正在加载图片...

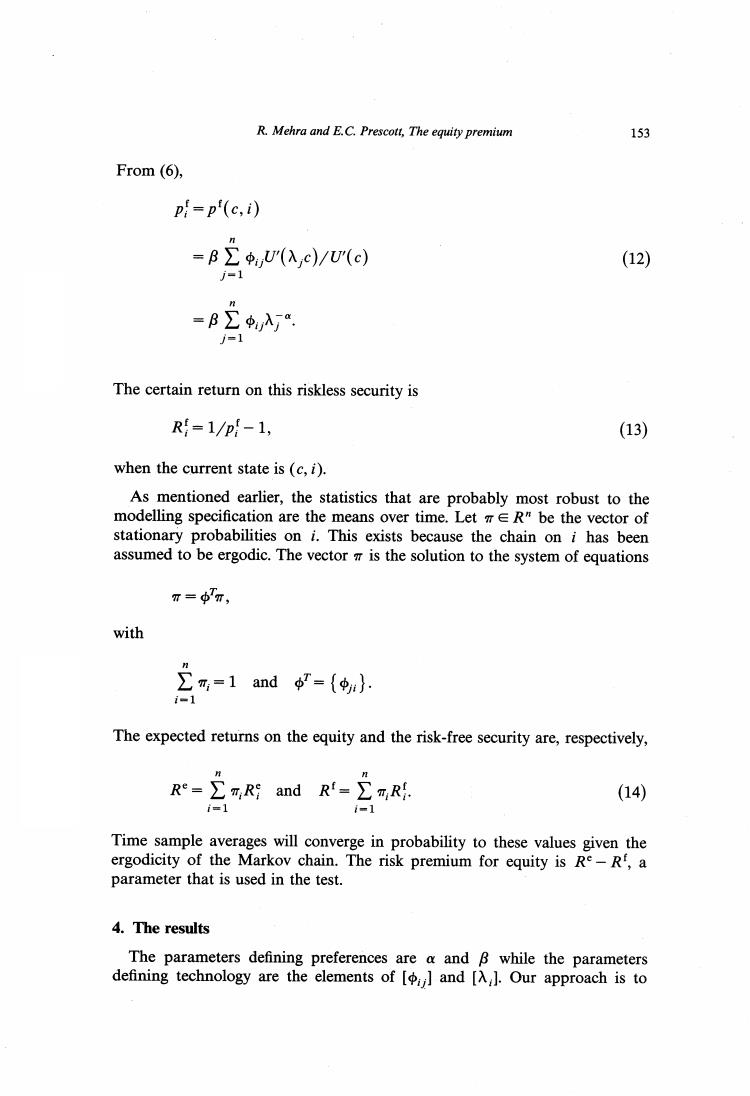

R.Mehra and E.C.Prescott,The equity premium 153 From (6), p=p'(c,i) =BΣ中U(入c)/U(c) (12) j=1 =B∑中入 =1 The certain return on this riskless security is R=1/p-1, (13) when the current state is (c,i). As mentioned earlier,the statistics that are probably most robust to the modelling specification are the means over time.Let TER"be the vector of stationary probabilities on i.This exists because the chain on i has been assumed to be ergodic.The vector is the solution to the system of equations π=Tπ, with 1and ={$} i-1 The expected returns on the equity and the risk-free security are,respectively, Re-∑m,R and Rf-∑m,R. (14) =1 Time sample averages will converge in probability to these values given the ergodicity of the Markov chain.The risk premium for equity is Re-R,a parameter that is used in the test. 4.The results The parameters defining preferences are a and B while the parameters defining technology are the elements of [and [A,].Our approach is to