正在加载图片...

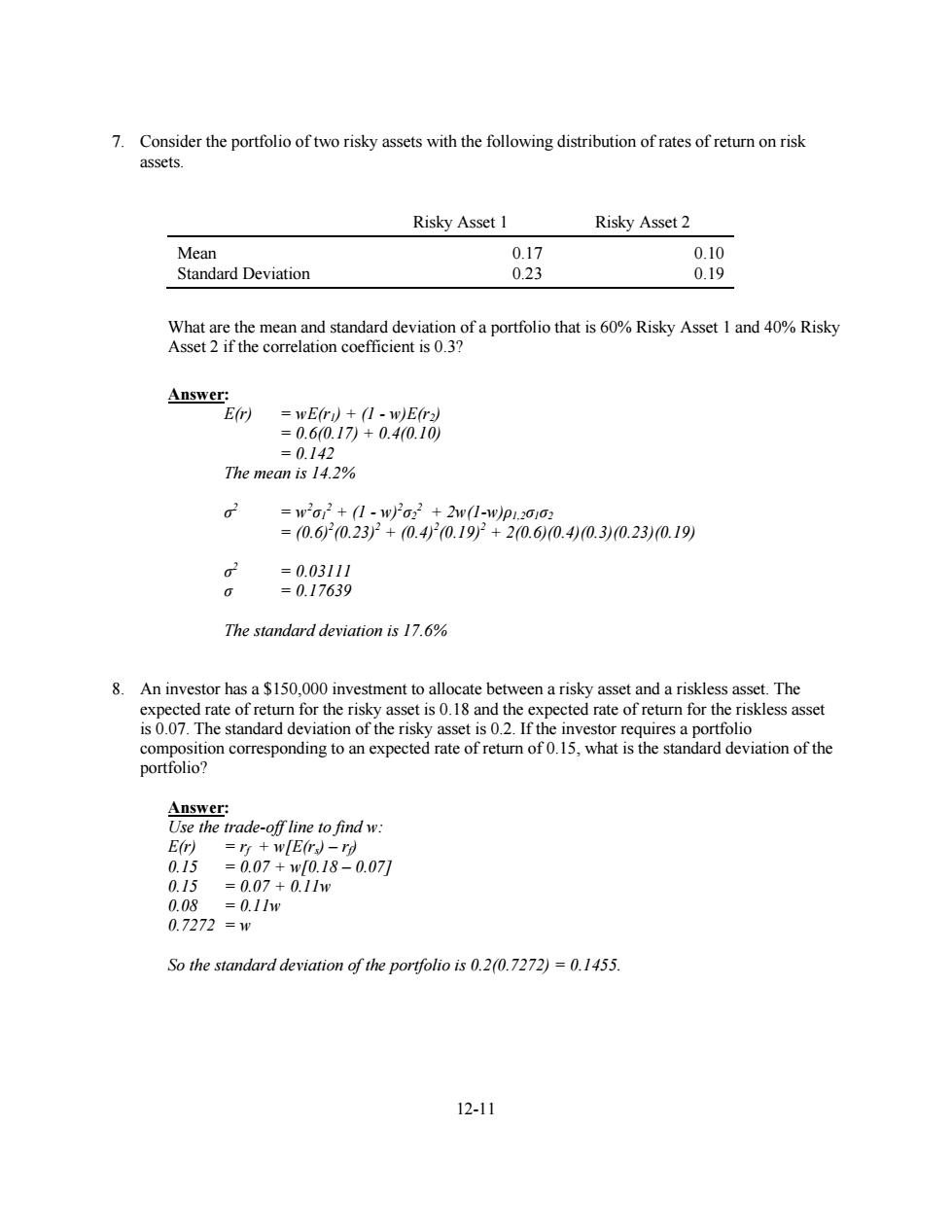

7.Consider the portfolio of two risky assets with the following distribution of rates of return on risk assets. Risky Asset 1 Risky Asset 2 Mean 0.17 0.10 Standard Deviation 0.23 0.19 What are the mean and standard deviation of a portfolio that is 60%Risky Asset 1 and 40%Risky Asset 2 if the correlation coefficient is 0.3? Answer: E(r) =wE(r)+(1-w)E(r2) =0.60.17)+0.40.10) =0.142 The mean is 14.2% 3 =w2o2+(1-1w2o22+2r1-w)p1,201o2 =(0.60.232+0.40.192+20.6)0.40.30.23)0.19) 03 =0.03111 =0.17639 The standard deviation is 17.6% 8.An investor has a $150,000 investment to allocate between a risky asset and a riskless asset.The expected rate of return for the risky asset is 0.18 and the expected rate of return for the riskless asset is 0.07.The standard deviation of the risky asset is 0.2.If the investor requires a portfolio composition corresponding to an expected rate of return of 0.15,what is the standard deviation of the portfolio? Answer: Use the trade-off line to find w: E(r)=rt+wE(rs)-ro 0.15=0.07+w[0.18-0.071 0.15=0.07+0.11w 0.08=0.11w 0.7272=w So the standard deviation of the portfolio is 0.2(0.7272)=0.1455. 12-1112-11 7. Consider the portfolio of two risky assets with the following distribution of rates of return on risk assets. Risky Asset 1 Risky Asset 2 Mean Standard Deviation 0.17 0.23 0.10 0.19 What are the mean and standard deviation of a portfolio that is 60% Risky Asset 1 and 40% Risky Asset 2 if the correlation coefficient is 0.3? Answer: E(r) = wE(r1) + (1 - w)E(r2) = 0.6(0.17) + 0.4(0.10) = 0.142 The mean is 14.2% σ 2 = w 2 σ1 2 + (1 - w) 2 σ2 2 + 2w(1-w)ρ1,2σ1σ2 = (0.6)2 (0.23)2 + (0.4)2 (0.19)2 + 2(0.6)(0.4)(0.3)(0.23)(0.19) σ 2 = 0.03111 σ = 0.17639 The standard deviation is 17.6% 8. An investor has a $150,000 investment to allocate between a risky asset and a riskless asset. The expected rate of return for the risky asset is 0.18 and the expected rate of return for the riskless asset is 0.07. The standard deviation of the risky asset is 0.2. If the investor requires a portfolio composition corresponding to an expected rate of return of 0.15, what is the standard deviation of the portfolio? Answer: Use the trade-off line to find w: E(r) = rf + w[E(rs) – rf) 0.15 = 0.07 + w[0.18 – 0.07] 0.15 = 0.07 + 0.11w 0.08 = 0.11w 0.7272 = w So the standard deviation of the portfolio is 0.2(0.7272) = 0.1455