正在加载图片...

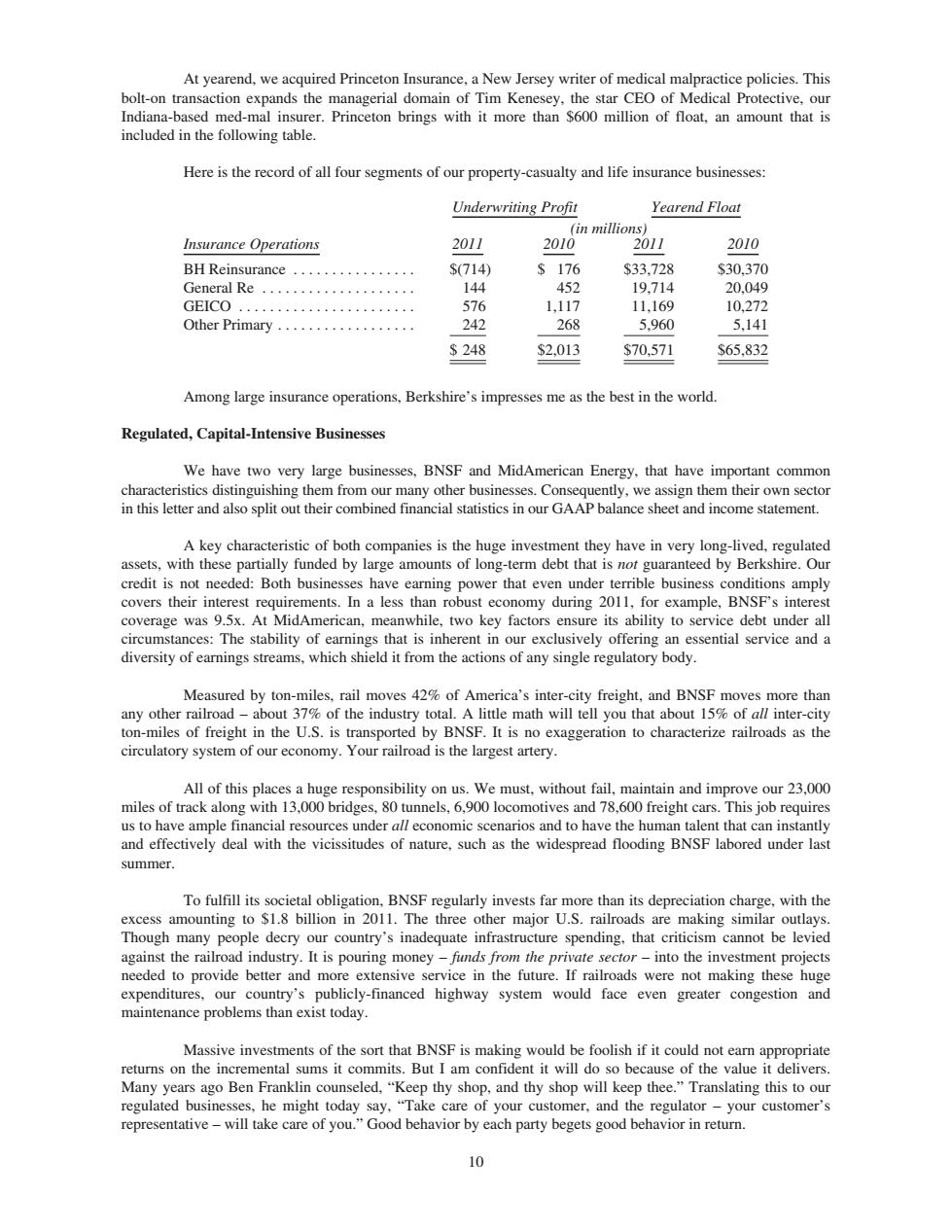

nce,a New Jersey writer of medical ma ctice nolicies this ction expands the m gerial domain of Tim Ken the star CEO of Medical Protective ou Indiana-based med-mal insurer.Princeton brings with it more than $600 million of float,an amount that is included in the following table. Here is the record of all fou segments of our property-casualty and life insurance businesses Underwriting Profit Yearend Float Insurance Operations 2011 2010 BH Reir s(7 44 GEICO 576 1117 11169 1027 Other Primary....... 242 268 5.960 5.141 $248 S2.013 $70.571 S65.832 Among large insurance operations.Berkshire's impresses me as the best in the world. Regulated,Capital-Intensive Businesses We have two very large businesses.BNSF and MidAmerican Energy.that have important common letter a osplit out their combine A key characteristic of both companies is the huge investment they have in very long-lived,regulated these partially funded by large amounts of long-term debt h guaranteed by Berkshire.Our ede s have eaming power that even unde 0 e busine amply coverage was 95x.At MidAmerican.meanwhile two key factors ensure its ability to service debt under a Mea red by es 42 of Am a's inter ity and RNSE any other railroad-about 37%of the industry total.A little math will tell you that about 15%ofinter-city All of this plac :a hu nsibility on us We must without fail maintain and im ove our 23 000 miles of track along with 13.000 bridges,80 tunnels,6900 locomotives and 78.600 freight cars.This job requires 二de esprea ed under las To fulfill its societal obligation.BNSF regularly invests far more than its depreciation charge,with the .8 billion in 201 Th three other major U.S s are mal ing simil spe mg. hat be levi needed to provide better and more extensive service in the future.were not making expenditures.our country's publicly-financed highway system would face even greater congestion and maintenance problems than exist today Massive investments of the sort that bnse is makin would be foolish if it could not earn a counseled,"Ke p thy shop,and thy shop will keep thee. Translating this to our od be yourcustomer's At yearend, we acquired Princeton Insurance, a New Jersey writer of medical malpractice policies. This bolt-on transaction expands the managerial domain of Tim Kenesey, the star CEO of Medical Protective, our Indiana-based med-mal insurer. Princeton brings with it more than $600 million of float, an amount that is included in the following table. Here is the record of all four segments of our property-casualty and life insurance businesses: Underwriting Profit Yearend Float (in millions) Insurance Operations 2011 2010 2011 2010 BH Reinsurance ................ $(714) $ 176 $33,728 $30,370 General Re . . . . . . . . . . . . . . . . . . . . 144 452 19,714 20,049 GEICO . . . . . . . . . . . . . . . . . . . . . . . 576 1,117 11,169 10,272 Other Primary . . . . . . . . . . . . . . . . . . 