正在加载图片...

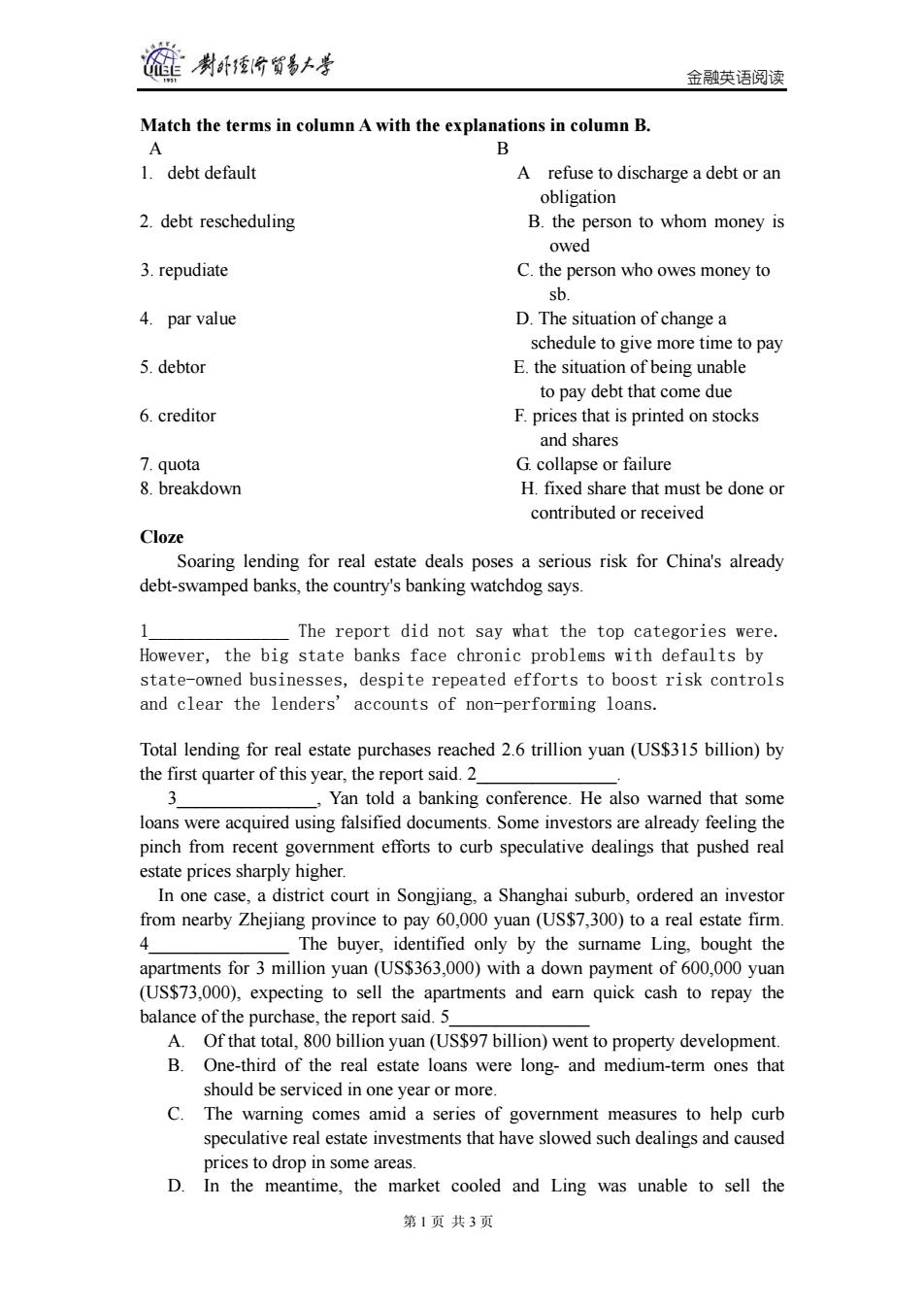

制卧价贸易+学 金融英语阅读 Match the terms in column A with the explanations in column B. A B 1.debt default A refuse to discharge a debt or an obligation 2.debt rescheduling B.the person to whom money is owed 3.repudiate C.the person who owes money to sb. 4.par value D.The situation of change a schedule to give more time to pay 5.debtor E.the situation of being unable to pay debt that come due 6.creditor F.prices that is printed on stocks and shares 7.quota G.collapse or failure 8.breakdown H.fixed share that must be done or contributed or received Cloze Soaring lending for real estate deals poses a serious risk for China's already debt-swamped banks,the country's banking watchdog says. 1 The report did not say what the top categories were. However,the big state banks face chronic problems with defaults by state-owned businesses,despite repeated efforts to boost risk controls and clear the lenders'accounts of non-performing loans. Total lending for real estate purchases reached 2.6 trillion yuan(US$315 billion)by the first quarter of this year,the report said.2 3 Yan told a banking conference.He also warned that some loans were acquired using falsified documents.Some investors are already feeling the pinch from recent government efforts to curb speculative dealings that pushed real estate prices sharply higher. In one case,a district court in Songjiang,a Shanghai suburb,ordered an investor from nearby Zhejiang province to pay 60,000 yuan(US$7,300)to a real estate firm. The buyer,identified only by the surname Ling,bought the apartments for 3 million yuan(US$363,000)with a down payment of 600,000 yuan (US$73,000),expecting to sell the apartments and earn quick cash to repay the balance of the purchase,the report said.5 A.Of that total,800 billion yuan(US$97 billion)went to property development. B.One-third of the real estate loans were long-and medium-term ones that should be serviced in one year or more. C.The warning comes amid a series of government measures to help curb speculative real estate investments that have slowed such dealings and caused prices to drop in some areas. D.In the meantime,the market cooled and Ling was unable to sell the 第1页共3页金融英语阅读 第 1 页 共 3 页 Match the terms