正在加载图片...

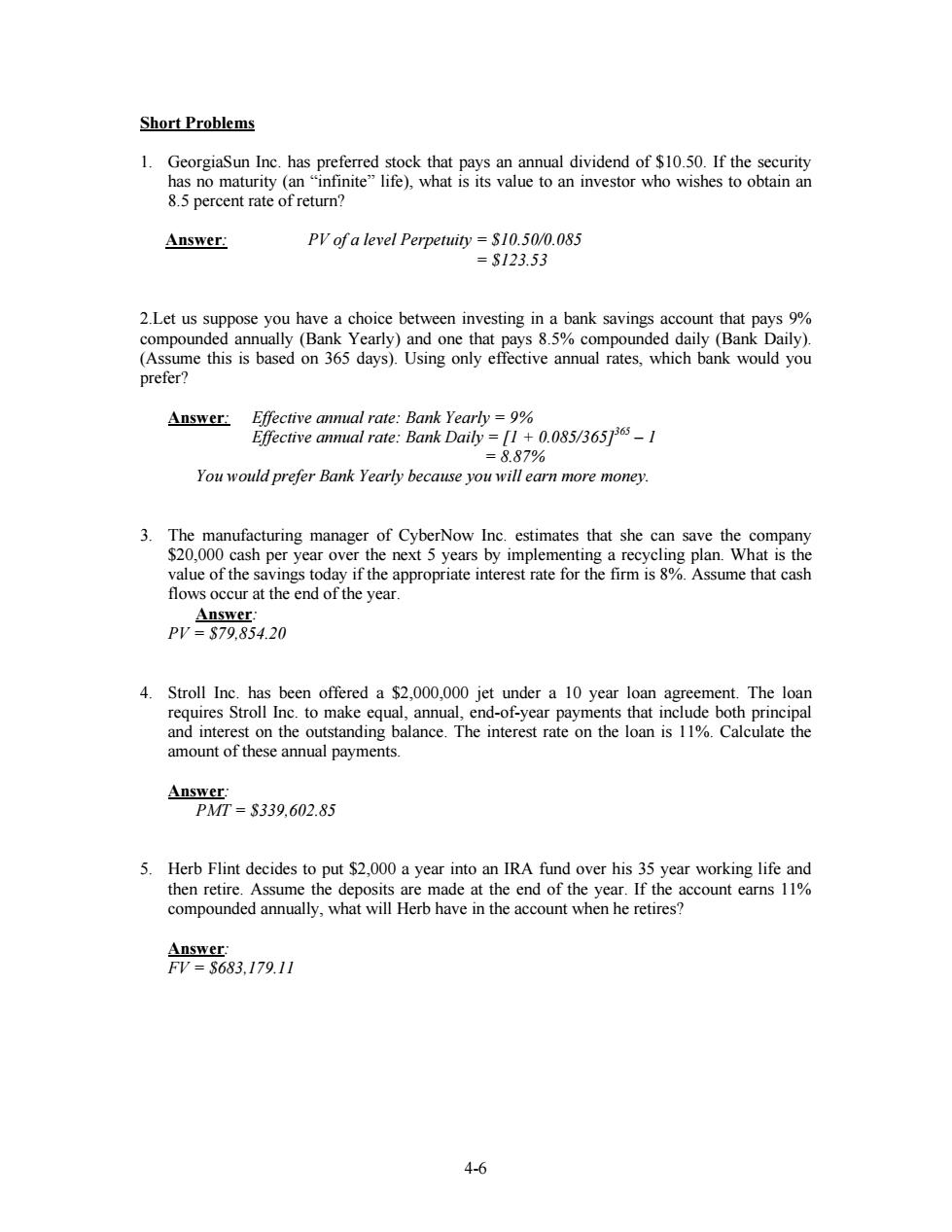

Short Problems 1.GeorgiaSun Inc.has preferred stock that pays an annual dividend of $10.50.If the security has no maturity (an "infinite"life),what is its value to an investor who wishes to obtain an 8.5 percent rate ofreturn? Answer. PV of a level Perpetuity $10.50/0.085 =$123.53 2.Let us suppose you have a choice between investing in a bank savings account that pays 9% compounded annually (Bank Yearly)and one that pays 8.5%compounded daily (Bank Daily). (Assume this is based on 365 days).Using only effective annual rates,which bank would you prefer? Answer: Effective annual rate:Bank Yearly =9% Effective annual rate:Bank Daily =[1+0.085/3651365-1 =8.87% You would prefer Bank Yearly because you will earn more money. 3.The manufacturing manager of CyberNow Inc.estimates that she can save the company $20,000 cash per year over the next 5 years by implementing a recycling plan.What is the value of the savings today if the appropriate interest rate for the firm is 8%.Assume that cash flows occur at the end of the year. Answer: PV=$79,854.20 4. Stroll Inc.has been offered a $2,000,000 jet under a 10 year loan agreement.The loan requires Stroll Inc.to make equal,annual,end-of-year payments that include both principal and interest on the outstanding balance.The interest rate on the loan is 11%.Calculate the amount of these annual payments. Answer. PMT=S339,602.85 5.Herb Flint decides to put $2,000 a year into an IRA fund over his 35 year working life and then retire.Assume the deposits are made at the end of the year.If the account earns 11% compounded annually,what will Herb have in the account when he retires? Answer: FV=S683,179.11 4-64-6 Short Problems 1. GeorgiaSun Inc. has preferred stock that pays an annual dividend of $10.50. If the security has no maturity (an “infinite” life), what is its value to an investor who wishes to obtain an 8.5 percent rate of return? Answer: PV of a level Perpetuity = $10.50/0.085 = $123.53 2.Let us suppose you have a choice between investing in a bank savings account that pays 9% compounded annually (Bank Yearly) and one that pays 8.5% compounded daily (Bank Daily). (Assume this is based on 365 days). Using only effective annual rates, which bank would you prefer? Answer: Effective annual rate: Bank Yearly = 9% Effective annual rate: Bank Daily = [1 + 0.085/365]365 – 1 = 8.87% You would prefer Bank Yearly because you will earn more money. 3. The manufacturing manager of CyberNow Inc. estimates that she can save the company $20,000 cash per year over the next 5 years by implementing a recycling plan. What is the value of the savings today if the appropriate interest rate for the firm is 8%. Assume that cash flows occur at the end of the year. Answer: PV = $79,854.20 4. Stroll Inc. has been offered a $2,000,000 jet under a 10 year loan agreement. The loan requires Stroll Inc. to make equal, annual, end-of-year payments that include both principal and interest on the outstanding balance. The interest rate on the loan is 11%. Calculate the amount of these annual payments. Answer: PMT = $339,602.85 5. Herb Flint decides to put $2,000 a year into an IRA fund over his 35 year working life and then retire. Assume the deposits are made at the end of the year. If the account earns 11% compounded annually, what will Herb have in the account when he retires? Answer: FV = $683,179.11