正在加载图片...

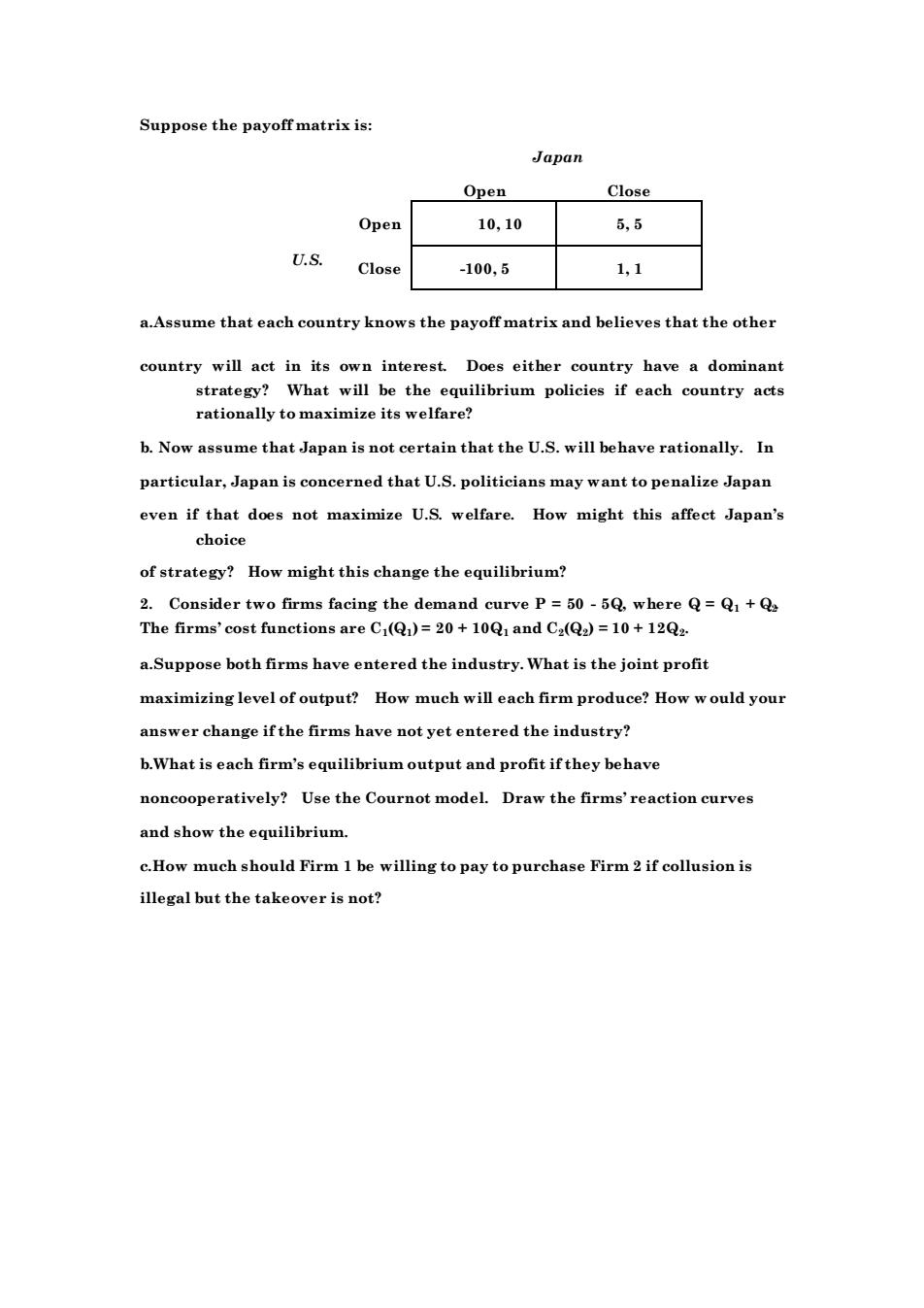

Suppose the payoffmatrix is: Japan Open Close Open 10,10 6,5 U.S. Close -100.5 1,1 a.Assume that each country knows the payoffmatrix and believes that the other country will act in its own interest.Does either country have a dominant strategy?What will be the equilibrium policies if each country acts rationally to maximize its welfare? b.Now assume that Japan is not certain that the U.S.will behave rationally.In particular,Japan is concerned that U.S.politicians may want to penalize Japan even if that does not maximize U.S.welfare.How might this affect Japan's choice of strategy?How might this change the equilibrium? 2.Consider two firms facing the demand curve P=50-5Q where Q=+ The firms'cost functions are C(Q)=20+10Q and Ca(Q)=10+12Q a.Suppose both firms have entered the industry.What is the joint profit maximizing level of output?How much will each firm produce?How w ould your answer change if the firms have not yet entered the industry? b.What is each firm's equilibrium output and profit if they behave noncooperatively?Use the Cournot model.Draw the firms'reaction curves and show the equilibrium. e.How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not?Suppose the payoff matrix is: Japan Open Close Open 10, 10 5, 5 U.S. Close -100, 5 1, 1 a.Assume that each country knows the payoff matrix and believes that the other country will act in its own interest. Does either country have a dominant strategy? What will be the equilibrium policies if each country acts rationally to maximize its welfare? b. Now assume that Japan is not certain that the U.S. will behave rationally. In particular, Japan is concerned that U.S. politicians may want to penalize Japan even if that does not maximize U.S. welfare. How might this affect Japan’s choice of strategy? How might this change the equilibrium? 2. Consider two firms facing the demand curve P = 50 - 5Q, where Q = Q1 + Q2 . The firms’ cost functions are C1 (Q1 ) = 20 + 10Q1 and C2 (Q2 ) = 10 + 12Q2 . a.Suppose both firms have entered the industry. What is the joint profit maximizing level of output? How much will each firm produce? How would your answer change if the firms have not yet entered the industry? b.What is each firm’s equilibrium output and profit if they behave noncooperatively? Use the Cournot model. Draw the firms’ reaction curves and show the equilibrium. c.How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not?