正在加载图片...

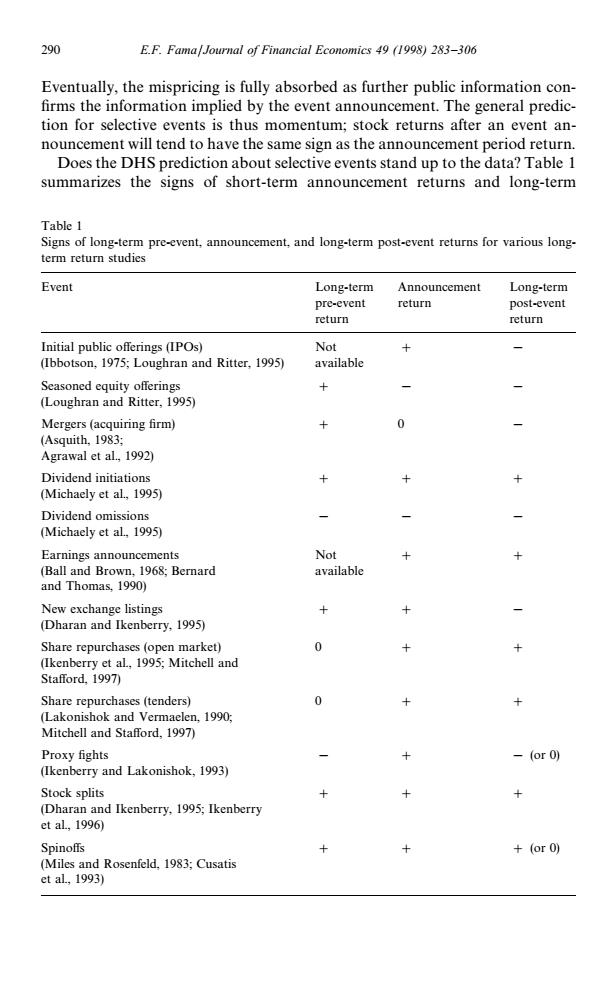

290 E.F.FamafJournal of Financial Economics 49 (1998)283-306 Eventually,the mispricing is fully absorbed as further public information con- firms the information implied by the event announcement.The general predic- tion for selective events is thus momentum;stock returns after an event an- nouncement will tend to have the same sign as the announcement period return. Does the DHS prediction about selective events stand up to the data?Table 1 summarizes the signs of short-term announcement returns and long-term Table 1 Signs of long-term pre-event,announcement,and long-term post-event returns for various long- term return studies Event Long-term Announcement Long-term pre-event return post-event return return Initial public offerings (IPOs) Not (Ibbotson,1975;Loughran and Ritter,1995) available Seasoned equity offerings (Loughran and Ritter,1995) Mergers(acquiring firm) (Asquith,1983; Agrawal et al.,1992) Dividend initiations (Michaely et al,1995) Dividend omissions (Michaely et al,1995) Earnings announcements Not (Ball and Brown,1968;Bernard available and Thomas,1990) New exchange listings (Dharan and Ikenberry,1995) Share repurchases(open market) (Ikenberry et al,1995;Mitchell and Stafford,1997) Share repurchases (tenders) (Lakonishok and Vermaelen,1990; Mitchell and Stafford,1997) Proxy fights -(or0) (Ikenberry and Lakonishok,1993) Stock splits (Dharan and Ikenberry,1995;Ikenberry etal,1996) Spinoffs +(or0) (Miles and Rosenfeld,1983;Cusatis etal,1993)Table 1 Signs of long-term pre-event, announcement, and long-term post-event returns for various longterm return studies Event Long-term pre-event return Announcement return Long-term post-event return Initial public offerings (IPOs) (Ibbotson, 1975; Loughran and Ritter, 1995) Not available # ! Seasoned equity offerings (Loughran and Ritter, 1995) #! ! Mergers (acquiring firm) (Asquith, 1983; Agrawal et al., 1992) # 0 ! Dividend initiations (Michaely et al., 1995) ## # Dividend omissions (Michaely et al., 1995) !! ! Earnings announcements (Ball and Brown, 1968; Bernard and Thomas, 1990) Not available # # New exchange listings (Dharan and Ikenberry, 1995) ## ! Share repurchases (open market) (Ikenberry et al., 1995; Mitchell and Stafford, 1997) 0 # # Share repurchases (tenders) (Lakonishok and Vermaelen, 1990; Mitchell and Stafford, 1997) 0 # # Proxy fights (Ikenberry and Lakonishok, 1993) !# ! (or 0) Stock splits (Dharan and Ikenberry, 1995; Ikenberry et al., 1996) ## # Spinoffs (Miles and Rosenfeld, 1983; Cusatis et al., 1993) ## # (or 0) Eventually, the mispricing is fully absorbed as further public information con- firms the information implied by the event announcement. The general prediction for selective events is thus momentum; stock returns after an event announcement will tend to have the same sign as the announcement period return. Does the DHS prediction about selective events stand up to the data? Table 1 summarizes the signs of short-term announcement returns and long-term 290 E.F. Fama/Journal of Financial Economics 49 (1998) 283—306