正在加载图片...

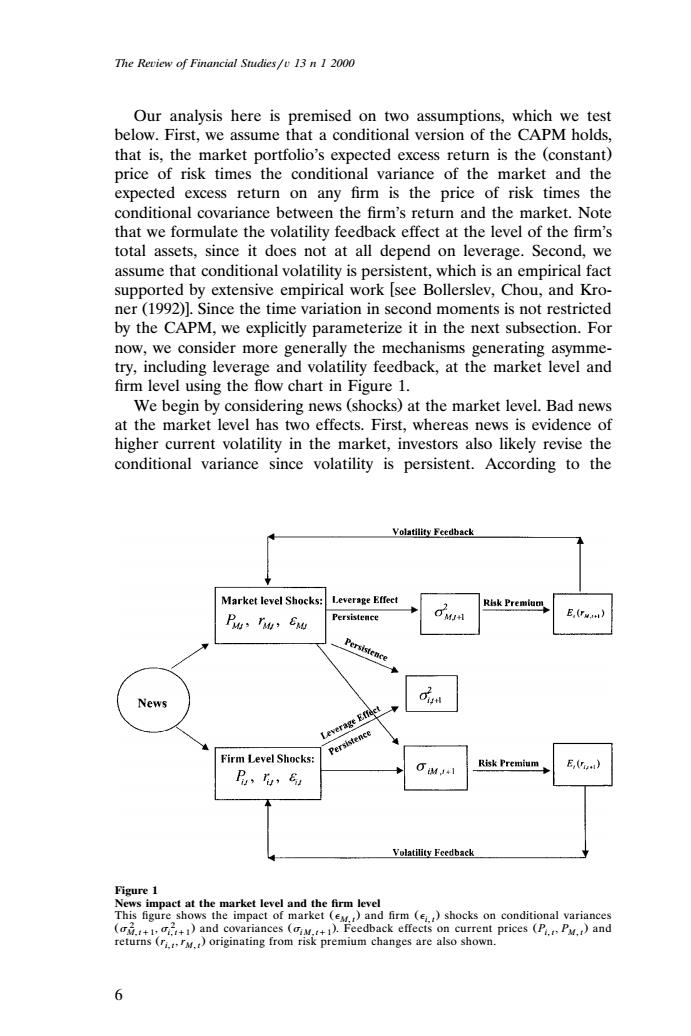

The Review of Financial Studies/v 13 n 1 2000 Our analysis here is premised on two assumptions,which we test below.First,we assume that a conditional version of the CAPM holds that is,the market portfolio's expected excess return is the (constant) price of risk times the conditional variance of the market and the expected excess return on any firm is the price of risk times the conditional covariance between the firm's return and the market.Note that we formulate the volatility feedback effect at the level of the firm's total assets,since it does not at all depend on leverage.Second,we assume that conditional volatility is persistent,which is an empirical fact supported by extensive empirical work [see Bollerslev,Chou,and Kro- ner (1992)].Since the time variation in second moments is not restricted by the CAPM,we explicitly parameterize it in the next subsection.For now,we consider more generally the mechanisms generating asymme- try,including leverage and volatility feedback,at the market level and firm level using the flow chart in Figure 1. We begin by considering news (shocks)at the market level.Bad news at the market level has two effects.First,whereas news is evidence of higher current volatility in the market,investors also likely revise the conditional variance since volatility is persistent.According to the Volatility Feedback Market level Shocks: Leverage Effect dwua Risk Premiu Pu Tu Ewu Persistence Persistence News Leverage Effact→ 3 Persistence Firm Level Shocks: OMJ小 Risk Premium E,) B,h,6 Volatility Feedback Figure 1 News impact at the market level and the firm level This figure shows the impact of market (eM.)and firm (shocks on conditional variances (+and covariances (iM,+).Feedback effects on current prices (P.P.)and returns(ri.rM.)originating from risk premium changes are also shown. 6The Reiew of Financial Studies 13 n 1 2000 Our analysis here is premised on two assumptions, which we test below. First, we assume that a conditional version of the CAPM holds, that is, the market portfolio’s expected excess return is the constant Ž . price of risk times the conditional variance of the market and the expected excess return on any firm is the price of risk times the conditional covariance between the firm’s return and the market. Note that we formulate the volatility feedback effect at the level of the firm’s total assets, since it does not at all depend on leverage. Second, we assume that conditional volatility is persistent, which is an empirical fact supported by extensive empirical work see Bollerslev, Chou, and Kro- ner 1992 . Since the time variation in second moments is not restricted Ž . by the CAPM, we explicitly parameterize it in the next subsection. For now, we consider more generally the mechanisms generating asymmetry, including leverage and volatility feedback, at the market level and firm level using the flow chart in Figure 1. We begin by considering news shocks at the market level. Bad news Ž . at the market level has two effects. First, whereas news is evidence of higher current volatility in the market, investors also likely revise the conditional variance since volatility is persistent. According to the Figure 1 News impact at the market level and the firm level This figure shows the impact of market Ž . Ž. M and firm shocks on conditional variances , t i, t Ž 2 2 M, t1, i, t1. Ž. Ž . and covariances i M, t1 . Feedback effects on current prices Pi, t M , P , t and returns Ž . r , r originating from risk premium changes are also shown. i, t M, t 6�����