242 268 5,960 5,141 $ 248 $2,013 $70,571 $65,832 Among large insurance operations, Berkshire’s impresses me as the best in the world. Regulated, Capital-Intensive Businesses We have two very large businesses, BNSF and MidAmerican Energy, that have important common characteristics distinguishing them from our many other businesses. Consequently, we assign them their own sector in this letter and also split out their combined financial statistics in our GAAP balance sheet and income statement. A key characteristic of both companies is the huge investment they have in very long-lived, regulated assets, with these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is not needed: Both businesses have earning power that even under terrible business conditions amply covers their interest requirements. In a less than robust economy during 2011, for example, BNSF’s interest coverage was 9.5x. At MidAmerican, meanwhile, two key factors ensure its ability to service debt under all circumstances: The stability of earnings that is inherent in our exclusively offering an essential service and a diversity of earnings streams, which shield it from the actions of any single regulatory body. Measured by ton-miles, rail moves 42% of America’s inter-city freight, and BNSF moves more than any other railroad – about 37% of the industry total. A little math will tell you that about 15% of all inter-city ton-miles of freight in the U.S. is transported by BNSF. It is no exaggeration to characterize railroads as the circulatory system of our economy. Your railroad is the largest artery. All of this places a huge responsibility on us. We must, without fail, maintain and improve our 23,000 miles of track along with 13,000 bridges, 80 tunnels, 6,900 locomotives and 78,600 freight cars. This job requires us to have ample financial resources under all economic scenarios and to have the human talent that can instantly and effectively deal with the vicissitudes of nature, such as the widespread flooding BNSF labored under last summer. To fulfill its societal obligation, BNSF regularly invests far more than its depreciation charge, with the excess amounting to $1.8 billion in 2011. The three other major U.S. railroads are making similar outlays. Though many people decry our country’s inadequate infrastructure spending, that criticism cannot be levied against the railroad industry. It is pouring money – funds from the private sector – into the investment projects needed to provide better and more extensive service in the future. If railroads were not making these huge expenditures, our country’s publicly-financed highway system would face even greater congestion and maintenance problems than exist today. Massive investments of the sort that BNSF is making would be foolish if it could not earn appropriate returns on the incremental sums it commits. But I am confident it will do so because of the value it delivers. Many years ago Ben Franklin counseled, “Keep thy shop, and thy shop will keep thee.” Translating this to our regulated businesses, he might today say, “Take care of your customer, and the regulator – your customer’s representative – will take care of you.” Good behavior by each party begets good behavior in return. 10