正在加载图片...

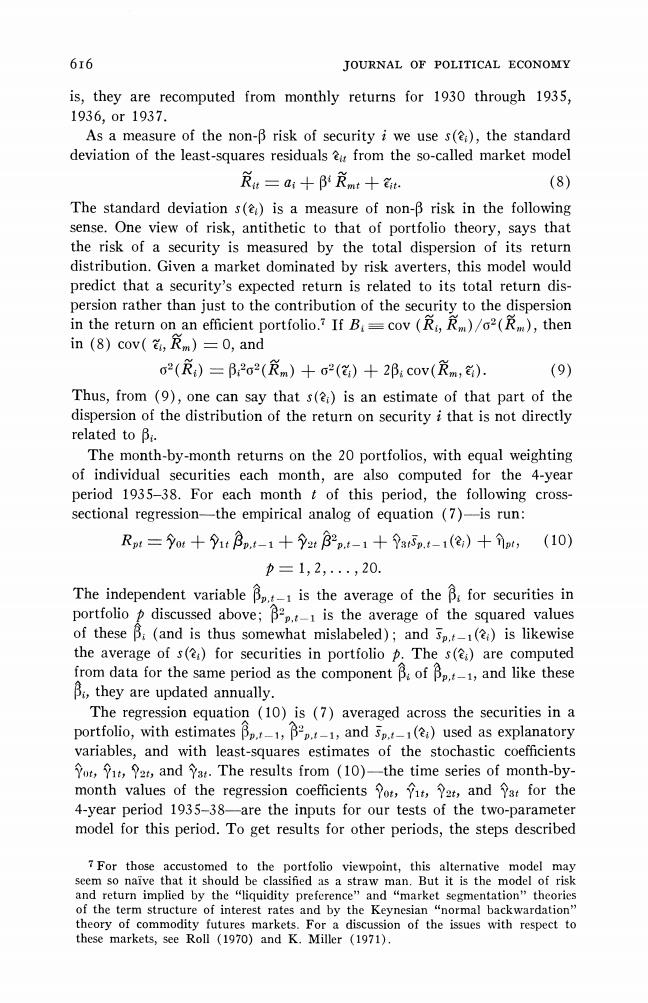

6r6 JOURNAL OF POLITICAL ECONOMY is,they are recomputed from monthly returns for 1930 through 1935, 1936,or1937. As a measure of the non-B risk of security i we use s(),the standard deviation of the least-squares residuals from the so-called market model 哀t=a:+B哀nt十t (8) The standard deviation s()is a measure of non-B risk in the following sense.One view of risk,antithetic to that of portfolio theory,says that the risk of a security is measured by the total dispersion of its return distribution.Given a market dominated by risk averters,this model would predict that a security's expected return is related to its total return dis- persion rather than just to the contribution of the security to the dispersion in the return on an efficient portfolio.7 If B=cov (R,R)/a2(R),then in (8)cov(Rm)=0,and o2(R)=B2o2(m)十o2()+2B:cov(m,). (9) Thus,from (9),one can say that s()is an estimate of that part of the dispersion of the distribution of the return on security i that is not directly related to Bi. The month-by-month returns on the 20 portfolios,with equal weighting of individual securities each month,are also computed for the 4-year period 1935-38.For each month t of this period,the following cross- sectional regression-the empirical analog of equation (7)-is run: R=ot十1:Bnt-1十rB2n.t-1十a5n.t-1(e)十①t, (10)) p=1,2,…,20 The independent variable B.is the average of the B for securities in portfolio p discussed above;B2p.is the average of the squared values of these B:(and is thus somewhat mislabeled);and p.1()is likewise the average of s()for securities in portfolio The s()are computed from data for the same period as the component Bof Bp.1,and like these B,they are updated annually. The regression equation (10)is (7)averaged across the securities in a portfolio,with estimates B,B1,and 5.()used as explanatory variables,and with least-squares estimates of the stochastic coefficients Yot,,2t,and Ya.The results from (10)-the time series of month-by- month values of the regression coefficients ot,,2,and ?st for the 4-year period 1935-38-are the inputs for our tests of the two-parameter model for this period.To get results for other periods,the steps described 7 For those accustomed to the portfolio viewpoint,this alternative model may seem so naive that it should be classified as a straw man.But it is the model of risk and return implied by the“liquidity preference”and“market segmentation”theories of the term structure of interest rates and by the Keynesian "normal backwardation" theory of commodity futures markets.For a discussion of the issues with respect to these markets,see Roll (1970)and K.Miller (1971)