正在加载图片...

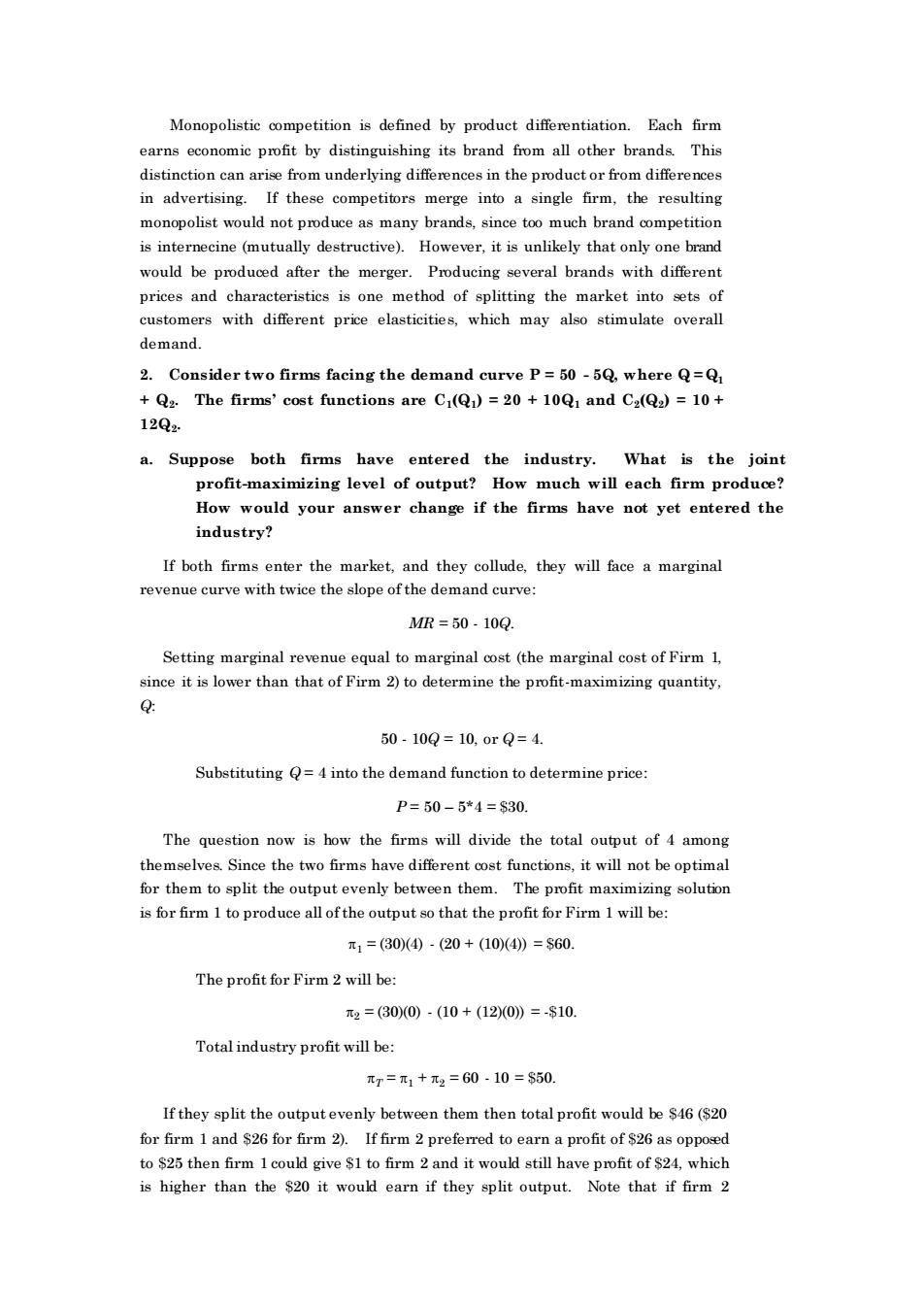

Monopolistic competition is defined by product differentiation.Each firm in advertising. If these competitors merge into a single firm,the resulting monopolist would not produce as many brands.since too much brand competition is internecine (mutually destructive).However,it is unlikely that only one brand would be produced afer the merger.Producing several brands withdifferen prices and c ha ristics is one method of spli tting the market into setso customers with different price elasticities,which may also stimulate overal demand. 2.Consider two firms facing the demand curve P=50-5Q where Q=Q +Q2.The firms'cost functions are C1(Q)=20+10Q1 and C2(Q2)=10+ 12Q4 a.Suppose both firms have entered the industr What is the ioint profit-maximizing level ofo output?How m uch will each firm produce? How would your answer change if the firms have not yet entered the industry? If both firms enter the market,and they collude,they will face a marginal revenue curve with twice the slope of the demand curve: MR=50.10Q. Setting marginal revenue equal to marginal oost(the marginal cost of Firm 1 since it is lower than that of Firm 2)to determine the profit-maximizing quantity. 50.10Q=10,orQ=4 Substituting=4into the demand function to determine price P=50-5*4=$30 The question now is bow the firms will divide the total output of 4 among themselves Since the two firms have different oost functions,it will not be optimal for them to split the output evenly between them.The profit maximizing solution is for firm 1 to produce all of the output so that the profit for Firm 1 will be: x1=(30)(④·.(20+(104)=$60. The profit for Firm 2 will be: 2=(300)-(10+(12)(0》=-$10. Total industry profit will be: r=元1+元2=60.10=S50. If they split the them then total profit would be6(20 for firm 1 and $26 for firm 2).If firm 2 prefe rred to earn a profit of $26 as oppo to $25 then firm 1 could give $1 to firm 2 and it would still have profit of $24,which is higher than the $20 it woul earn if they split output.Note that if firm 2 Monopolistic competition is defined by product differentiation. Each firm earns economic profit by distinguishing its brand