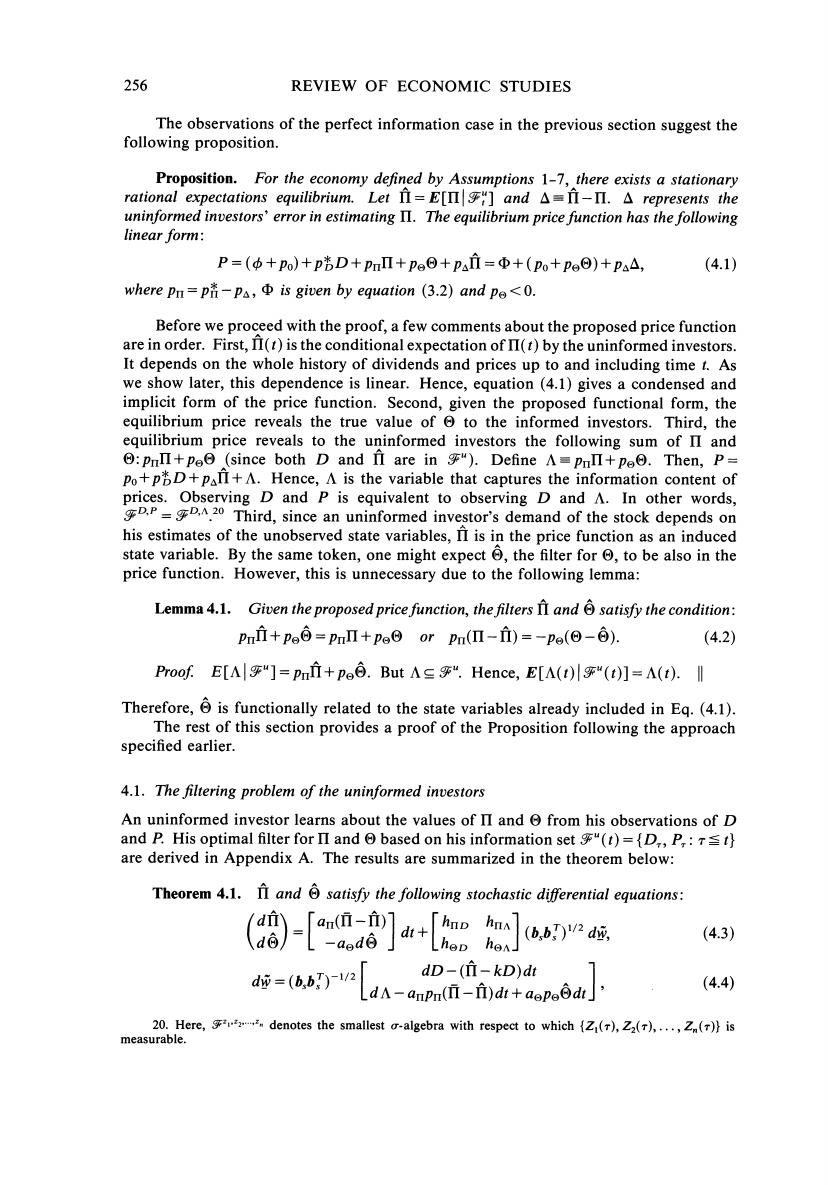

256 REVIEW OF ECONOMIC STUDIES The observations of the perfect information case in the previous section suggest the following proposition. Proposition.For the economy defined by Assumptions 1-7,there exists a stationary rational expectations equilibrium.Let II=E[II]and A=II-II.A represents the uninformed investors'error in estimating II.The equilibrium price function has the following linear form: P=(中+po)+pD+pmΠ+peΘ+Pai=Φ+(po+po⊙)+pa△, (4.1) where pn=p-pa,is given by equation (3.2)and pe<0. Before we proceed with the proof,a few comments about the proposed price function are in order.First,II(t)is the conditional expectation of II(t)by the uninformed investors. It depends on the whole history of dividends and prices up to and including time t.As we show later,this dependence is linear.Hence,equation(4.1)gives a condensed and implicit form of the price function.Second,given the proposed functional form,the equilibrium price reveals the true value of to the informed investors.Third,the equilibrium price reveals to the uninformed investors the following sum of II and o:pmΠ+peo(since both D and II are in“).Define A=pulΠ+peoo.Then,P- Po+pD+PanI+A.Hence,A is the variable that captures the information content of prices.Observing D and P is equivalent to observing D and A.In other words, 20 Third,since an uninformed investor's demand of the stock depends on his estimates of the unobserved state variables,II is in the price function as an induced state variable.By the same token,one might expect the filter for to be also in the price function.However,this is unnecessary due to the following lemma: Lemma 4.1.Given the proposed price function,the filters andsatisfy the condition: pmi+pg⊙=pmΠ+pg0orpm(Π-i)=-pa(⊙-⊙) (4.2) Proof.E[Ar“]=pmi+po日.But As“.Hence,E[A(t)lr“(t)]=A(t).I Therefore,is functionally related to the state variables already included in Eq.(4.1). The rest of this section provides a proof of the Proposition following the approach specified earlier. 4.1.The filtering problem of the uninformed investors An uninformed investor learns about the values of II and from his observations of D and P.His optimal filter for II and based on his information set"(t)={D,,P,:st} are derived in Appendix A.The results are summarized in the theorem below: Theorem 4.1.II and 6 satisfy the following stochastic differential equations: 8-[a8]+[e]” (4.3) dD-(f-kD)dt LdA-anpn(II-f)dt+aoPe0dt] (4.4) 20.Here,denotes the smallest a-algebra with respect to which (()Z(),...,Zn())is measurable