正在加载图片...

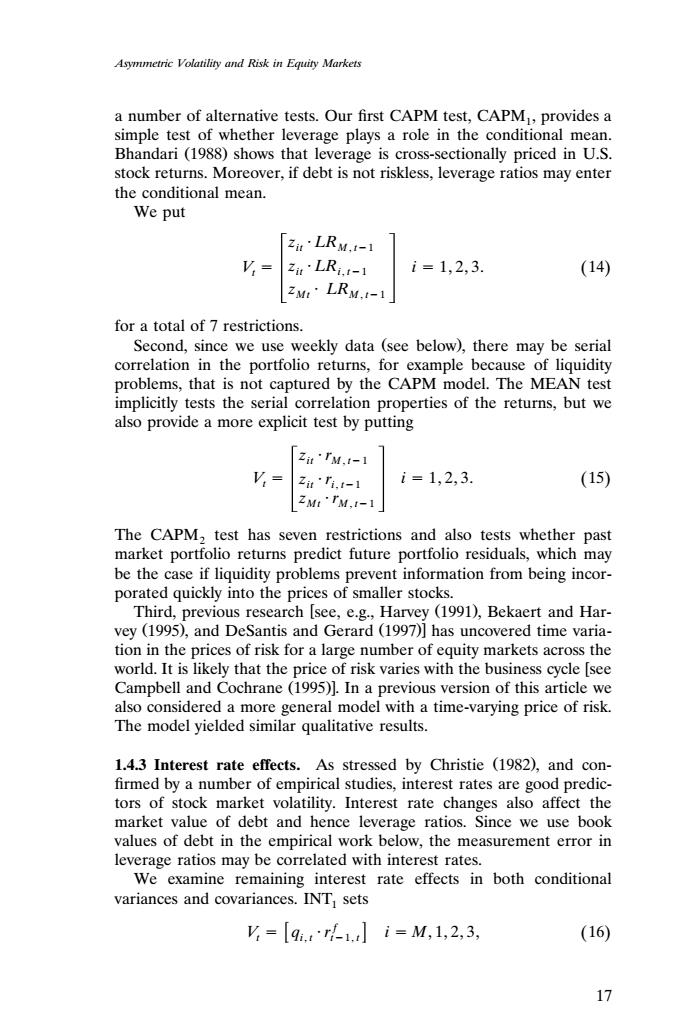

Asymmetric Volatility and Risk in Equity Markets a number of alternative tests.Our first CAPM test,CAPM,provides a simple test of whether leverage plays a role in the conditional mean. Bhandari (1988)shows that leverage is cross-sectionally priced in U.S. stock returns.Moreover,if debt is not riskless,leverage ratios may enter the conditional mean. We put zit'LRM.-1 V zi'LRi.-1 i=1,2,3. (14) ZM·LRM,-1 for a total of 7 restrictions. Second,since we use weekly data (see below),there may be serial correlation in the portfolio returns,for example because of liquidity problems,that is not captured by the CAPM model.The MEAN test implicitly tests the serial correlation properties of the returns,but we also provide a more explicit test by putting Zi'IM,-1 V,= Zi'fi.-1 i=1,2,3 (15) ZMt'IM.1-1 The CAPM,test has seven restrictions and also tests whether past market portfolio returns predict future portfolio residuals,which may be the case if liquidity problems prevent information from being incor- porated quickly into the prices of smaller stocks. Third,previous research [see,e.g.,Harvey (1991),Bekaert and Har- vey (1995),and DeSantis and Gerard (1997)]has uncovered time varia- tion in the prices of risk for a large number of equity markets across the world.It is likely that the price of risk varies with the business cycle [see Campbell and Cochrane (1995)].In a previous version of this article we also considered a more general model with a time-varying price of risk. The model yielded similar qualitative results. 1.4.3 Interest rate effects.As stressed by Christie (1982),and con- firmed by a number of empirical studies,interest rates are good predic- tors of stock market volatility.Interest rate changes also affect the market value of debt and hence leverage ratios.Since we use book values of debt in the empirical work below,the measurement error in leverage ratios may be correlated with interest rates. We examine remaining interest rate effects in both conditional variances and covariances.INT sets =9.tr-1.ti=M,1,2,3, (16) 17Asymmetric Volatility and Risk in Equity Markets a number of alternative tests. Our first CAPM test, CAPM , provides a 1 simple test of whether leverage plays a role in the conditional mean. Bhandari 1988 shows that leverage is cross-sectionally priced in U.S. Ž . stock returns. Moreover, if debt is not riskless, leverage ratios may enter the conditional mean. We put zit M LR , t1 V zit i LR , t1 i 1, 2, 3. 14 Ž . t zMt M LR , t1 for a total of 7 restrictions. Second, since we use weekly data see below , there may be serial Ž . correlation in the portfolio returns, for example because of liquidity problems, that is not captured by the CAPM model. The MEAN test implicitly tests the serial correlation properties of the returns, but we also provide a more explicit test by putting z r it M , t1 V z r i 1, 2, 3. 15 Ž . t it i, t1 zMt M r , t1 The CAPM test has seven restrictions and also tests whether past 2 market portfolio returns predict future portfolio residuals, which may be the case if liquidity problems prevent information from being incorporated quickly into the prices of smaller stocks. Third, previous research see, e.g., Harvey 1991 , Bekaert and Har- Ž . vey 1995 , and DeSantis and Gerard 1997 has uncovered time varia- Ž. Ž. tion in the prices of risk for a large number of equity markets across the world. It is likely that the price of risk varies with the business cycle see Campbell and Cochrane 1995 . In a previous version of this article we Ž . also considered a more general model with a time-varying price of risk. The model yielded similar qualitative results. 1.4.3 Interest rate effects. As stressed by Christie 1982 , and con- Ž . firmed by a number of empirical studies, interest rates are good predictors of stock market volatility. Interest rate changes also affect the market value of debt and hence leverage ratios. Since we use book values of debt in the empirical work below, the measurement error in leverage ratios may be correlated with interest rates. We examine remaining interest rate effects in both conditional variances and covariances. INT sets 1 f V q r i M, 1, 2, 3, 16 Ž . t i, t t1, t 17��