正在加载图片...

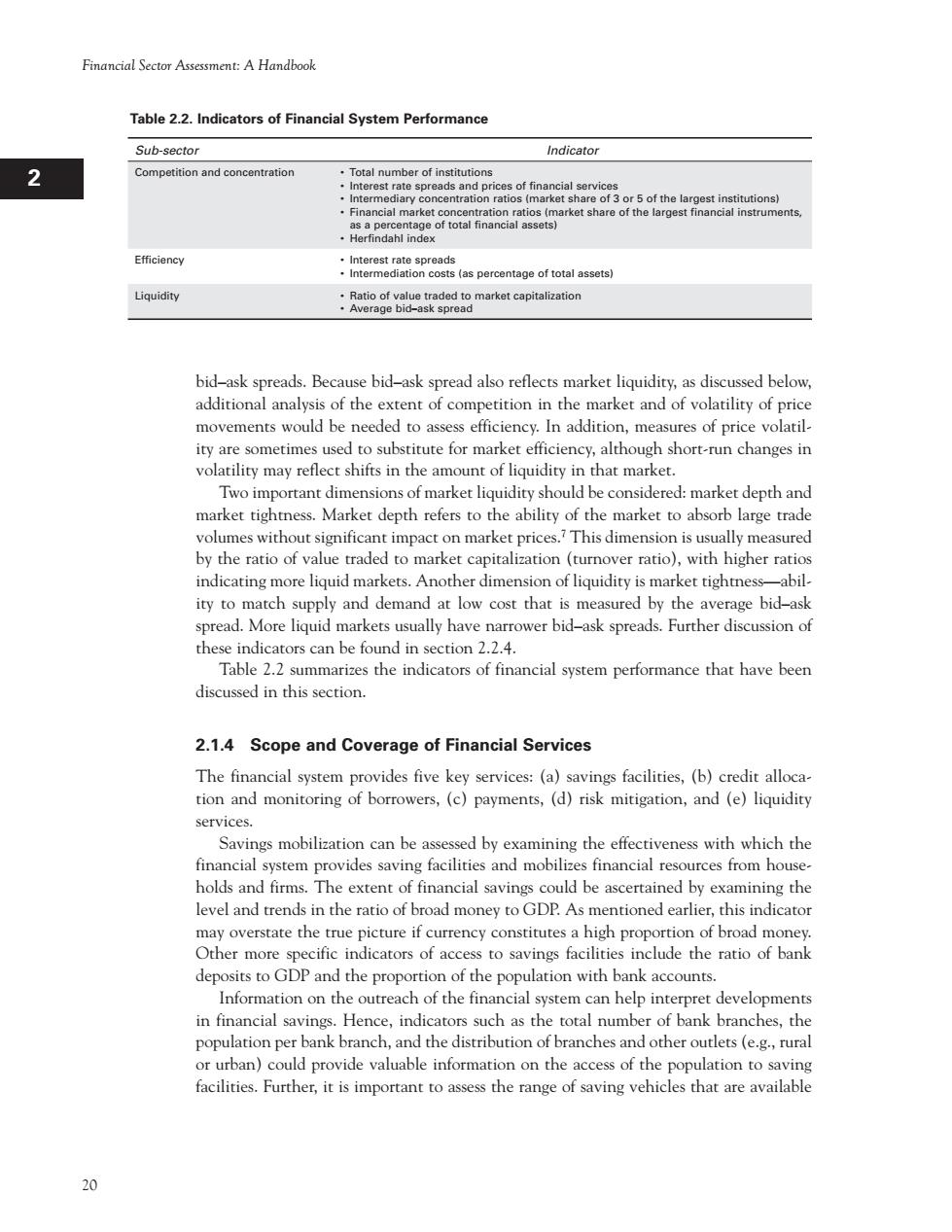

Financial Sector Assessment A handhook Table 2.2.Indicators of Financial System Performance Sub-sector Indicator 2 Competition and concentration Total number of institu :lhterotratesproadsandprice5offinancialsorvice Efficiency :lheretnopeee e(as percentage of total assets Liquidity :Aeegekspeamrtaapaaion bid-ask spreads.Because bid-ask spread also reflects market liquidity,as discussed below. arket and of volatility of pric itioalnatoteecsCcoehadnnesca ity are sometimes used to substitute for market efficiency,although short-run changes in volatility may reflect shifts in the amount of liquidity in that market. Two important dimensions of market liquidity should be considered:market depth and market tightness.Market depth refers to the ability of the market to absorb large trade volumes without significant impact on market prices.This dimension is usually measured by the ratio of value traded to market capitalization (tu ratio),with higher ra indicating more liquid markets.Another dimension of liquidity marke t tightne ity to ch supply and demand t low cost that s measured y the average bid-as these indicators can be found in section 2.2.4. Table 2.2 summarizes the indicators of financial system performance that have been discussed in this section. 2.1.4 Scope and Coverage of Financial Services The financial system provides five key services:(a)savings facilities,(b)credit alloca- tion and monitoring of borrowers,(c)payments,(d)risk mitigation,and (e)liquidity serv ices ed by e examining the effec tiveness with which the hond m The exrent of fnanc inern xnth system provides saving facilities and mobil sfinancial resources from hou level and trends in the ratio of broad money to GDP.As mentioned earlier,this indicator may overstate the true picture if currency constitutes a high proportion of broad money. Other more specific indicators of access to savings facilities include the ratio of bank deposits to GDP and the proportion of the population with bank accounts. Information on the ou ach of the fina ial s m can help inter in financial saving nche on per bank br and th distribution of nd other ou tlets (e.g.rura or uban)could provide valuable information on the access of the population to saving facilities.Further,it is important to assess the range of saving vehicles that are available 20 Financial Sector Assessment: A Handbook 1 I H G F E D C B A 12 11 10 9 8 7 6 5 4 3 2 bid–ask spreads. Because bid–ask spread also reflects market liquidity, as discussed below, additional analysis of the extent of competition in the market and of volatility of price movements would be needed to assess efficiency. In addition, measures of price volatility are sometimes used to substitute for