正在加载图片...

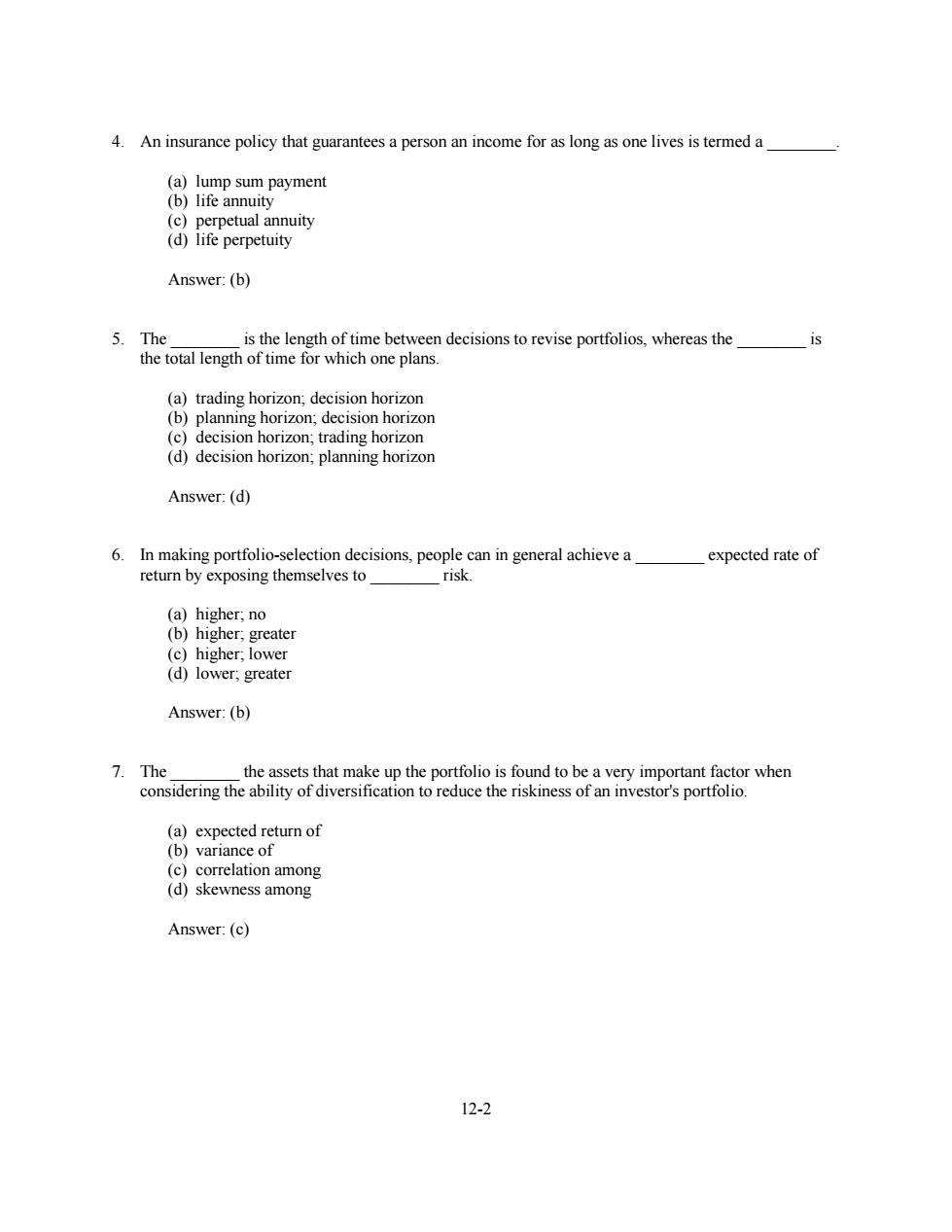

4.An insurance policy that guarantees a person an income for as long as one lives is termed a (a)lump sum payment (b)life annuity (c)perpetual annuity (d)life perpetuity Answer:(b) 5.The is the length of time between decisions to revise portfolios,whereas the the total length of time for which one plans. (a)trading horizon;decision horizon (b)planning horizon;decision horizon (c)decision horizon;trading horizon (d)decision horizon;planning horizon Answer:(d) 6.In making portfolio-selection decisions,people can in general achieve a expected rate of return by exposing themselves to risk. (a)higher;no (b)higher;greater (c)higher;lower (d)lower;greater Answer:(b) 7.The the assets that make up the portfolio is found to be a very important factor when considering the ability of diversification to reduce the riskiness of an investor's portfolio. (a)expected return of (b)variance of (c)correlation among (d)skewness among Answer:(c) 12-212-2 4. An insurance policy that guarantees a person an income for as long as one lives is termed a ________. (a) lump sum payment (b) life annuity (c) perpetual annuity (d) life perpetuity Answer: (b) 5. The ________ is the length of time between decisions to revise portfolios, whereas the ________ is the total length of time for which one plans. (a) trading horizon; decision horizon (b) planning horizon; decision horizon (c) decision horizon; trading horizon (d) decision horizon; planning horizon Answer: (d) 6. In making portfolio-selection decisions, people can in general achieve a ________ expected rate of return by exposing themselves to ________ risk. (a) higher; no (b) higher; greater (c) higher; lower (d) lower; greater Answer: (b) 7. The ________ the assets that make up the portfolio is found to be a very important factor when considering the ability of diversification to reduce the riskiness of an investor's portfolio. (a) expected return of (b) variance of (c) correlation among (d) skewness among Answer: (c)