正在加载图片...

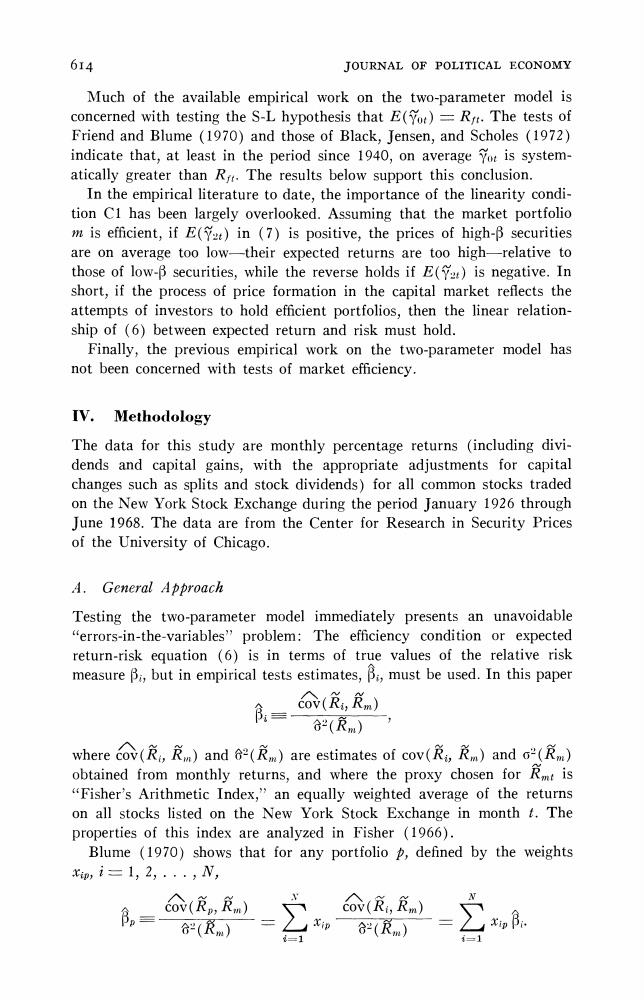

614 JOURNAL OF POLITICAL ECONOMY Much of the available empirical work on the two-parameter model is concerned with testing the S-L hypothesis that E(Y)=Rs.The tests of Friend and Blume (1970)and those of Black,Jensen,and Scholes (1972) indicate that,at least in the period since 1940,on average To is system- atically greater than R.The results below support this conclusion. In the empirical literature to date,the importance of the linearity condi- tion CI has been largely overlooked.Assuming that the market portfolio m is efficient,if E()in (7)is positive,the prices of high-B securities are on average too low-their expected returns are too high-relative to those of low-B securities,while the reverse holds if E()is negative.In short,if the process of price formation in the capital market reflects the attempts of investors to hold efficient portfolios,then the linear relation- ship of (6)between expected return and risk must hold. Finally,the previous empirical work on the two-parameter model has not been concerned with tests of market efficiency. IV.Methodology The data for this study are monthly percentage returns (including divi- dends and capital gains,with the appropriate adjustments for capital changes such as splits and stock dividends)for all common stocks traded on the New York Stock Exchange during the period January 1926 through June 1968.The data are from the Center for Research in Security Prices of the University of Chicago. A.General Approach Testing the two-parameter model immediately presents an unavoidable "errors-in-the-variables"problem:The efficiency condition or expected return-risk equation (6)is in terms of true values of the relative risk measure Bi,but in empirical tests estimates,Bi,must be used.In this paper (,m) 三 2(m) where(R,n)and()are estimates of cov(,飞n)ando(之m) obtained from monthly returns,and where the proxy chosen for Rm is "Fisher's Arithmetic Index,"an equally weighted average of the returns on all stocks listed on the New York Stock Exchange in month t.The properties of this index are analyzed in Fisher (1966). Blume (1970)shows that for any portfolio defined by the weights p,i=1,2,.,·,N, (R,n) 6(Rm) =1 xipRm) 1