正在加载图片...

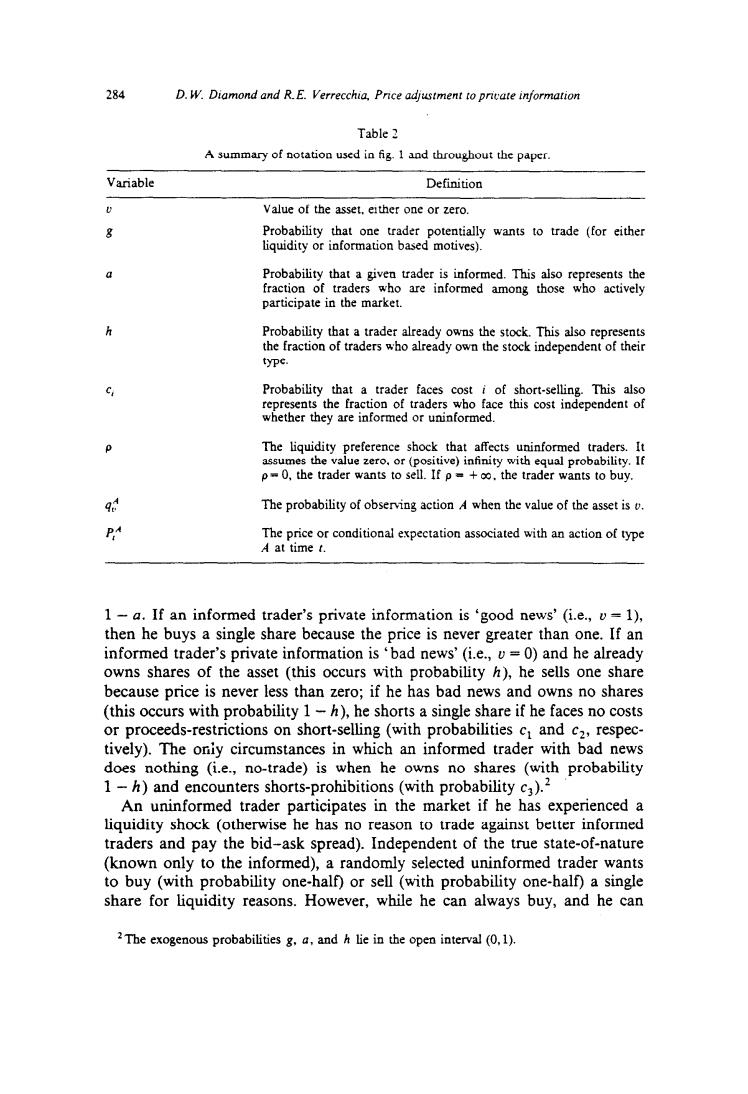

284 D.W.Diamond and R.E.Verrecchia,Price adjustment to pricate information Table 2 A summary of notation used in fig.1 and throughout the paper. Variable Definition Value of the asset,either one or zero. 8 Probability that one trader potentially wants to trade (for either liquidity or information based motives). a Probability that a given trader is informed.This also represents the fraction of traders who are informed among those who actively participate in the market. h Probability that a trader already owns the stock.This also represents the fraction of traders who already own the stock independent of their typc. Probability that a trader faces cost i of short-selling.This also represents the fraction of traders who face this cost independent of whether they are informed or uninformed. p The liquidity preference shock that affects uninformed traders.It assumes the value zero.or(positive)infinity with equal probability.If p=0,the trader wants to sell.If p=+oo.the trader wants to buy. The probability of observing action A when the value of the asset is v. The price or conditional expectation associated with an action of type A at time t. 1-a.If an informed trader's private information is 'good news'(i.e.,=1), then he buys a single share because the price is never greater than one.If an informed trader's private information is'bad news'(i.e.,v=0)and he already owns shares of the asset (this occurs with probability h),he sells one share because price is never less than zero;if he has bad news and owns no shares (this occurs with probability 1-h),he shorts a single share if he faces no costs or proceeds-restrictions on short-selling (with probabilities c and c2,respec- tively).The oniy circumstances in which an informed trader with bad news does nothing (i.e,no-trade)is when he owns no shares (with probability 1-h)and encounters shorts-prohibitions(with probability c3).2 An uninformed trader participates in the market if he has experienced a liquidity shock (otherwise he has no reason to trade against better informed traders and pay the bid-ask spread).Independent of the true state-of-nature (known only to the informed),a randomly selected uninformed trader wants to buy (with probability one-half)or sell(with probability one-half)a single share for liquidity reasons.However,while he can always buy,and he can 2The exogenous probabilities g.a,and h lie in the open interval (0.1).284 D. W. Diamond and R.E. Verrecchla. Pnce adjustment to prwate mformanon Table 2 A summary of notation used in fig. 1 and throughout the paper. Variable Definition ” g Value of the asset. either one or zero. Probability that one trader potentially wants to trade (for either liquidity or information based motives). a Probability that a given trader is informed. This also represents the fraction of traders who are informed among those who actively participate in the market. h Probability that a trader already owns the stock. This also represents the fraction of traders who already own the stock independent of their type. c, Probability that a trader faces cost i of short-selling. This also represents the fraction of traders who face this cost independent of whether they are informed or uninformed. P The liquidity preference shock that affects uninformed traders. It assumes the value zero. or (positive) infinity with equal probability. If p= 0, the trader wants to sell. If p = + a~, the trader wants to buy. A 41, P, The probability of observing action A when the value of the asset is o. The price or conditional expectation associated with an action of type A at time t. 1 - a. If an informed trader’s private information is ‘good news’ (i.e., u = l), then he buys a single share because the price is never greater than one. If an informed trader’s private information is ‘bad news’ (i.e., u = 0) and he already owns shares of the asset (this occurs with probability h), he sells one share because price is never less than zero; if he has bad news and owns no shares (this occurs with probability 1 - h), he shorts a single share if he faces no costs or proceeds-restrictions on short-selling (with probabilities ct and cz, respectively). The o&y circumstances in which an informed trader with bad news does nothing (i.e., no-trade) is when he owns no shares (with probability 1 - h) and encounters shorts-prohibitions (with probability cs).’ An uninformed trader participates in the market if he has experienced a liquidity shock (otherwise he has no reason to trade against better informed traders and pay the bid-ask spread). Independent of the true state-of-nature (known only to the informed), a randomly selected uninformed trader wants to buy (with probability one-half) or sell (with probability one-half) a single share for liquidity reasons. However, while he can always buy, and he can 2The exogenous probabilities g, a, and h lie in the open interval (0,l)