正在加载图片...

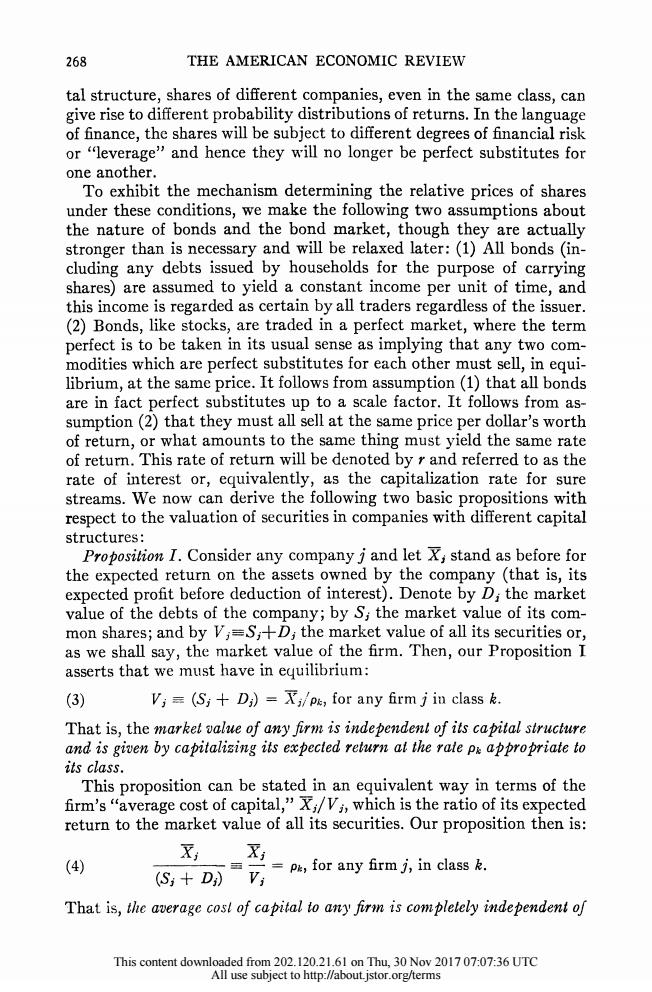

268 THE AMERICAN ECONOMIC REVIEW tal structure,shares of different companies,even in the same class,can give rise to different probability distributions of returns.In the language of finance,the shares will be subject to different degrees of financial risk or "leverage"and hence they will no longer be perfect substitutes for one another. To exhibit the mechanism determining the relative prices of shares under these conditions,we make the following two assumptions about the nature of bonds and the bond market,though they are actually stronger than is necessary and will be relaxed later:(1)All bonds(in- cluding any debts issued by households for the purpose of carrying shares)are assumed to yield a constant income per unit of time,and this income is regarded as certain by all traders regardless of the issuer. (2)Bonds,like stocks,are traded in a perfect market,where the term perfect is to be taken in its usual sense as implying that any two com- modities which are perfect substitutes for each other must sell,in equi- librium,at the same price.It follows from assumption(1)that all bonds are in fact perfect substitutes up to a scale factor.It follows from as- sumption(2)that they must all sell at the same price per dollar's worth of return,or what amounts to the same thing must yield the same rate of return.This rate of return will be denoted by r and referred to as the rate of interest or,equivalently,as the capitalization rate for sure streams.We now can derive the following two basic propositions with respect to the valuation of securities in companies with different capital structures: Proposition I.Consider any company j and let X;stand as before for the expected return on the assets owned by the company (that is,its expected profit before deduction of interest).Denote by D;the market value of the debts of the company;by S;the market value of its com- mon shares;and by V;=S;++D;the market value of all its securities or, as we shall say,the market value of the firm.Then,our Proposition I asserts that we must have in equilibrium: (3) Vi=(Sj+Di)=Xi/pe,for any firm j in class k. That is,the markel value of any firm is independen of its capital structure and is given by capitalizing its expected relurn at the rale p&appropriate to its class. This proposition can be stated in an equivalent way in terms of the firm's"average cost of capital,"Xi/Vi,which is the ratio of its expected return to the market value of all its securities.Our proposition then is: 又 X (4) -pa,for any firm j,in class k. (S;+D)V That is,the average cosl of capital to any firm is complelely independent of This content downloaded from 202.120.21.61 on Thu,30 Nov 201707:07:36 UTC All use subject to http://about jstor.org/terms268 THE AMERICAN ECONOMIC REVIEW tal structure, shares of different companies, even in the same class, can give rise to different probability distributions of returns. In the language of finance, the shares will be subject to different degrees of filancial risk or "leverage" and hence they will no longer be perfect substitutes for one another. To exhibit the mechanism determining the relative prices of shares under these conditions, we make the following two assumptions about the nature of bonds and the bond market, though they are actually stronger than is necessary and will be relaxed later: (1) All bonds (in- cluding any debts issued by households for the purpose of carrying shares) are assumed to yield a constant income per unit of time, and this income is regarded as certain by all traders regardless of the issuer. (2) Bonds, like stocks, are traded in a perfect market, where the term perfect is to be taken in its usual sense as implying that any two com- modities which are perfect substitutes for each other must sell, in equi- librium, at the same price. It follows from assumption (1) that all bonds are in fact perfect substitutes up to a scale factor. It follows from as- sumption (2) that they must all sell at the same price per dollar's worth of return, or what amounts to the same thing must yield the same rate of return. This rate of return will be denoted by r and referred to as the rate of interest or, equivalently, as the capitalization rate for sure streams. We now can derive the following two basic propositions with respect to the valuation of securities in companies with different capital structures: Proposition I. Consider any company j and let Xi stand as before for the expected return on the assets owned by the company (that is, its expected profit before deduction of interest). Denote by Di the market value of the debts of the company; by Sj the market value of its com- mon shares; and by Vj=Sj+Dj the market value of all its securities or, as we shall say, the market value of the firm. Then, our Proposition I asserts that we must have in equilibrium: (3) Vi (Sj + Dj) = Xjl/pk, for any firm j in class k. That is, the market value of any firm is indepezdentt of its capital structure and is given by capitalizinzg its expected return at the rate Pk appropriate to its class. This proposition can be stated in an equivalent way in terms of the firm's "average cost of capital," Xj/Vj, which is the ratio of its expected return to the market value of all its securities. Our proposition then is: xj Xj (4) - = Pk, for any firm j, in class k. (Sj + Di) Va That is, thec average cost of capital, to any firm 'IS comipletely independent of This content downloaded from 202.120.21.61 on Thu, 30 Nov 2017 07:07:36 UTC All use subject to http://about.jstor.org/terms