market efficiency, although short-run changes in volatility may reflect shifts in the amount of liquidity in that market. Two important dimensions of market liquidity should be considered: market depth and market tightness. Market depth refers to the ability of the market to absorb large trade volumes without significant impact on market prices.7 This dimension is usually measured by the ratio of value traded to market capitalization (turnover ratio), with higher ratios indicating more liquid markets. Another dimension of liquidity is market tightness—ability to match supply and demand at low cost that is measured by the average bid–ask spread. More liquid markets usually have narrower bid–ask spreads. Further discussion of these indicators can be found in section 2.2.4. Table 2.2 summarizes the indicators of financial system performance that have been discussed in this section. 2.1.4 Scope and Coverage of Financial Services The financial system provides five key services: (a) savings facilities, (b) credit allocation and monitoring of borrowers, (c) payments, (d) risk mitigation, and (e) liquidity services. Savings mobilization can be assessed by examining the effectiveness with which the financial system provides saving facilities and mobilizes financial resources from households and firms. The extent of financial savings could be ascertained by examining the level and trends in the ratio of broad money to GDP. As mentioned earlier, this indicator may overstate the true picture if currency constitutes a high proportion of broad money. Other more specific indicators of access to savings facilities include the ratio of bank deposits to GDP and the proportion of the population with bank accounts. Information on the outreach of the financial system can help interpret developments in financial savings. Hence, indicators such as the total number of bank branches, the population per bank branch, and the distribution of branches and other outlets (e.g., rural or urban) could provide valuable information on the access of the population to saving facilities. Further, it is important to assess the range of saving vehicles that are available Table 2.2. Indicators of Financial System Performance Sub-sector Indicator Competition and concentration • Total number of institutions • Interest rate spreads and prices of financial services • Intermediary concentration ratios (market share of 3 or 5 of the largest institutions) • Financial market concentration ratios (market share of the largest financial instruments, as a percentage of total financial assets) • Herfindahl index Efficiency • Interest rate spreads • Intermediation costs (as percentage of total assets) Liquidity • Ratio of value traded to market capitalization • Average bid–ask spread