正在加载图片...

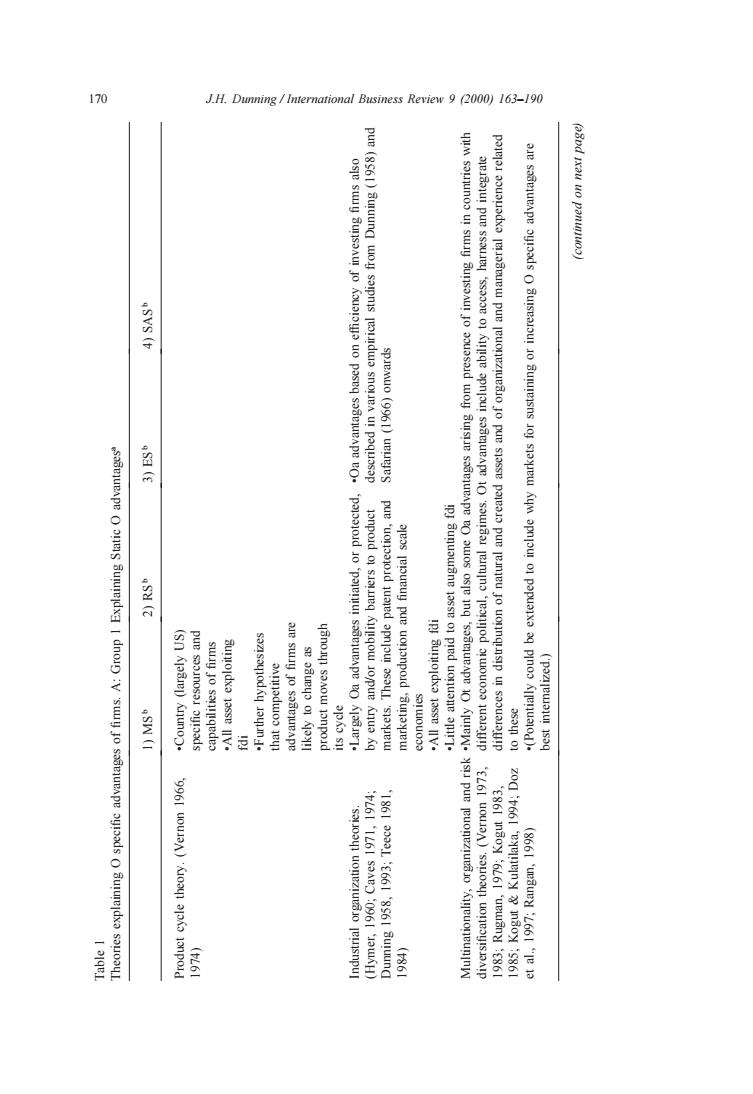

170 J.H.Dunning/International Business Review 9 000)163-190 SVS spiemuo (9961) 人7 8 4SW (I 1861 22L E661 '8561170 J.H. Dunning / International Business Review 9 (2000) 163–190 Table 1 Theories explaining O specific advantages of firms. A: Group 1 Explaining Static O advantagesa 1) MSb 2) RSb 3) ESb 4) SASb Product cycle theory. (Vernon 1966, •Country (largely US) 1974) specific resources and capabilities of firms •All asset exploiting fdi •Further hypothesizes that competitive advantages of firms are likely to change as product moves through its cycle Industrial organization theories. •Largely Oa advantages initiated, or protected, •Oa advantages based on efficiency of investing firms also (Hymer, 1960; Caves 1971, 1974; by entry and/or mobility barriers to product described in various empirical studies from Dunning (1958) and Dunning 1958, 1993; Teece 1981, markets. These include patent protection, and Safarian (1966) onwards 1984) marketing, production and financial scale economies •All asset exploiting fdi •Little attention paid to asset augmenting fdi Multinationality, organizational and risk •Mainly Ot advantages, but also some Oa advantages arising from presence of investing firms in countries with diversification theories. (Vernon 1973, different economic political, cultural regimes. Ot advantages include ability to access, harness and integrate 1983; Rugman, 1979; Kogut 1983, differences in distribution of natural and created assets and of organizational and managerial experience related 1985; Kogut & Kulatilaka, 1994; Doz to these et al., 1997; Rangan, 1998) •(Potentially could be extended to include why markets for sustaining or increasing O specific advantages are best internalized.) (continued on next page)