正在加载图片...

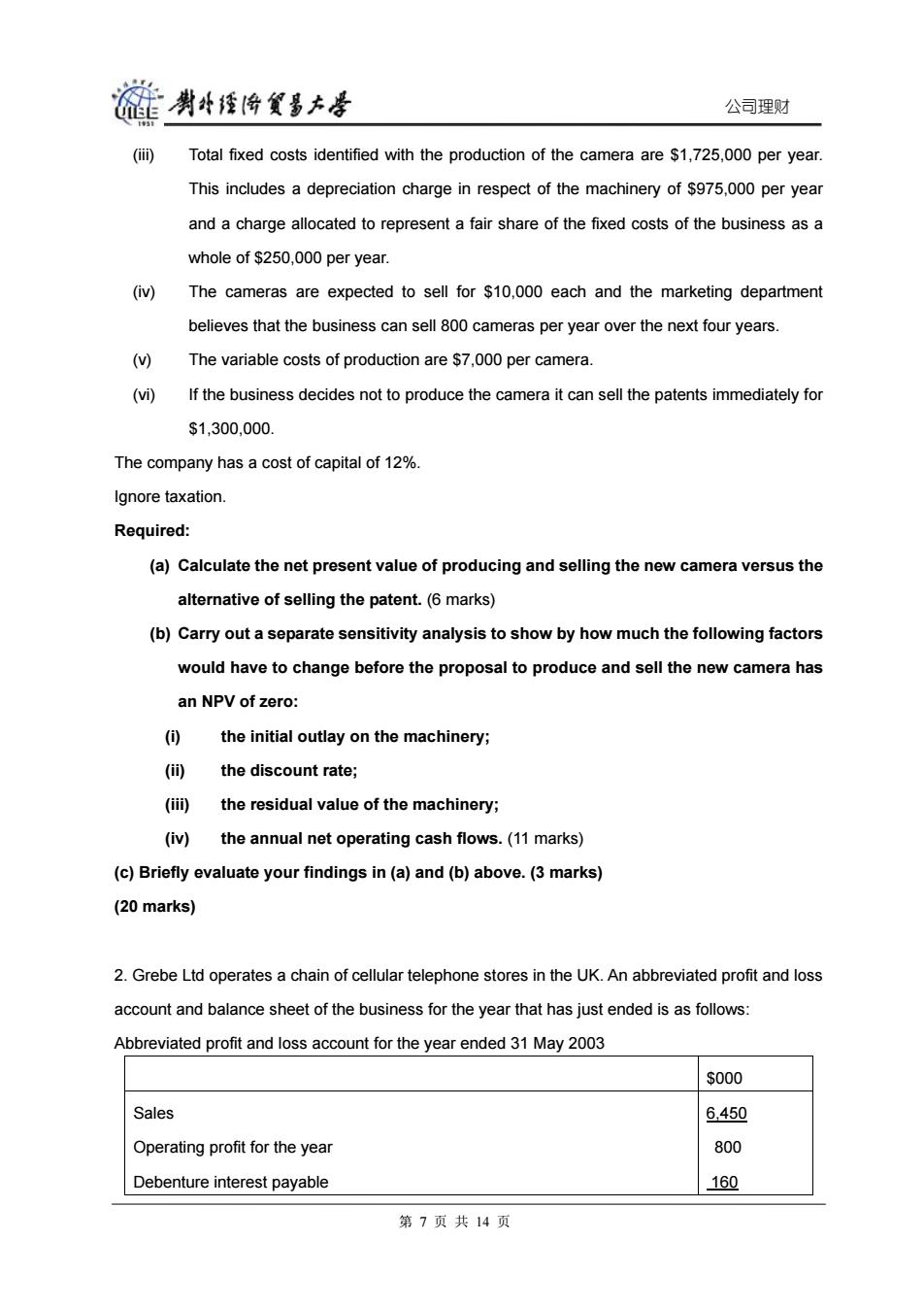

剥好径份贺易大是 公司理财 ( Total fixed costs identified with the production of the camera are $1,725,000 per year. This includes a depreciation charge in respect of the machinery of $975,000 per year and a charge allocated to represent a fair share of the fixed costs of the business as a whole of $250,000 per year. () The cameras are expected to sell for $10,000 each and the marketing department believes that the business can sell 800 cameras per year over the next four years. () The variable costs of production are $7,000 per camera. (vi) If the business decides not to produce the camera it can sell the patents immediately for $1,300,000. The company has a cost of capital of 12%. Ignore taxation. Required: (a)Calculate the net present value of producing and selling the new camera versus the alternative of selling the patent.(6 marks) (b)Carry out a separate sensitivity analysis to show by how much the following factors would have to change before the proposal to produce and sell the new camera has an NPV of zero: () the initial outlay on the machinery; () the discount rate; (im) the residual value of the machinery; (iv) the annual net operating cash flows.(11 marks) (c)Briefly evaluate your findings in(a)and(b)above.(3 marks) (20 marks) 2.Grebe Ltd operates a chain of cellular telephone stores in the UK.An abbreviated profit and loss account and balance sheet of the business for the year that has just ended is as follows: Abbreviated profit and loss account for the year ended 31 May 2003 $000 Sales 6.450 Operating profit for the year 800 Debenture interest payable 160 第7页共14页公司理财 (iii) Total fixed costs identified with the production of the camera are $1,725,000 per year. This includes a depreciation charge in respect of the machinery of $975,000 per year and a charge allocated to represent a fair share of the fixed costs of the business as a whole of $250,000 per year. (iv) The cameras are expected to sell for $10,000 each and the marketing department believes that the business can sell 800 cameras per year over the next four years. (v) The variable costs of production are $7,000 per camera. (vi) If the business decides not to produce the camera it can sell the patents immediately for $1,300,000. The company has a cost of capital of 12%. Ignore taxation. Required: (a) Calculate the net present value of producing and selling the new camera versus the alternative of selling the patent. (6 marks) (b) Carry out a separate sensitivity analysis to show by how much the following factors would have to change before the proposal to produce and sell the new camera has an NPV of zero: (i) the initial outlay on the machinery; (ii) the discount rate; (iii) the residual value of the machinery; (iv) the annual net operating cash flows. (11 marks) (c) Briefly evaluate your findings in (a) and (b) above. (3 marks) (20 marks) 2. Grebe Ltd operates a chain of cellular telephone stores in the UK. An abbreviated profit and loss account and balance sheet of the business for the year that has just ended is as follows: Abbreviated profit and loss account for the year ended 31 May 2003 $000 Sales Operating profit for the year Debenture interest payable 6,450 800 160 第 7 页 共 14 页