正在加载图片...

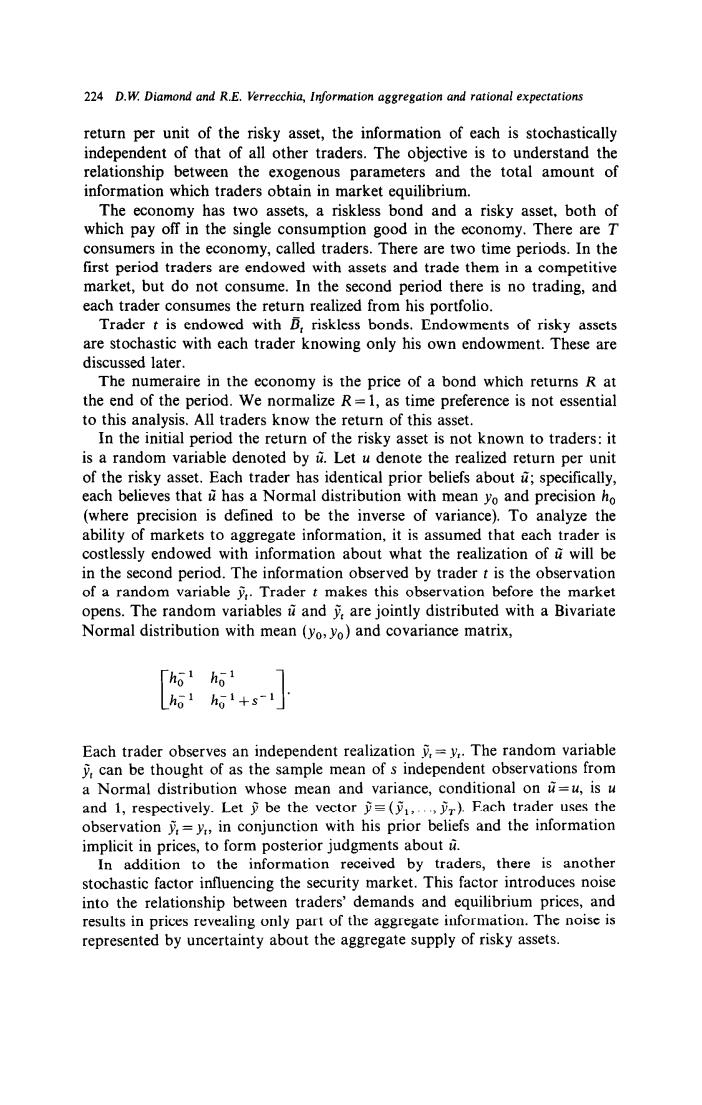

224 D.W.Diamond and R.E.Verrecchia,Information aggregation and rational expectations return per unit of the risky asset,the information of each is stochastically independent of that of all other traders.The objective is to understand the relationship between the exogenous parameters and the total amount of information which traders obtain in market equilibrium. The economy has two assets,a riskless bond and a risky asset,both of which pay off in the single consumption good in the economy.There are T consumers in the economy,called traders.There are two time periods.In the first period traders are endowed with assets and trade them in a competitive market,but do not consume.In the second period there is no trading,and each trader consumes the return realized from his portfolio. Trader t is endowed with B,riskless bonds.Endowments of risky asscts are stochastic with each trader knowing only his own endowment.These are discussed later. The numeraire in the economy is the price of a bond which returns R at the end of the period.We normalize R=1,as time preference is not essential to this analysis.All traders know the return of this asset. In the initial period the return of the risky asset is not known to traders:it is a random variable denoted by i.Let u denote the realized return per unit of the risky asset.Each trader has identical prior beliefs about specifically, each believes that u has a Normal distribution with mean yo and precision ho (where precision is defined to be the inverse of variance).To analyze the ability of markets to aggregate information,it is assumed that each trader is costlessly endowed with information about what the realization of will be in the second period.The information observed by trader t is the observation of a random variable.Trader t makes this observation before the market opens.The random variables i and y.are jointly distributed with a Bivariate Normal distribution with mean (yo,yo)and covariance matrix, ho ho ho h1+s-1 Each trader observes an independent realization,=y,.The random variable y.can be thought of as the sample mean of s independent observations from a Normal distribution whose mean and variance,conditional on =u,is u and 1,respectively.Let$be the vector=(1....,r).Each trader uses the observation y=y:,in conjunction with his prior beliefs and the information implicit in prices,to form posterior judgments about 4. In addition to the information received by traders,there is another stochastic factor influencing the security market.This factor introduces noise into the relationship between traders'demands and equilibrium prices,and results in prices revealing only part of the aggregate information.The noise is represented by uncertainty about the aggregate supply of risky assets.224 D.W Diamond and R.E. Verrecchia, Information aggregation and rational expectations return per unit of the risky asset, the information of each is stochastically independent of that of all other traders. The objective is to understand the relationship between the exogenous parameters and the total amount of information which traders obtain in market equilibrium. The economy has two assets, a riskless bond and a risky asset, both of which pay off in the single consumption good in the economy. There are T consumers in the economy, called traders. There are two time periods. In the first period traders are endowed with assets and trade them in a competitive market, but do not consume. In the second period there is no trading, and each trader consumes the return realized from his portfolio. Trader t is endowed with B, riskless bonds. Endowments of risky assets are stochastic with each trader knowing only his own endowment. These are discussed later. The numeraire in the economy is the price of a bond which returns R at the end of the period. We normalize R = 1, as time preference is not essential to this analysis. All traders know the return of this asset. In the initial period the return of the risky asset is not known to traders: it is a random variable denoted by 6. Let u denote the realized return per unit of the risky asset. Each trader has identical prior beliefs about u”; specifically, each believes that C has a Normal distribution with mean y, and precision h, (where precision is defined to be the inverse of variance). To analyze the ability of markets to aggregate information, it is assumed that each trader is costlessly endowed with information about what the realization of u’ will be in the second period. The information observed by trader t is the observation of a random variable jj,. Trader t makes this observation before the market opens. The random variables 6 and jjt are jointly distributed with a Bivariate Normal distribution with mean (y,,, yO) and covariance matrix, h,’ h,’ h, l 1 h,'+s-' Each trader observes an independent realization jj, = y,. The random variable jj, can be thought of as the sample mean of s independent observations from a Normal distribution whose mean and variance, conditional on C=U, is u and 1, respectively. Let J be the vector jj = (PI,. ., Each uses observation in with prior and information in to posterior about In to information by there another factor the market. factor noise the between demands equilibrium and in revealing part the information. noise represented uncertainty the supply risky