正在加载图片...

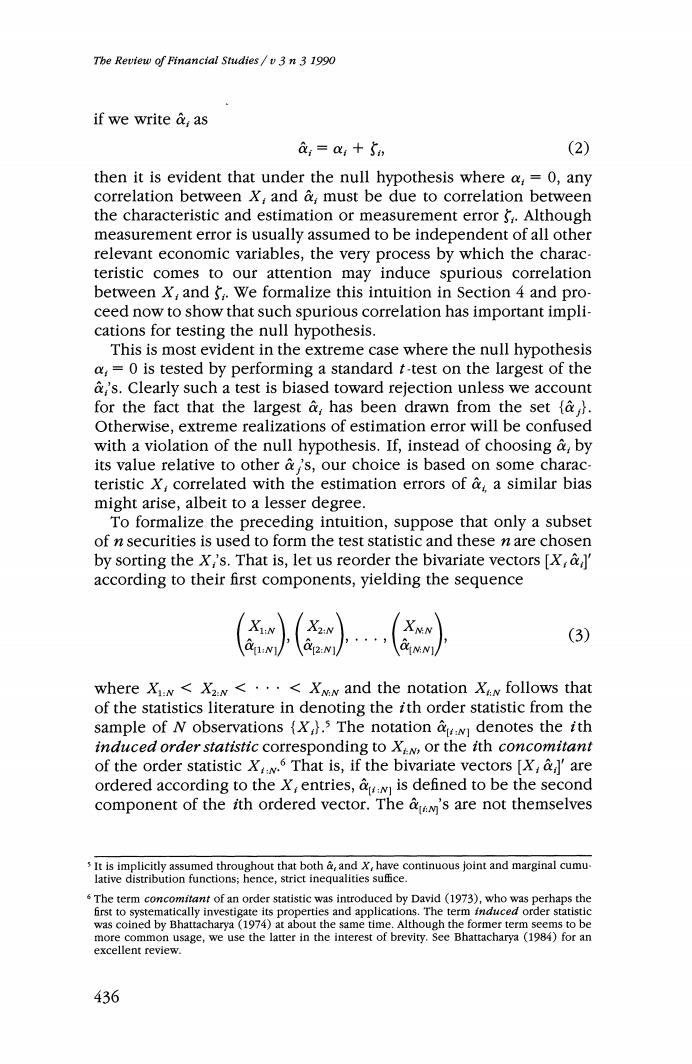

The Review of Financial Studies /v 3 n 3 1990 if we write a as a;=ai+Si (2) then it is evident that under the null hypothesis where a,=0,any correlation between X,and &must be due to correlation between the characteristic and estimation or measurement error 5.Although measurement error is usually assumed to be independent of all other relevant economic variables,the very process by which the charac- teristic comes to our attention may induce spurious correlation between X,and 5.We formalize this intuition in Section 4 and pro- ceed now to show that such spurious correlation has important impli- cations for testing the null hypothesis. This is most evident in the extreme case where the null hypothesis a,=0 is tested by performing a standard t-test on the largest of the a,'s.Clearly such a test is biased toward rejection unless we account for the fact that the largest &has been drawn from the set {a. Otherwise,extreme realizations of estimation error will be confused with a violation of the null hypothesis.If,instead of choosing a,by its value relative to other a's,our choice is based on some charac. teristic X,correlated with the estimation errors of @a similar bias might arise,albeit to a lesser degree. To formalize the preceding intuition,suppose that only a subset of n securities is used to form the test statistic and these n are chosen by sorting the X,'s.That is,let us reorder the bivariate vectors [X,a according to their first components,yielding the sequence (3) where Xi:w<Xz:w<···<XNN and the notation Xan follows that of the statistics literature in denoting the ith order statistic from the sample of N observations (X,).3 The notation w denotes the ith induced order statistic corresponding to XiN,or the ith concomitant of the order statistic XN That is,if the bivariate vectors [X,are ordered according to the X,entries,is defined to be the second component of the ith ordered vector.The &'s are not themselves s It is implicitly assumed throughout that both &and X,have continuous joint and marginal cumu- lative distribution functions;hence,strict inequalities suffice. sThe term concomitant of an order statistic was introduced by David (1973),who was perhaps the first to systematically investigate its properties and applications.The term fnduced order statistic was coined by Bhattacharya(1974)at about the same time.Although the former term seems to be more common usage,we use the latter in the interest of brevity.See Bhattacharya (1984)for an excellent review. 436