正在加载图片...

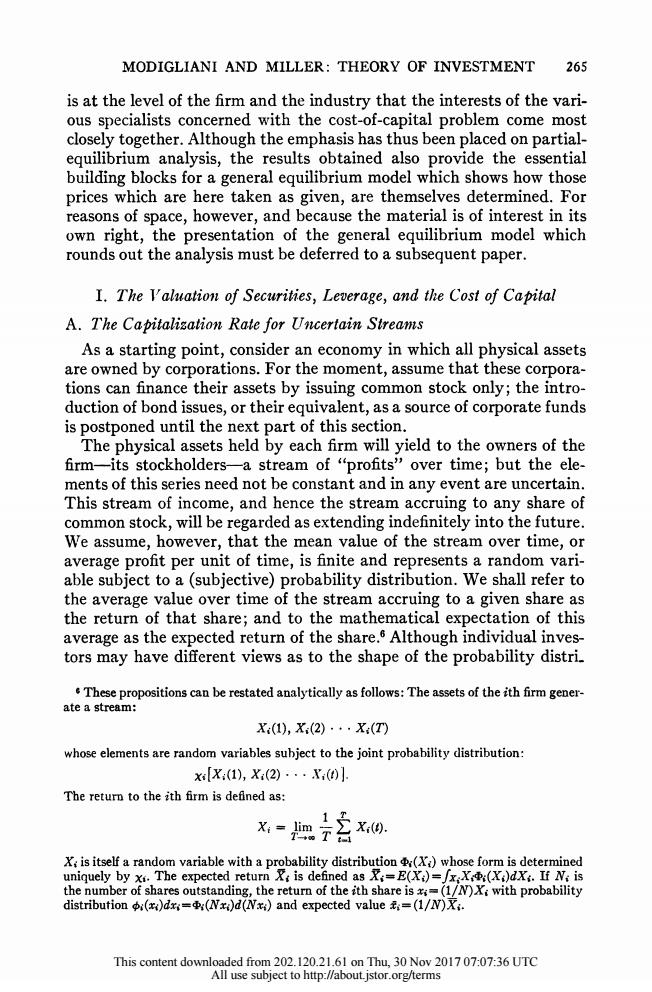

MODIGLIANI AND MILLER:THEORY OF INVESTMENT 265 is at the level of the firm and the industry that the interests of the vari- ous specialists concerned with the cost-of-capital problem come most closely together.Although the emphasis has thus been placed on partial- equilibrium analysis,the results obtained also provide the essential building blocks for a general equilibrium model which shows how those prices which are here taken as given,are themselves determined.For reasons of space,however,and because the material is of interest in its own right,the presentation of the general equilibrium model which rounds out the analysis must be deferred to a subsequent paper. I.The Valuation of Securities,Leverage,and the Cost of Capital A.The Capitalization Rate for Uncertain Streams As a starting point,consider an economy in which all physical assets are owned by corporations.For the moment,assume that these corpora- tions can finance their assets by issuing common stock only;the intro- duction of bond issues,or their equivalent,as a source of corporate funds is postponed until the next part of this section. The physical assets held by each firm will yield to the owners of the frm一its stockholders--a stream of“profits'”over time;but the ele- ments of this series need not be constant and in any event are uncertain. This stream of income,and hence the stream accruing to any share of common stock,will be regarded as extending indefinitely into the future. We assume,however,that the mean value of the stream over time,or average profit per unit of time,is finite and represents a random vari- able subject to a(subjective)probability distribution.We shall refer to the average value over time of the stream accruing to a given share as the return of that share;and to the mathematical expectation of this average as the expected return of the share.6 Although individual inves- tors may have different views as to the shape of the probability distri. These propositions can be restated analytically as follows:The assets of the ith firm gener- ate a stream: X(1),X(2)···X(T) whose elements are random variables subject to the joint probability distribution: xX:(1),X(2)···X(0 The return to the ith firm is defined as: Xi=lim xi(). X;is itself a random variable with a probability distribution(Xi)whose form is determined uniquely by x.The expected return X;is defined as X;=E(Xi)=/x;X;(Xi)dXi.If N:is the number of shares outstanding,the return of the ith share is x;=(1/N)X:with probability distribution (xdxs=(Nxi)d(Nx;)and expected value=(1/N)Xi. This content downloaded from 202.120.21.61 on Thu,30 Nov 201707:07:36 UTC All use subject to http://about.jstor.org/termsMODIGLIANI AND MILLER: THEORY OF INVESTMENT 265 is at the level of the firm and the industry that the interests of the vari- ous specialists concerned with the cost-of-capital problem come most closely together. Although the emphasis has thus been placed on partial- equilibrium analysis, the results obtained also provide the essential building blocks for a general equilibrium model which shows how those prices which are here taken as given, are themselves determined. For reasons of space, however, and because the material is of interest in its own right, the presentation of the general equilibrium model which rounds out the analysis must be deferred to a subsequent paper. I. Tihe Valuation of Securities, Leverage, and tihe Cost of Capital A. T'he Capitalization Rate for Uncertain Streams As a starting point, consider an economy in which all physical assets are owned by corporations. For the moment, assume that these corpora- tions can finance their assets by issuing common stock only; the intro- duction of bond issues, or their equivalent, as a source of corporate funds is postponed until the next part of this section. The physical assets held by each firm will yield to the owners of the firm-its stockholders-a stream of "profits" over time; but the ele- ments of this series need not be constant and in any event are uncertain. This stream of income, and hence the stream accruing to any share of common stock, will be regarded as extending indefinitely into the future. WTe assume, however, that the mean value of the stream over time, or average profit per unit of time, is finite and represents a random vari- able subject to a (subjective) probability distribution. We shall refer to the average value over time of the stream accruing to a given share as the return of that share; and to the mathematical expectation of this average as the expected return of the share.6 Although individual inves- tors may have different views as to the shape of the probability distri 6 These propositions can be restated analytically as follows: The assets of the ith firm gener- ate a stream: Xi (I), Xi (2) ... Xi (T) whose elements are random variables subject to the joint probability distribution: Xi [Xi (1), Xi (2) .. *X\i (t)J. The return to the ith firm is defined as: liT Xi-= lim - Xsit). 7--co T t= Xi is itself a random variable with a probability distribution diW(Xi) whose form is determined uniquely by Xi. The expected return Xi is defined as Xi=E(Xi) =fxXib(X,)dX;. If Ni is the number of shares outstanding, the return of the ith share is xi= (1/N)X; with probability distribution Oi(xi)dx1=4i(Nxi)d(Nxi) and expected value 9i=(1/N)X,. This content downloaded from 202.120.21.61 on Thu, 30 Nov 2017 07:07:36 UTC All use subject to http://about.jstor.org/terms