正在加载图片...

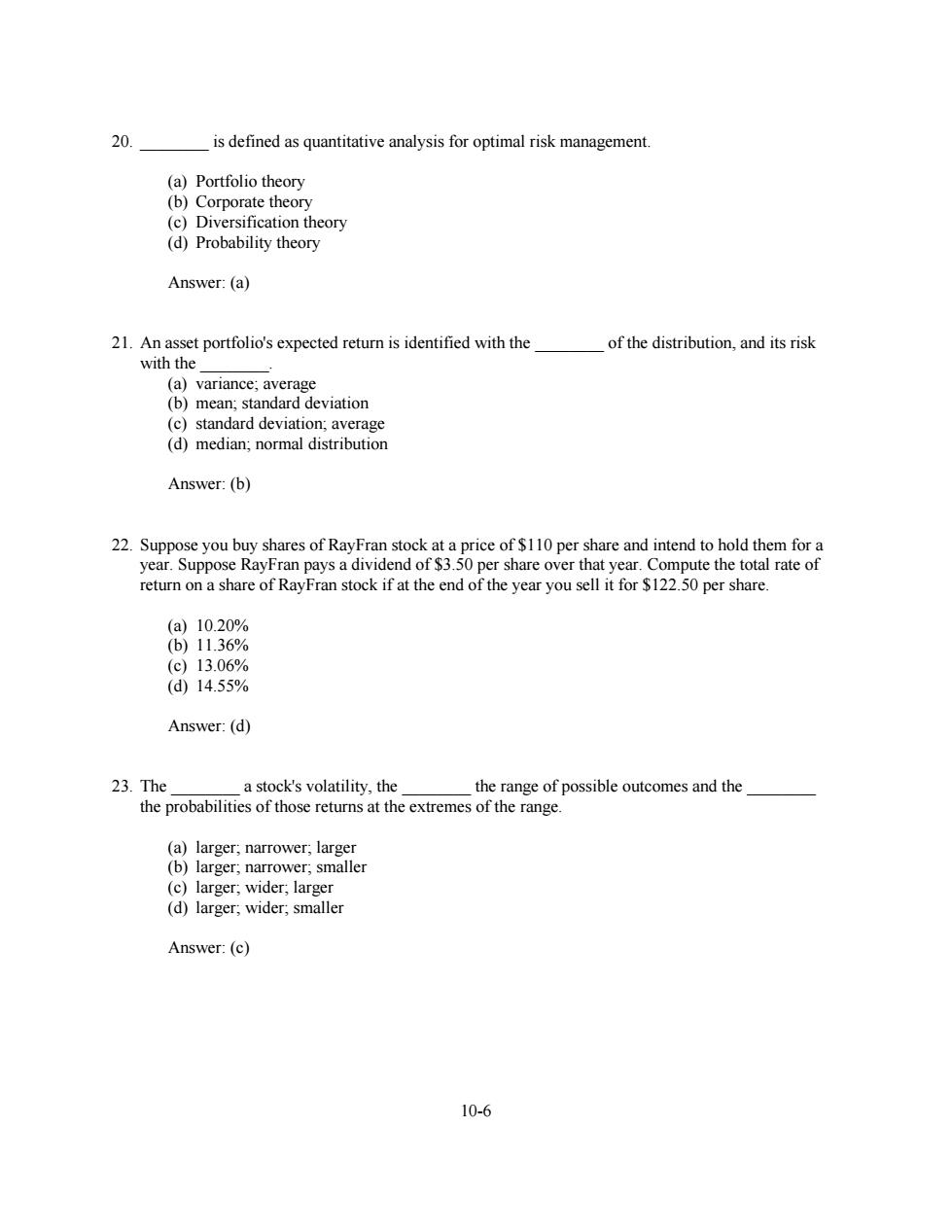

20. is defined as quantitative analysis for optimal risk management. (a)Portfolio theory (b)Corporate theory (c)Diversification theory (d)Probability theory Answer:(a) 21.An asset portfolio's expected return is identified with the of the distribution,and its risk with the (a)variance;average (b)mean;standard deviation (c)standard deviation;average (d)median;normal distribution Answer:(b) 22.Suppose you buy shares of RayFran stock at a price of $110 per share and intend to hold them for a year.Suppose RayFran pays a dividend of $3.50 per share over that year.Compute the total rate of return on a share of RayFran stock if at the end of the year you sell it for $122.50 per share. (a)10.20% (b)11.36% (c)13.06% (d14.55% Answer:(d) 23.The a stock's volatility,the the range of possible outcomes and the the probabilities of those returns at the extremes of the range. (a)larger;narrower;larger (b)larger;narrower;smaller (c)larger;wider;larger (d)larger;wider;smaller Answer:(c) 10-610-6 20. ________ is defined as quantitative analysis for optimal risk management. (a) Portfolio theory (b) Corporate theory (c) Diversification theory (d) Probability theory Answer: (a) 21. An asset portfolio's expected return is identified with the ________ of the distribution, and its risk with the ________. (a) variance; average (b) mean; standard deviation (c) standard deviation; average (d) median; normal distribution Answer: (b) 22. Suppose you buy shares of RayFran stock at a price of $110 per share and intend to hold them for a year. Suppose RayFran pays a dividend of $3.50 per share over that year. Compute the total rate of return on a share of RayFran stock if at the end of the year you sell it for $122.50 per share. (a) 10.20% (b) 11.36% (c) 13.06% (d) 14.55% Answer: (d) 23. The ________ a stock's volatility, the ________ the range of possible outcomes and the ________ the probabilities of those returns at the extremes of the range. (a) larger; narrower; larger (b) larger; narrower; smaller (c) larger; wider; larger (d) larger; wider; smaller Answer: (c)