正在加载图片...

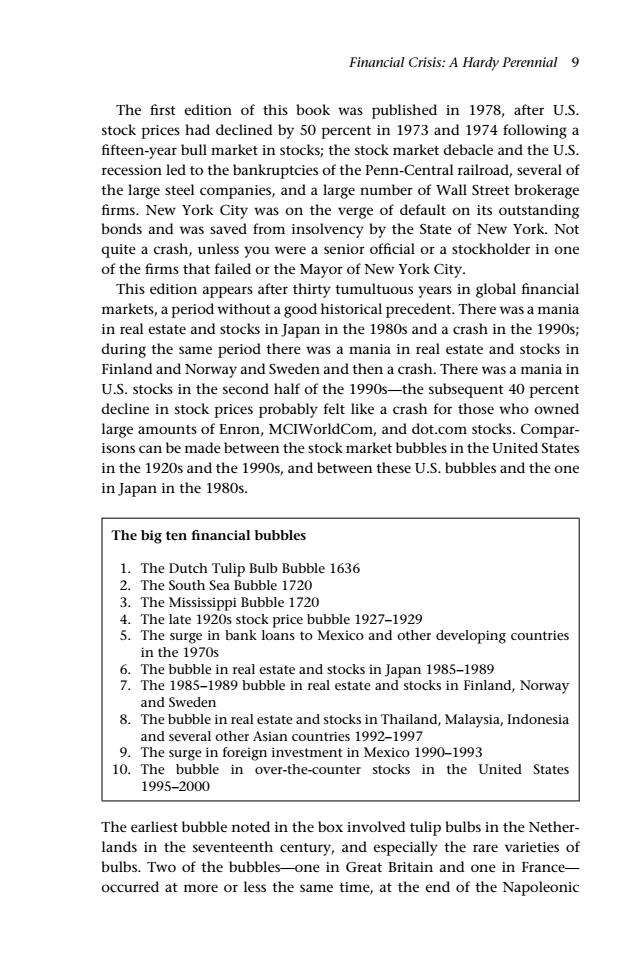

Financial Crisis:A Hardy Perennial 9 The first edition of this book was published in 1978,after U.S. stock prices had declined by 50 percent in 1973 and 1974 following a fifteen-year bull market in stocks;the stock market debacle and the U.S. recession led to the bankruptcies of the Penn-Central railroad.several of the large steel companies,and a large number of Wall Street brokerage firms.New York City was on the verge of default on its outstanding bonds and was saved from insolvency by the State of New York.Not quite a crash,unless you were a senior official or a stockholder in one of the firms that failed or the Mayor of New York City. This edition appears after thirty tumultuous years in global financial markets,a period without a good historical precedent.There was a mania in real estate and stocks in Japan in the 1980s and a crash in the 1990s: during the same period there was a mania in real estate and stocks in Finland and norway and sweden and then a crash.There was a mania in U.S.stocks in the second half of the 1990s-the subsequent 40 percent decline in stock prices probably felt like a crash for those who owned large amounts of Enron,MCIWorldCom,and dot.com stocks.Compar- isons can be made between the stock market bubbles in the United States in the 1920s and the 1990s,and between these U.S.bubbles and the one in Japan in the 1980s. The big ten financial bubbles 1.The Dutch Tulip Bulb Bubble 1636 2.The South Sea Bubble 1720 3.The Mississippi Bubble 1720 4.The late 1920s stock price bubble 1927-1929 5.The surge in bank loans to Mexico and other developing countries in the 1970s 6.The bubble in real estate and stocks in Japan 1985-1989 7.The 1985-1989 bubble in real estate and'stocks in Finland,Norway and Sweden 8.The bubble in real estate and stocks in Thailand,Malaysia,Indonesia and several other Asian countries 1992-1997 9.The surge in foreign investment in Mexico 1990-1993 10.The bubble in over-the-counter stocks in the United States 1995-2000 The earliest bubble noted in the box involved tulip bulbs in the Nether- lands in the seventeenth century,and especially the rare varieties of bulbs.Two of the bubbles-one in Great Britain and one in France occurred at more or less the same time,at the end of the Napoleonicc01 JWBK120/Kindleberger February 13, 2008 14:58 Char Count= Financial Crisis: A Hardy Perennial 9 The first edition of this book was published in 1978, after U.S. stock prices had declined by 50 percent in 1973 and 1974 following a fifteen-year bull market in stocks; the stock market debacle and the U.S. recession led to the bankruptcies of the Penn-Central railroad, several of the large steel companies, and a large number of Wall Street brokerage firms. New York City was on the verge of default on its outstanding bonds and was saved from insolvency by the State of New York. Not quite a crash, unless you were a senior official or a stockholder in one of the firms that failed or the Mayor of New York City. This edition appears after thirty tumultuous years in global financial markets, a period without a good historical precedent. There was a mania in real estate and stocks in Japan in the 1980s and a crash in the 1990s; during the same period there was a mania in real estate and stocks in Finland and Norway and Sweden and then a crash. There was a mania in U.S. stocks in the second half of the 1990s—the subsequent 40 percent decline in stock prices probably felt like a crash for those who owned large amounts of Enron, MCIWorldCom, and dot.com stocks. Comparisons can be made between the stock market bubbles in the United States in the 1920s and the 1990s, and between these U.S. bubbles and the one in Japan in the 1980s. The big ten financial bubbles 1. The Dutch Tulip Bulb Bubble 1636 2. The South Sea Bubble 1720 3. The Mississippi Bubble 1720 4. The late 1920s stock price bubble 1927–1929 5. The surge in bank loans to Mexico and other developing countries in the 1970s 6. The bubble in real estate and stocks in Japan 1985–1989 7. The 1985–1989 bubble in real estate and stocks in Finland, Norway and Sweden 8. The bubble in real estate and stocks in Thailand, Malaysia, Indonesia and several other Asian countries 1992–1997 9. The surge in foreign investment in Mexico 1990–1993 10. The bubble in over-the-counter stocks in the United States 1995–2000 The earliest bubble noted in the box involved tulip bulbs in the Netherlands in the seventeenth century, and especially the rare varieties of bulbs. Two of the bubbles—one in Great Britain and one in France— occurred at more or less the same time, at the end of the Napoleonic