正在加载图片...

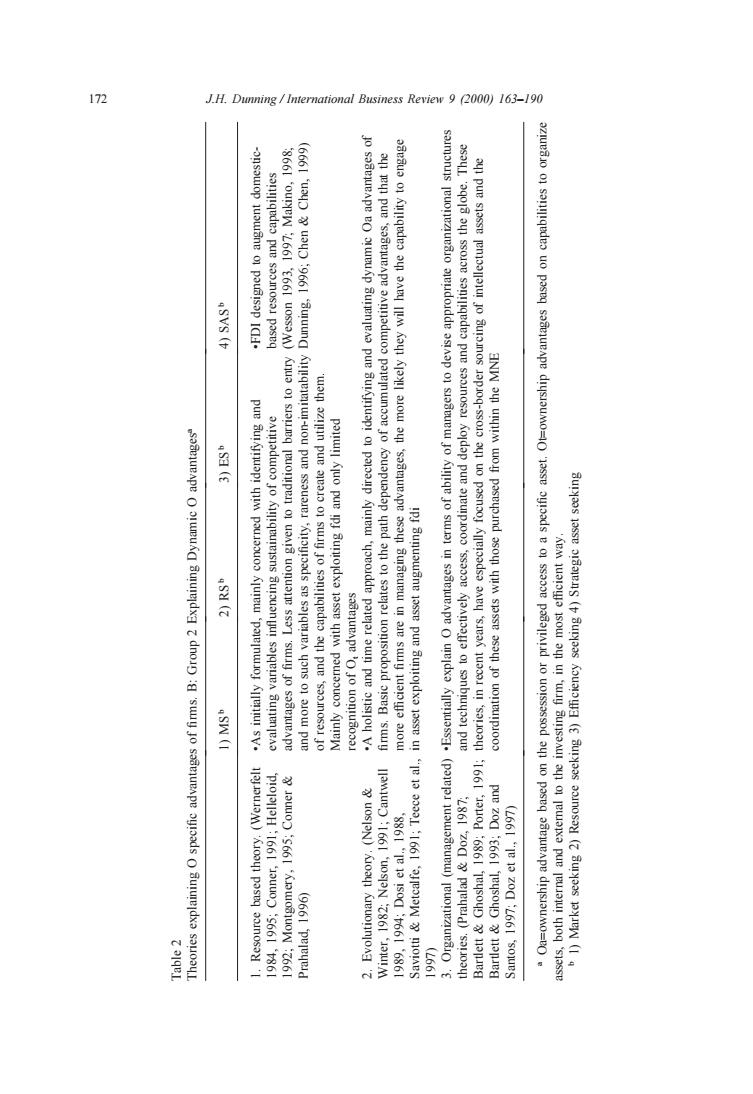

172 J.H.Dunning/International Business Review 9 000)163-190 -onsswop uawane o pausap I4 aSVS (t "155531 网a兰m之之 nFw限s172 J.H. Dunning / International Business Review 9 (2000) 163–190 Table 2 Theories explaining O specific advantages of firms. B: Group 2 Explaining Dynamic O advantagesa 1) MSb 2) RSb 3) ESb 4) SASb 1. Resource based theory. (Wernerfelt •As initially formulated, mainly concerned with identifying and •FDI designed to augment domestic- 1984, 1995; Conner, 1991; Helleloid, evaluating variables influencing sustainability of competitive based resources and capabilities 1992; Montgomery, 1995; Conner & advantages of firms. Less attention given to traditional barriers to entry (Wesson 1993, 1997; Makino, 1998; Prahalad, 1996) and more to such variables as specificity, rareness and non-imitatability Dunning, 1996; Chen & Chen, 1999) of resources, and the capabilities of firms to create and utilize them. Mainly concerned with asset exploiting fdi and only limited recognition of Ot advantages 2. Evolutionary theory. (Nelson & •A holistic and time related approach, mainly directed to identifying and evaluating dynamic Oa advantages of Winter, 1982; Nelson, 1991; Cantwell firms. Basic proposition relates to the path dependency of accumulated competitive advantages, and that the 1989, 1994; Dosi et al., 1988, more efficient firms are in managing these advantages, the more likely they will have the capability to engage Saviotti & Metcalfe, 1991; Teece et al., in asset exploiting and asset augmenting fdi 1997) 3. Organizational (management related) •Essentially explain O advantages in terms of ability of managers to devise appropriate organizational structures theories. (Prahalad & Doz, 1987; and techniques to effectively access, coordinate and deploy resources and capabilities across the globe. These Bartlett & Ghoshal, 1989; Porter, 1991; theories, in recent years, have especially focused on the cross-border sourcing of intellectual assets and the Bartlett & Ghoshal, 1993; Doz and coordination of these assets with those purchased from within the MNE Santos, 1997; Doz et al., 1997) a Oa=ownership advantage based on the possession or privileged access to a specific asset. Ot=ownership advantages based on capabilities to organize assets, both internal and external to the investing firm, in the most efficient way. b 1) Market seeking 2) Resource seeking 3) Efficiency seeking 4) Strategic asset seeking