正在加载图片...

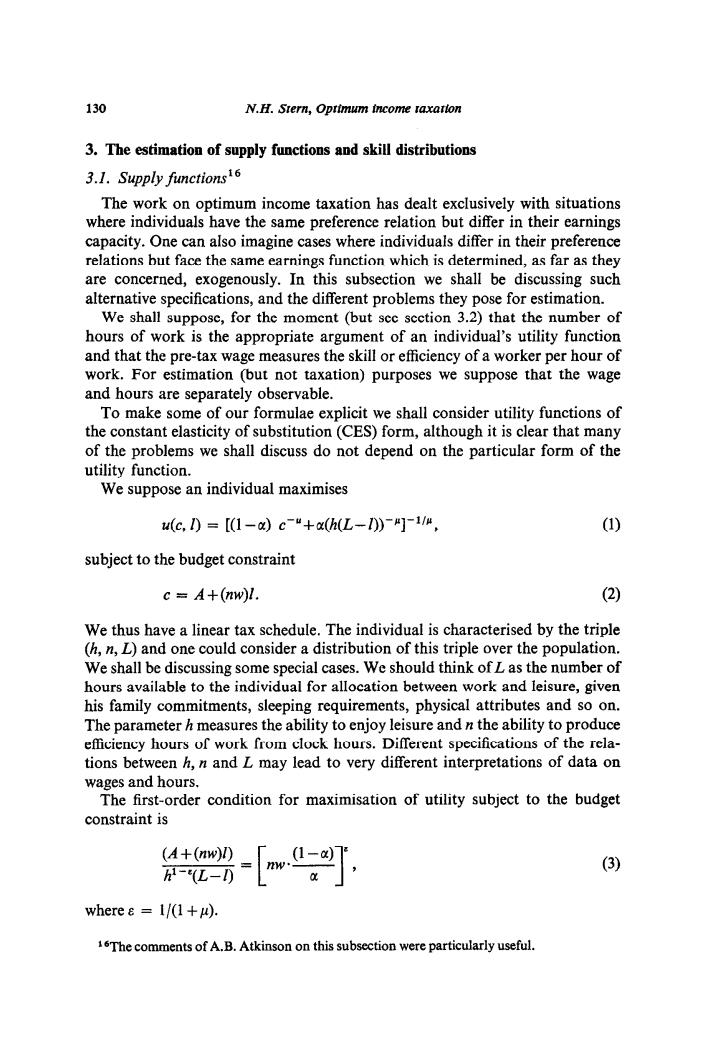

130 N.H.Stern,Oprtmum income taxatton 3.The estimation of supply functions and skill distributions 3.1.Supply functions whereotimtion ha deal evely wth siuation The y ave ning capacity.One can also imagine cases where individ als differ in their preferen relations but face the same earnings function which is determined,as far as they are concerned,exogenously.In this subsection we shall be discussing such alternative specifications,and the different problems they pose for estimation. We shall supposc,for the moment (but see section 3.2)that the number of hours of work is the appropriate argument of an individual's utility function and that the pre-tax wag es the skill or efficiency of a worker per hour of mation (but not taxation)purposes we suppose that the wage are separ rately obser To make some of our formulae explicit we shall consider utility fun ctions of the constant elasticity of substitution(CES)form,although it is clear that many of the problems we shall discuss do not depend on the particular form of the utility function. We suppose an individual maximises (c,D=[1-a)c-“+x(L-0)-]1e, (1) subject to the budget constraint c=A+(nw)l. (2) We thus have a linear tax schedule.The individual is characterised by the triple (h,n,L)and one could consider a distribution of this triple over the population. We shall be discussing some special cases.We should think of L as the number of hours available to the individual for allocation between work and leisure,given his family commitments,sleeping requirements,physical attributes and so on. The parameter h measures the ability to enjoy leisure and n the ability to produce efficiency hours of work from clock hours.DifTerent specifications of the rela- tions betweenh,nand L may lead to very different interpretations of data on condition for maximisation of utility subject to the budget constraint is (3) where =1/(1+u). The comments of A.B.Atkinson on this subsection were particularly useful 130 N.H. Stern, Optimum income taxation 3. The estimation of supply functions and skill distributions 3.1. Supply functions’6 The work on optimum income taxation has dealt exclusively with situations where individuals have the same preference relation but differ in their earnings capacity. One can also imagine cases where individuals differ in their preference relations but face the same earnings function which is determined, as far as they are concerned, exogenously. In this subsection we shall be discussing such alternative specifications, and the different problems they pose for estimation. We shall suppose, for the moment (but see section 3.2) that the number of hours of work is the appropriate argument of an individual’s utility function and that the pre-tax wage measures the skill or efficiency of a worker per hour of work. For estimation (but not taxation) purposes we suppose that the wage and hours are separately observable. To make some of our formulae explicit we shall consider utility functions of the constant elasticity of substitution (CES) form, although it is clear that many of the problems we shall discuss do not depend on the particular form of the utility function. We suppose an individual maximises u(c, I) = [(l-U) c-“+cc(h(L-I))-“]-“, (1) subject to the budget constraint c = A+(nw)Z. (2) We thus have a linear tax schedule. The individual is characterised by the triple (h, n, L) and one could consider a distribution of this triple over the population. We shall be discussing some special cases. We should think of L as the number of hours available to the individual for allocation between work and leisure, given his family commitments, sleeping requirements, physical attributes and so on. The parameter h measures the ability to enjoy leisure and n the ability to produce efficiency hours of work from clock hours. Different specifications of the relations between h, n and L may lead to very different interpretations of data on wages and hours. The first-order condition for maximisation of utility subject to the budget constraint is (A + WY> P-"(L-Z) = [_.~J, (3) where E = l/(1 +I*). ‘@like comments of A.B. Atkinson on this subsection were particularly useful