正在加载图片...

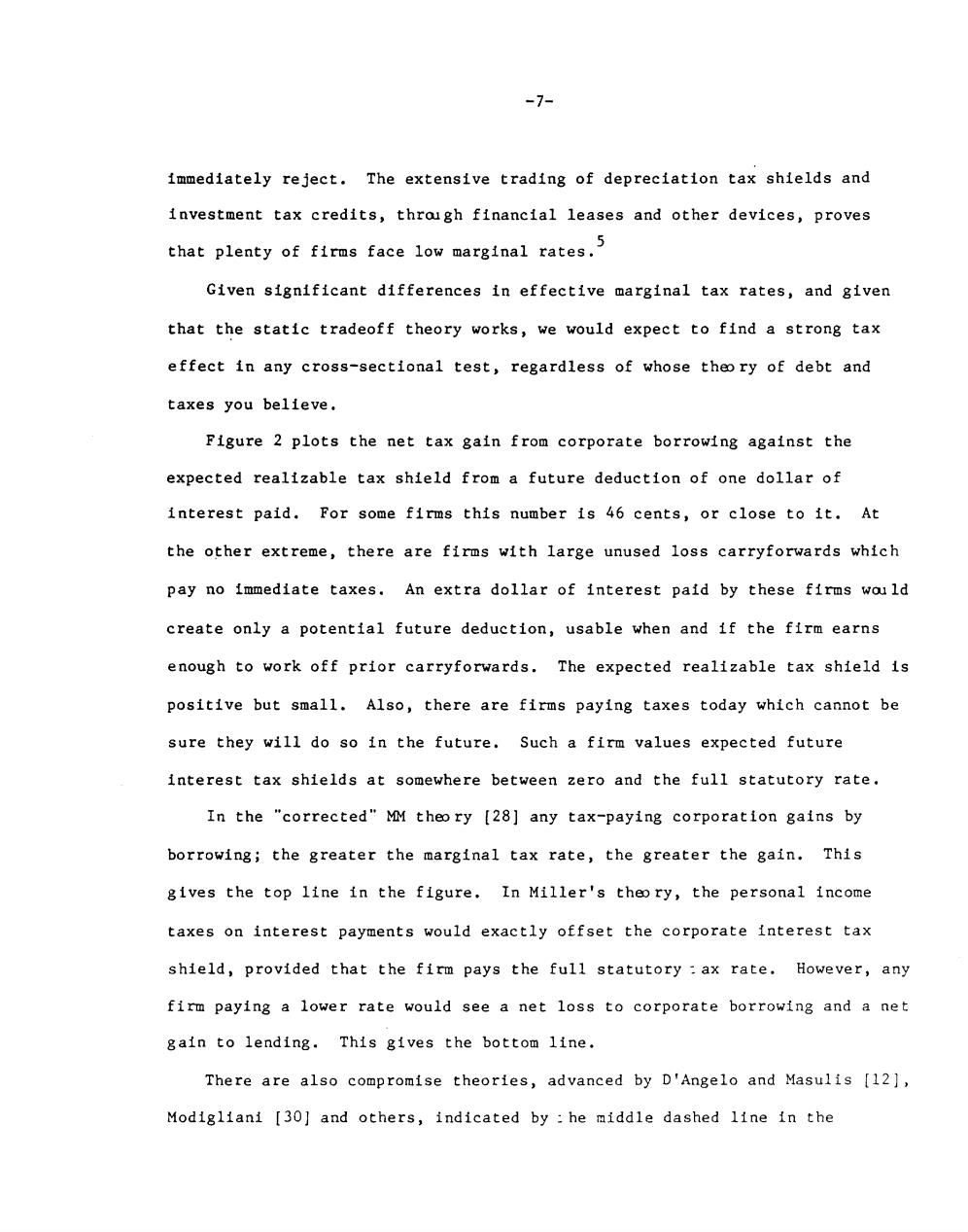

-7- immediately reject.The extensive trading of depreciation tax shields and investment tax credits,throigh financial leases and other devices,proves 5 that plenty of firms face low marginal rates. Given significant differences in effective marginal tax rates,and given that the static tradeoff theory works,we would expect to find a strong tax effect in any cross-sectional test,regardless of whose theo ry of debt and taxes you believe, Figure 2 plots the net tax gain from corporate borrowing against the expected realizable tax shield from a future deduction of one dollar of interest paid.For some firms this number is 46 cents,or close to it.At the other extreme,there are firms with large unused loss carryforwards which pay no immediate taxes.An extra dollar of interest paid by these firms would create only a potential future deduction,usable when and if the firm earns enough to work off prior carryforwards.The expected realizable tax shield is positive but small.Also,there are firms paying taxes today which cannot be sure they will do so in the future.Such a firm values expected future interest tax shields at somewhere between zero and the full statutory rate. In the "corrected"MM theo ry [28]any tax-paying corporation gains by borrowing;the greater the marginal tax rate,the greater the gain.This gives the top line in the figure.In Miller's theo ry,the personal income taxes on interest payments would exactly offset the corporate interest tax shield,provided that the firm pays the full statutory ax rate.However,any firm paying a lower rate would see a net loss to corporate borrowing and a net gain to lending.This gives the bottom line. There are also compromise theories,advanced by D'Angelo and Masulis [12], Modigliani [30]and others,indicated by he middle dashed line in the