正在加载图片...

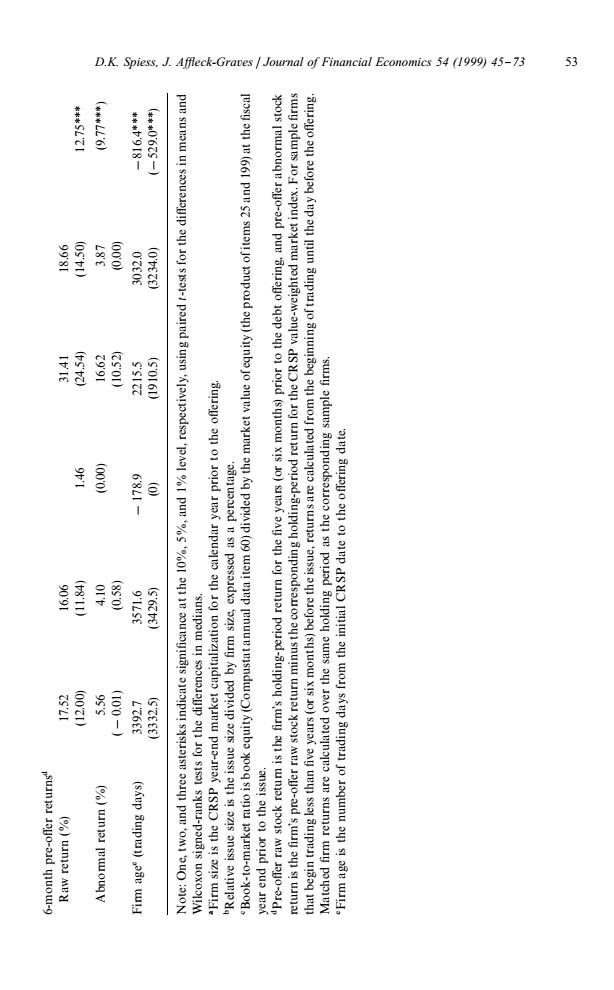

D.K. Spiess,J. Affleck-Graves Journal of Financial Economics 54 (1999)45-73 53 老老米0625-) 00k) 因 00.0 72809 44 2-. 25.0) (SOI6D) (000) (4s) 寻 (80.m (S'6VE) 255m 00.21) 100-) K2689 929t5) (SAep Buipul)ae uld6-month pre-o !er returns$ Raw return (%) 17.52 16.06 31.41 18.66 (12.00) (11.84) 1.46 (24.54) (14.50) 12.75*** Abnormal return (%) 5.56 4.10 (0.00) 16.62 3.87 (9.77***) (!0.01) (0.58) (10.52) (0.00) Firm age% (trading days) 3392.7 3571.6 !178.9 2215.5 3032.0 !816.4*** (3332.5) (3429.5) (0) (1910.5) (3234.0) ( !529.0***) Note: One, two, and three asterisks indicate signi"cance at the 10%, 5%, and 1% level, respectively, using paired t-tests for the di !erences in means and Wilcoxon signed-ranks tests for the di !erences in medians. !Firm size is the CRSP year-end market capitalization for the calendar year prior to the o !ering. "Relative issue size is the issue size divided by "rm size, expressed as a percentage. #Book-to-market ratio is book equity (Compustat annual data item 60) divided by the market value of equity (the product of items 25 and 199) at the "scal year end prior to the issue. $Pre-o !er raw stock return is the "rm's holding-period return for the "ve years (or six months) prior to the debt o !ering, and pre-o !er abnormal stock return is the "rm's pre-o !er raw stock return minus the corresponding holding-period return for the CRSP value-weighted market index. For sample "rms that begin trading less than "ve years (or six months) before the issue, returns are calculated from the beginning of trading until the day before the o !ering. Matched "rm returns are calculated over the same holding period as the corresponding sample "rms. %Firm age is the number of trading days from the initial CRSP date to the o !ering date. D.K. Spiess, J. A{eck-Graves / Journal of Financial Economics 54 (1999) 45}73 53