正在加载图片...

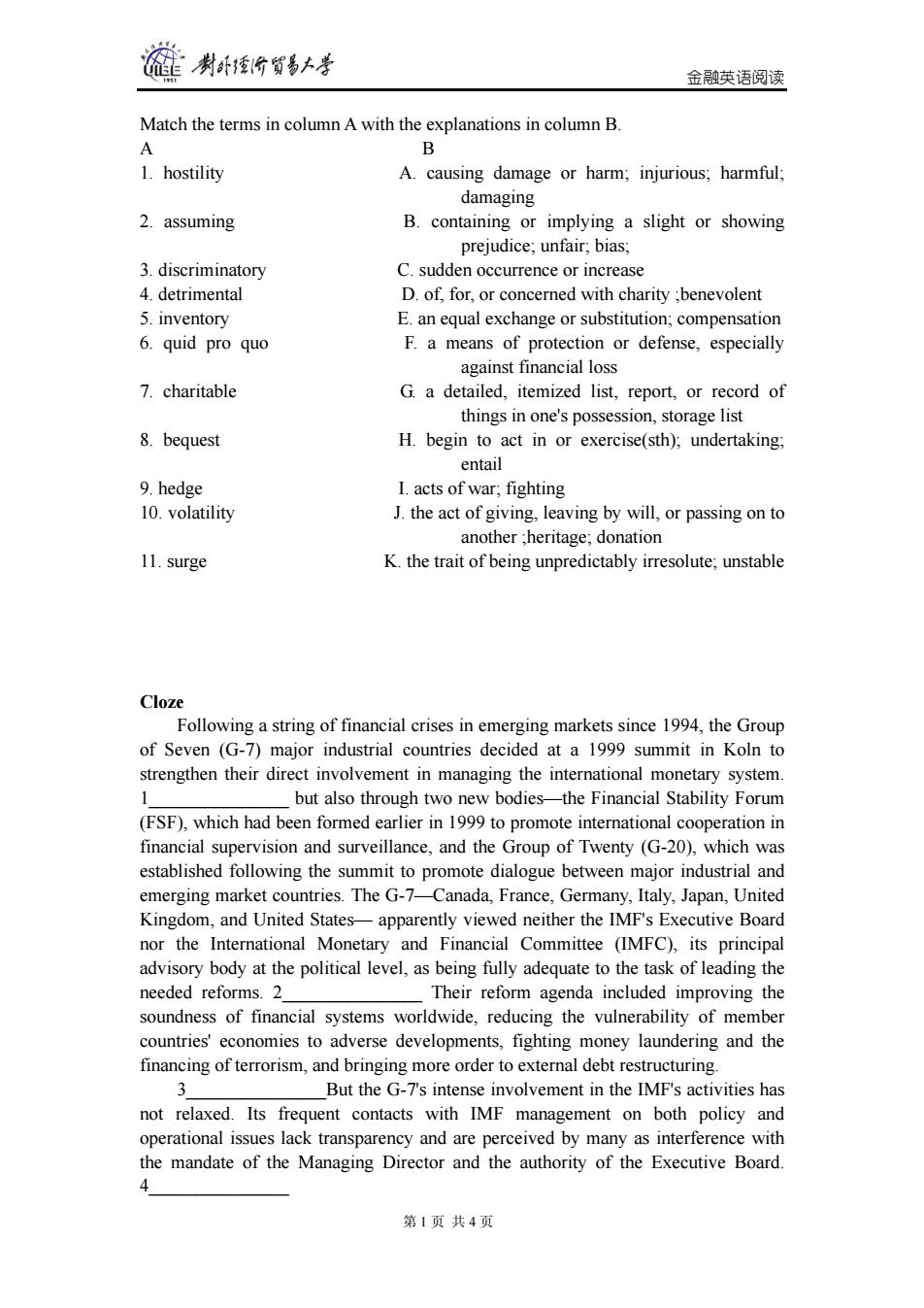

”制卧份贸易+考 金融英语阅读 Match the terms in column A with the explanations in column B. A B 1.hostility A.causing damage or harm;injurious;harmful; damaging 2.assuming B.containing or implying a slight or showing prejudice;unfair;bias; 3.discriminatory C.sudden occurrence or increase 4.detrimental D.of,for,or concerned with charity;benevolent 5.inventory E.an equal exchange or substitution;compensation 6.quid pro quo F.a means of protection or defense,especially against financial loss 7.charitable G.a detailed,itemized list,report,or record of things in one's possession,storage list 8.bequest H.begin to act in or exercise(sth);undertaking; entail 9.hedge I.acts of war;fighting 10.volatility J.the act of giving,leaving by will,or passing on to another;heritage;donation 11.surge K.the trait of being unpredictably irresolute;unstable Cloze Following a string of financial crises in emerging markets since 1994,the Group of Seven (G-7)major industrial countries decided at a 1999 summit in Koln to strengthen their direct involvement in managing the international monetary system. 1 but also through two new bodies-the Financial Stability Forum (FSF),which had been formed earlier in 1999 to promote international cooperation in financial supervision and surveillance,and the Group of Twenty (G-20),which was established following the summit to promote dialogue between major industrial and emerging market countries.The G-7-Canada,France,Germany,Italy,Japan,United Kingdom,and United States-apparently viewed neither the IMF's Executive Board nor the International Monetary and Financial Committee (IMFC),its principal advisory body at the political level,as being fully adequate to the task of leading the needed reforms.2 Their reform agenda included improving the soundness of financial systems worldwide,reducing the vulnerability of member countries'economies to adverse developments,fighting money laundering and the financing of terrorism,and bringing more order to external debt restructuring. 3 But the G-7's intense involvement in the IMF's activities has not relaxed.Its frequent contacts with IMF management on both policy and operational issues lack transparency and are perceived by many as interference with the mandate of the Managing Director and the authority of the Executive Board. 