正在加载图片...

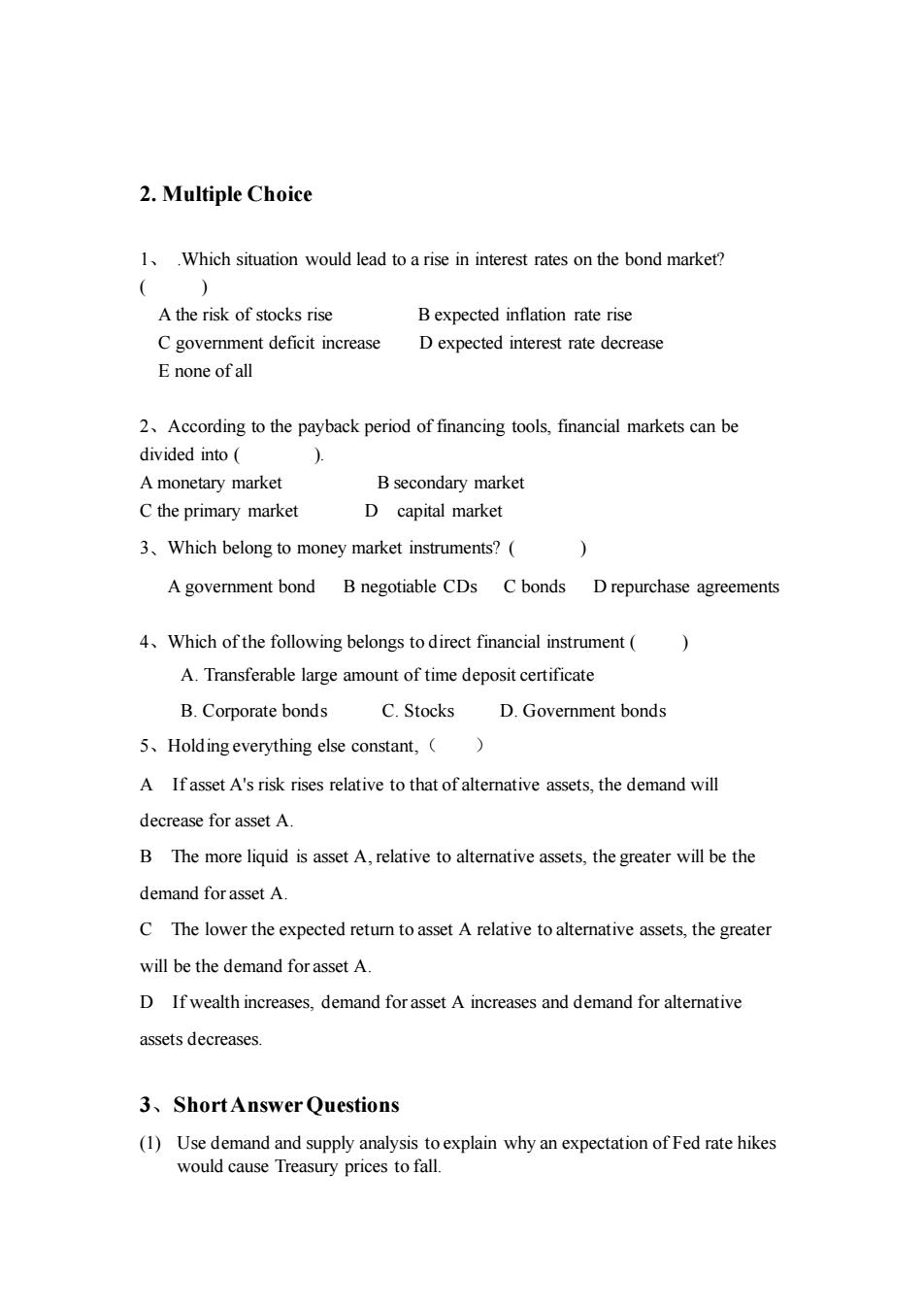

2.Multiple Choice 1,.Which situation would lead to a rise in interest rates on the bond market? () A the risk of stocks rise B expected inflation rate rise C government deficit increase D expected interest rate decrease E none of all 2.According to the payback period of financing tools,financial markets can be divided into ) A monetary market B secondary market C the primary market D capital market 3.Which belong to money market instruments?( A government bond B negotiable CDs C bonds D repurchase agreements 4.Which of the following belongs to direct financial instrument() A.Transferable large amount of time deposit certificate B.Corporate bonds C.Stocks D.Government bonds 5.Holding everything else constant,( A If asset A's risk rises relative to that of alternative assets,the demand will decrease for asset A B The more liquid is asset A,relative to alternative assets,the greater will be the demand for asset A. C The lower the expected return to asset A relative to alternative assets,the greater will be the demand for asset A. D If wealth increases,demand for asset A increases and demand for alternative assets decreases. 3.Short Answer Questions (1)Use demand and supply analysis to explain why an expectation of Fed rate hikes would cause Treasury prices to fall.2. Multiple Choice 1、 .Which situation would lead to a rise in interest rates on the bond market? ( ) A the risk of stocks rise B expected inflation rate rise C government deficit increase D expected interest rate decrease E none of all 2、According to the payback period of financing tools, financial markets can be divided into ( ). A monetary market B secondary market C the primary market D capital market 3、Which belong to money market instruments? ( ) A government bond B negotiable CDs C bonds D repurchase agreements 4、Which of the following belongs to direct financial instrument ( ) A. Transferable large amount of time deposit certificate B. Corporate bonds C. Stocks D. Government bonds 5、Holding everything else constant,( ) A If asset A's risk rises relative to that of alternative assets, the demand will decrease for asset A. B The more liquid is asset A, relative to alternative assets, the greater will be the demand for asset A. C The lower the expected return to asset A relative to alternative assets, the greater will be the demand for asset A. D If wealth increases, demand for asset A increases and demand for alternative assets decreases. 3、Short Answer Questions (1) Use demand and supply analysis to explain why an expectation of Fed rate hikes would cause Treasury prices to fall