正在加载图片...

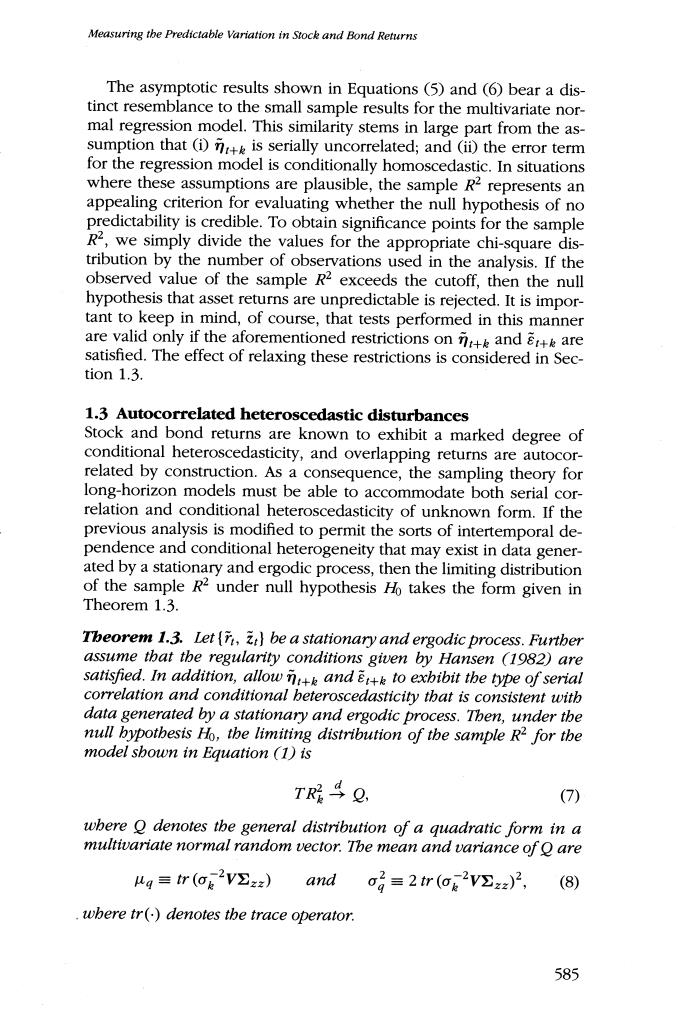

Measuring the Predictable Variation in Stock and Bond Returns The asymptotic results shown in Equations (5)and (6)bear a dis- tinct resemblance to the small sample results for the multivariate nor- mal regression model.This similarity stems in large part from the as- sumption that (i)is serially uncorrelated;and (ii)the error term for the regression model is conditionally homoscedastic.In situations where these assumptions are plausible,the sample R2 represents an appealing criterion for evaluating whether the null hypothesis of no predictability is credible.To obtain significance points for the sample R2,we simply divide the values for the appropriate chi-square dis- tribution by the number of observations used in the analysis.If the observed value of the sample R2 exceeds the cutoff,then the null hypothesis that asset returns are unpredictable is rejected.It is impor- tant to keep in mind,of course,that tests performed in this manner are valid only if the aforementioned restrictions on and are satisfied.The effect of relaxing these restrictions is considered in Sec- tion 1.3. 1.3 Autocorrelated heteroscedastic disturbances Stock and bond returns are known to exhibit a marked degree of conditional heteroscedasticity,and overlapping returns are autocor- related by construction.As a consequence,the sampling theory for long-horizon models must be able to accommodate both serial cor- relation and conditional heteroscedasticity of unknown form.If the previous analysis is modified to permit the sorts of intertemporal de- pendence and conditional heterogeneity that may exist in data gener- ated by a stationary and ergodic process,then the limiting distribution of the sample R2 under null hypothesis Ho takes the form given in Theorem 1.3. Theorem 1.3.Let (,be a stationary and ergodic process.Furtber assume that the regularity conditions given by Hansen (1982)are satisfied.In addition,allowk and to exbibit the type of serial correlation and conditional beteroscedasticity that is consistent with data generated by a stationary and ergodic process.Then,under the null bypotbesis Ho,the limiting distribution of the sample R2 for the model sbown in Equation (1)is TRQ. (7) wbere Q denotes the general distribution of a quadratic form in a multivariate normal random vector.The mean and variance of O are ug≡tr(o62V∑zz) and 0g=2r(o62V∑zz)2, (8) wbere tr()denotes the trace operator. 585