正在加载图片...

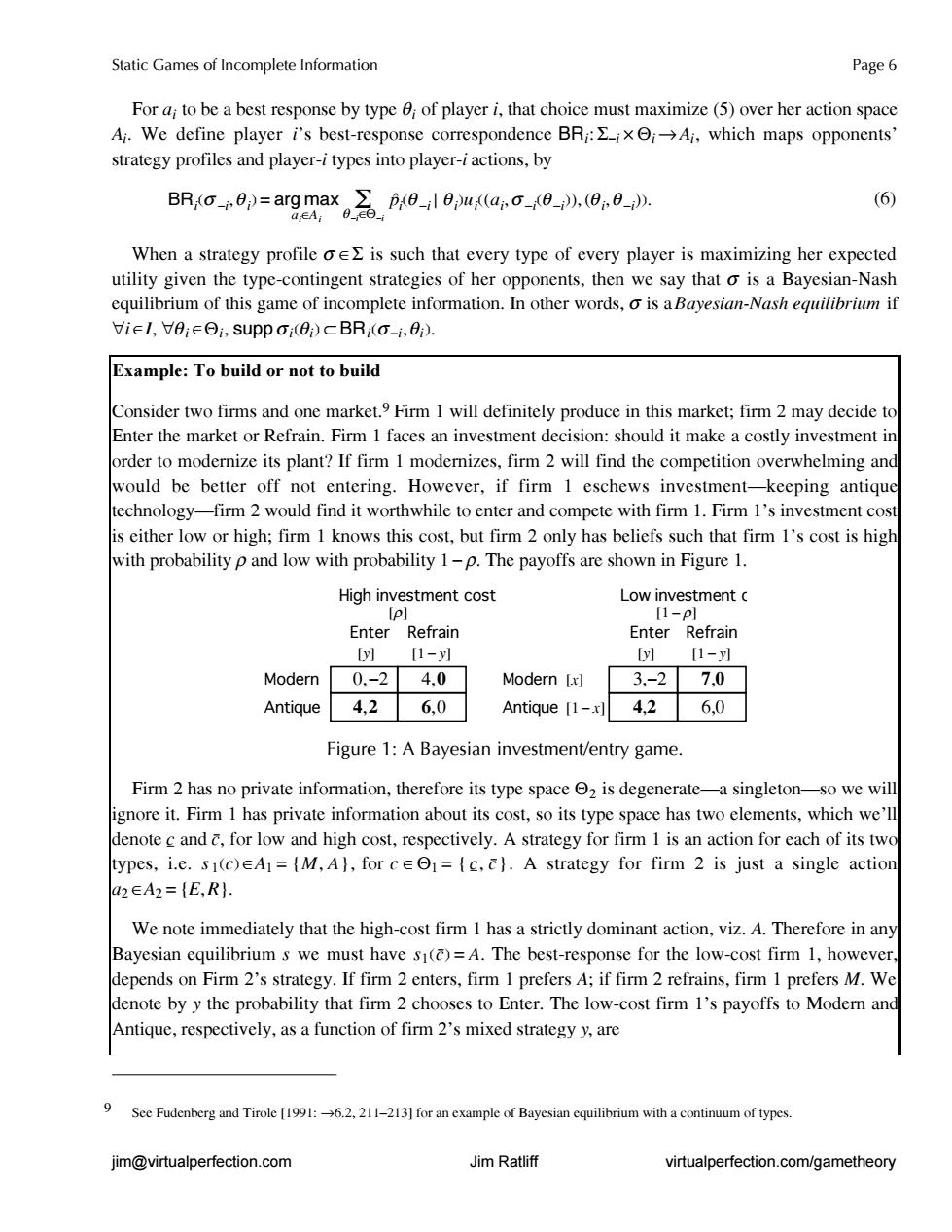

Static Games of Incomplete Information Page 6 For a;to be a best response by type 0;of player i,that choice must maximize(5)over her action space Ai.We define player i's best-response correspondence BRi:ixiAi,which maps opponents' strategy profiles and player-itypes into player-iactions,by BRo6)=arg mnax高6l6,a,00a,8-,》 (6) When a strategy profile o is such that every type of every player is maximizing her expected utility given the type-contingent strategies of her opponents,then we say that o is a Bayesian-Nash equilibrium of this game of incomplete information.In other words,o is a Bayesian-Nash equilibrium if ∀i∈l,∀0;eo,supp o(0)cBRi(o-i,0. Example:To build or not to build Consider two firms and one market.9 Firm 1 will definitely produce in this market;firm 2 may decide to Enter the market or Refrain.Firm 1 faces an investment decision:should it make a costly investment in order to modernize its plant?If firm I modernizes,firm 2 will find the competition overwhelming and would be better off not entering.However,if firm 1 eschews investment-keeping antique technology-firm 2 would find it worthwhile to enter and compete with firm 1.Firm I's investment cost is either low or high;firm 1 knows this cost,but firm 2 only has beliefs such that firm I's cost is high with probability p and low with probability 1-p.The payoffs are shown in Figure 1. High investment cost Low investment c [e] [1-p] Enter Refrain Enter Refrain y [1-y y [1-y Modern 0,-2 4.0 Modern [x] 3.-2 7.0 Antique 4,2 6,0 Antique [1-x] 4,2 6,0 Figure 1:A Bayesian investment/entry game. Firm 2 has no private information,therefore its type space 2 is degenerate-a singleton-so we will ignore it.Firm 1 has private information about its cost,so its type space has two elements,which we'll denote c and c,for low and high cost,respectively.A strategy for firm 1 is an action for each of its two types,i.e.si(c)EA=[M,A],for ce=(c,c).A strategy for firm 2 is just a single action a2∈A2={E,R}. We note immediately that the high-cost firm 1 has a strictly dominant action,viz.A.Therefore in any Bayesian equilibrium s we must have s(c)=A.The best-response for the low-cost firm 1,however. depends on Firm 2's strategy.If firm 2 enters,firm 1 prefers A;if firm 2 refrains,firm 1 prefers M.We denote by y the probability that firm 2 chooses to Enter.The low-cost firm 1's payoffs to Modern and Antique,respectively,as a function of firm 2's mixed strategy y,are See Fudenberg and Tirole [1991:-6.2,211-213]for an example of Bayesian equilibrium with a continuum of types. jim@virtualperfection.com Jim Ratliff virtualperfection.com/gametheoryStatic Games of Incomplete Information Page 