from all other brands. This distinction can arise from underlying differences in the product or from differences in advertising. If these competitors merge into a single firm, the resulting monopolist would not produce as many brands, since too much brand competition is internecine (mutually destructive). However, it is unlikely that only one brand would be produced after the merger. Producing several brands with different prices and characteristics is one method of splitting the market into sets of customers with different price elasticities, which may also stimulate overall demand. 2. Consider two firms facing the demand curve P = 50 - 5Q, where Q = Q1 + Q2 . The firms’ cost functions are C1 (Q1 ) = 20 + 10Q1 and C2 (Q2 ) = 10 + 12Q2 . a. Suppose both firms have entered the industry. What is the joint profit-maximizing level of output? How much will each firm produce? How would your answer change if the firms have not yet entered the industry? If both firms enter the market, and they collude, they will face a marginal revenue curve with twice the slope of the demand curve: MR = 50 - 10Q. Setting marginal revenue equal to marginal cost (the marginal cost of Firm 1, since it is lower than that of Firm 2) to determine the profit-maximizing quantity, Q: 50 - 10Q = 10, or Q = 4. Substituting Q = 4 into the demand function to determine price: P = 50 – 5*4 = $30. The question now is how the firms will divide the total output of 4 among themselves. Since the two firms have different cost functions, it will not be optimal for them to split the output evenly between them. The profit maximizing solution is for firm 1 to produce all of the output so that the profit for Firm 1 will be: 1 = (30)(4) - (20 + (10)(4)) = $60. The profit for Firm 2 will be: 2 = (30)(0) - (10 + (12)(0)) = -$10. Total industry profit will be: T = 1 + 2 = 60 - 10 = $50. If they split the output evenly between them then total profit would be $46 ($20 for firm 1 and $26 for firm 2). If firm 2 preferred to earn a profit of $26 as opposed to $25 then firm 1 could give $1 to firm 2 and it would still have profit of $24, which is higher than the $20 it would earn if they split output. Note that if firm 2