正在加载图片...

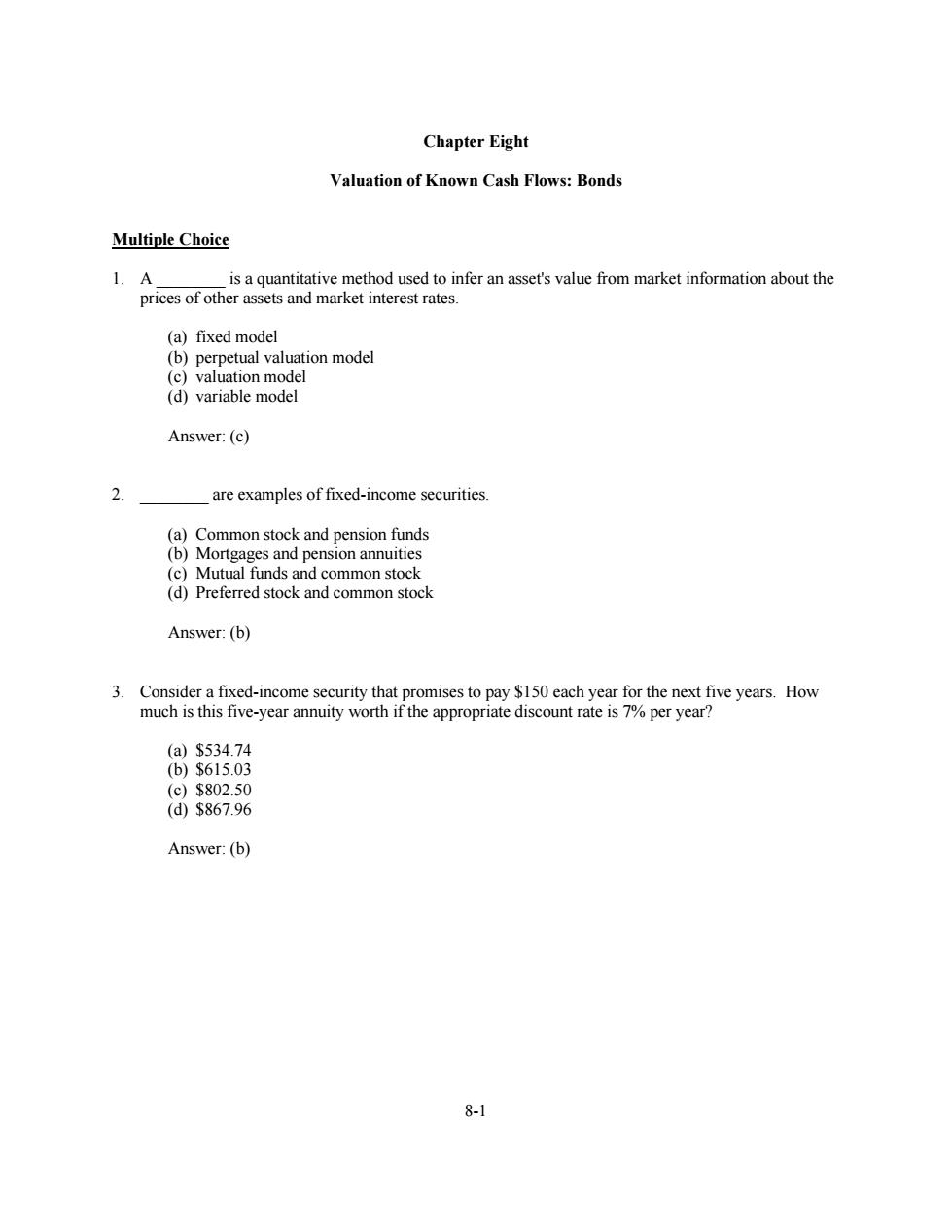

Chapter Eight Valuation of Known Cash Flows:Bonds Multiple Choice 1.A is a quantitative method used to infer an asset's value from market information about the prices of other assets and market interest rates. (a)fixed model (b)perpetual valuation model (c)valuation model (d)variable model Answer:(c) 2. are examples of fixed-income securities (a)Common stock and pension funds (b)Mortgages and pension annuities (c)Mutual funds and common stock (d)Preferred stock and common stock Answer:(b) 3. Consider a fixed-income security that promises to pay $150 each year for the next five years.How much is this five-year annuity worth if the appropriate discount rate is 7%per year? (a)$534.74 (b)$615.03 (c)$802.50 (d$867.96 Answer:(b) 8-18-1 Chapter Eight Valuation of Known Cash Flows: Bonds Multiple Choice 1. A ________ is a quantitative method used to infer an asset's value from market information about the prices of other assets and market interest rates. (a) fixed model (b) perpetual valuation model (c) valuation model (d) variable model Answer: (c) 2. ________ are examples of fixed-income securities. (a) Common stock and pension funds (b) Mortgages and pension annuities (c) Mutual funds and common stock (d) Preferred stock and common stock Answer: (b) 3. Consider a fixed-income security that promises to pay $150 each year for the next five years. How much is this five-year annuity worth if the appropriate discount rate is 7% per year? (a) $534.74 (b) $615.03 (c) $802.50 (d) $867.96 Answer: (b)