4 第1页共4页金融英语阅读 第 1 页 共 4 页 Match the terms in column A with the explanations in column B. A B 1. hostility A. causing damage or harm; injurious; harmful; damaging 2. assuming B. containing or implying a slight or showing prejudice; unfair; bias; 3. discriminatory C. sudden occurrence or increase 4. detrimental D. of, for, or concerned with charity ;benevolent 5. inventory E. an equal exchange or substitution; compensation 6. quid pro quo F. a means of protection or defense, especially against financial loss 7. charitable G. a detailed, itemized list, report, or record of things in one's possession, storage list 8. bequest H. begin to act in or exercise(sth); undertaking; entail 9. hedge I. acts of war; fighting 10. volatility J. the act of giving, leaving by will, or passing on to another ;heritage; donation 11. surge K. the trait of being unpredictably irresolute; unstable Cloze Following a string of financial crises in emerging markets since 1994, the Group of Seven (G-7) major industrial countries decided at a 1999 summit in Koln to strengthen their direct involvement in managing the international monetary system. 1_______________ but also through two new bodies—the Financial Stability Forum (FSF), which had been formed earlier in 1999 to promote international cooperation in financial supervision and surveillance, and the Group of Twenty (G-20), which was established following the summit to promote dialogue between major industrial and emerging market countries. The G-7—Canada, France, Germany, Italy, Japan, United Kingdom, and United States— apparently viewed neither the IMF's Executive Board nor the International Monetary and Financial Committee (IMFC), its principal advisory body at the political level, as being fully adequate to the task of leading the needed reforms. 2_______________ Their reform agenda included improving the soundness of financial systems worldwide, reducing the vulnerability of member countries' economies to adverse developments, fighting money laundering and the financing of terrorism, and bringing more order to external debt restructuring. 3_______________But the G-7's intense involvement in the IMF's activities has not relaxed. Its frequent contacts with IMF management on both policy and operational issues lack transparency and are perceived by many as interference with the mandate of the Managing Director and the authority of the Executive Board. 4_______________