正在加载图片...

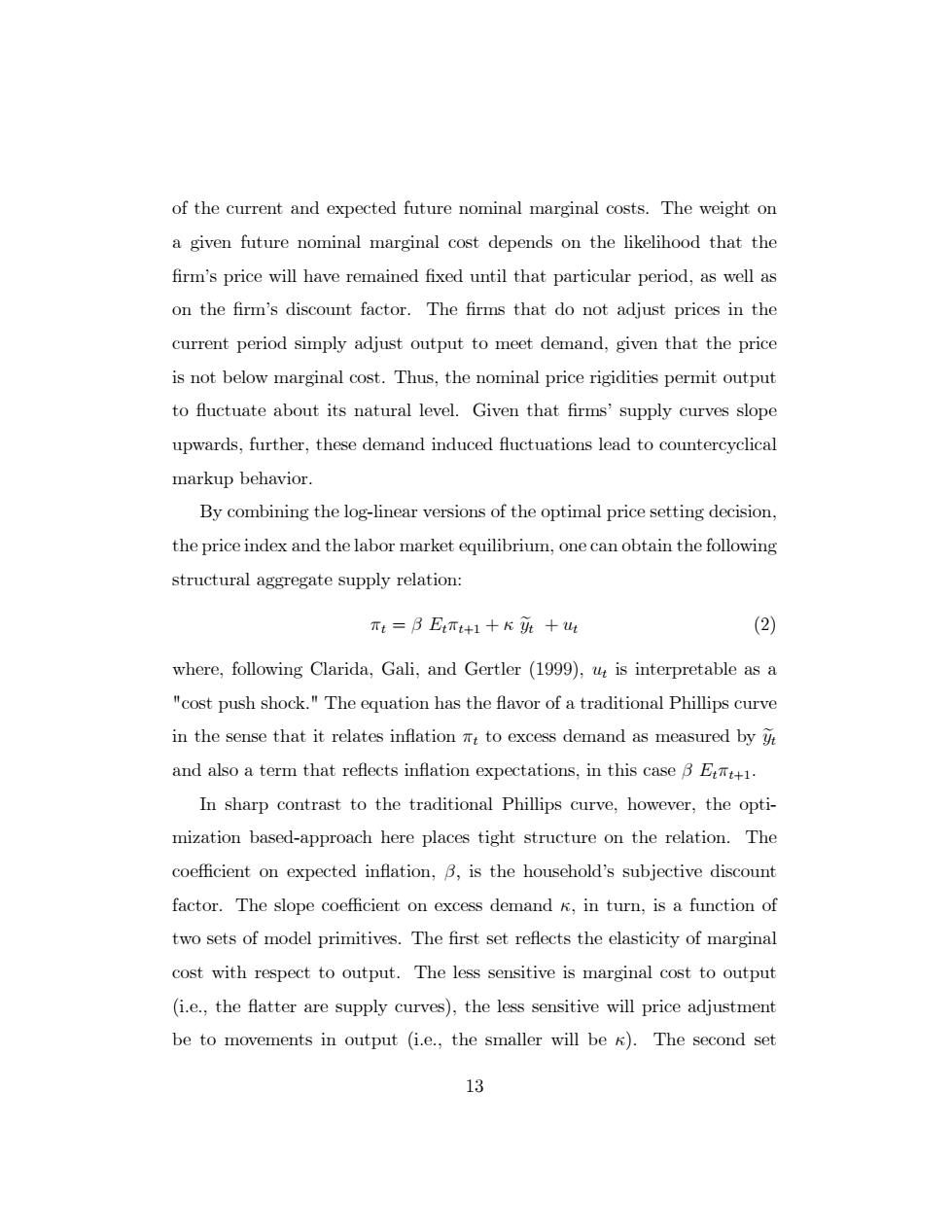

of the current and expected future nominal marginal costs.The weight on a given future nominal marginal cost depends on the likelihood that the firm's price will have remained fixed until that particular period,as well as on the firm's discount factor.The firms that do not adjust prices in the current period simply adjust output to meet demand,given that the price is not below marginal cost.Thus,the nominal price rigidities permit output to fluctuate about its natural level.Given that firms'supply curves slope upwards,further,these demand induced fluctuations lead to countercyclical markup behavior. By combining the log-linear versions of the optimal price setting decision, the price index and the labor market equilibrium,one can obtain the following structural aggregate supply relation: Tt=B ETt+1+K班+t (2) where,following Clarida,Gali,and Gertler (1999),uz is interpretable as a "cost push shock."The equation has the flavor of a traditional Phillips curve in the sense that it relates inflation mt to excess demand as measured by y and also a term that reflects inflation expectations,in this case B E. In sharp contrast to the traditional Phillips curve,however,the opti- mization based-approach here places tight structure on the relation.The coefficient on expected inflation,B,is the household's subjective discount factor.The slope coefficient on excess demand k,in turn,is a function of two sets of model primitives.The first set reflects the elasticity of marginal cost with respect to output.The less sensitive is marginal cost to output (i.e.,the flatter are supply curves),the less sensitive will price adjustment be to movements in output (i.e.,the smaller will be K).The second set 13of the current and expected future nominal marginal costs. The weight on a given future nominal marginal cost depends on the likelihood that the Örmís price will have remained Öxed until that particular period, as well as on the Örmís discount factor. The Örms that do not adjust prices in the current period simply adjust output to meet demand, given that the price is not below marginal cost. Thus, the nominal price rigidities permit output to áuctuate about its natural level. Given that Örmsí supply curves slope upwards, further, these demand induced áuctuations lead to countercyclical markup behavior. By combining the log-linear versions of the optimal price setting decision, the price index and the labor market equilibrium, one can obtain the following structural aggregate supply relation: t =

Ett+1 + yet + ut (2) where, following Clarida, Gali, and Gertler (1999), ut is interpretable as a "cost push shock." The equation has the áavor of a traditional Phillips curve in the sense that it relates ináation t to excess demand as measured by yet and also a term that reáects ináation expectations, in this case

Ett+1: In sharp contrast to the traditional Phillips curve, however, the optimization based-approach here places tight structure on the relation. The coe¢ cient on expected ináation,

; is the householdís subjective discount factor. The slope coe¢ cient on excess demand , in turn, is a function of two sets of model primitives. The Örst set reáects the elasticity of marginal cost with respect to output. The less sensitive is marginal cost to output (i.e., the áatter are supply curves), the less sensitive will price adjustment be to movements in output (i.e., the smaller will be ). The second set 13