in column A with the explanations in column B. A B 1. debt default A refuse to discharge a debt or an obligation 2. debt rescheduling B. the person to whom money is owed 3. repudiate C. the person who owes money to sb. 4. par value D. The situation of change a schedule to give more time to pay 5. debtor E. the situation of being unable to pay debt that come due 6. creditor F. prices that is printed on stocks and shares 7. quota G. collapse or failure 8. breakdown H. fixed share that must be done or contributed or received Cloze Soaring lending for real estate deals poses a serious risk for China's already debt-swamped banks, the country's banking watchdog says. 1_______________ The report did not say what the top categories were. However, the big state banks face chronic problems with defaults by state-owned businesses, despite repeated efforts to boost risk controls and clear the lenders' accounts of non-performing loans. Total lending for real estate purchases reached 2.6 trillion yuan (US$315 billion) by the first quarter of this year, the report said. 2_______________. 3_______________, Yan told a banking conference. He also warned that some loans were acquired using falsified documents. Some investors are already feeling the pinch from recent government efforts to curb speculative dealings that pushed real estate prices sharply higher. In one case, a district court in Songjiang, a Shanghai suburb, ordered an investor from nearby Zhejiang province to pay 60,000 yuan (US$7,300) to a real estate firm. 4_______________ The buyer, identified only by the surname Ling, bought the apartments for 3 million yuan (US$363,000) with a down payment of 600,000 yuan (US$73,000), expecting to sell the apartments and earn quick cash to repay the balance of the purchase, the report said. 5_______________ A. Of that total, 800 billion yuan (US$97 billion) went to property development. B. One-third of the real estate loans were long- and medium-term ones that should be serviced in one year or more. C. The warning comes amid a series of government measures to help curb speculative real estate investments that have slowed such dealings and caused prices to drop in some areas. D. In the meantime, the market cooled and Ling was unable to sell the