6 jim@virtualperfection.com Jim Ratliff virtualperfection.com/gametheory For ai to be a best response by type øi of player i, that choice must maximize (5) over her action space Ai. We define player i’s best-response correspondence BRi:Í¥i˜Øi§Ai, which maps opponents’ strategy profiles and player-i types into player-i actions, by BRi ªß¥i,øi º= pi ªø¥i|Ùøi ºui ª(ai ,ߥiªø¥iº),(øi ,ø¥i S )º ø¥i˙Ø¥i arg max ai ˙Ai . (6) When a strategy profile ß˙Í is such that every type of every player is maximizing her expected utility given the type-contingent strategies of her opponents, then we say that ß is a Bayesian-Nash equilibrium of this game of incomplete information. In other words, ß is a Bayesian-Nash equilibrium if Åi˙I, Åøi˙Øi, suppÙßiªøiºÓBRiªß¥i,øiº. Example: To build or not to build Consider two firms and one market.9 Firm 1 will definitely produce in this market; firm 2 may decide to Enter the market or Refrain. Firm 1 faces an investment decision: should it make a costly investment in order to modernize its plant? If firm 1 modernizes, firm 2 will find the competition overwhelming and would be better off not entering. However, if firm 1 eschews investment—keeping antique technology—firm 2 would find it worthwhile to enter and compete with firm 1. Firm 1’s investment cost is either low or high; firm 1 knows this cost, but firm 2 only has beliefs such that firm 1’s cost is high with probability ® and low with probability 1_®. The payoffs are shown in Figure 1. 0,¥2 4,0 4,2 6,0 Enter Refrain Modern Antique High investment cost [®] [y] [1_y] 3,¥2 7,0 4,2 6,0 Enter Refrain Modern [x] Antique [1_x] Low investment cost [1_®] [y] [1_y] Figure 1: A Bayesian investment/entry game. Firm 2 has no private information, therefore its type space Ø2 is degenerate—a singleton—so we will ignore it. Firm 1 has private information about its cost, so its type space has two elements, which we’ll denote c and c, for low and high cost, respectively. A strategy for firm 1 is an action for each of its two types, i.e. s 1ªcº˙A1={M,A}, for c˙Ø1= { c,c}. A strategy for firm 2 is just a single action a2˙A2={E,R}. We note immediately that the high-cost firm 1 has a strictly dominant action, viz. A. Therefore in any Bayesian equilibrium s we must have s1ªcº=A. The best-response for the low-cost firm 1, however, depends on Firm 2’s strategy. If firm 2 enters, firm 1 prefers A; if firm 2 refrains, firm 1 prefers M. We denote by y the probability that firm 2 chooses to Enter. The low-cost firm 1’s payoffs to Modern and Antique, respectively, as a function of firm 2’s mixed strategy y, are 9 See Fudenberg and Tirole [1991: §6.2, 211–213] for an example of Bayesian equilibrium with a continuum of types