正在加载图片...

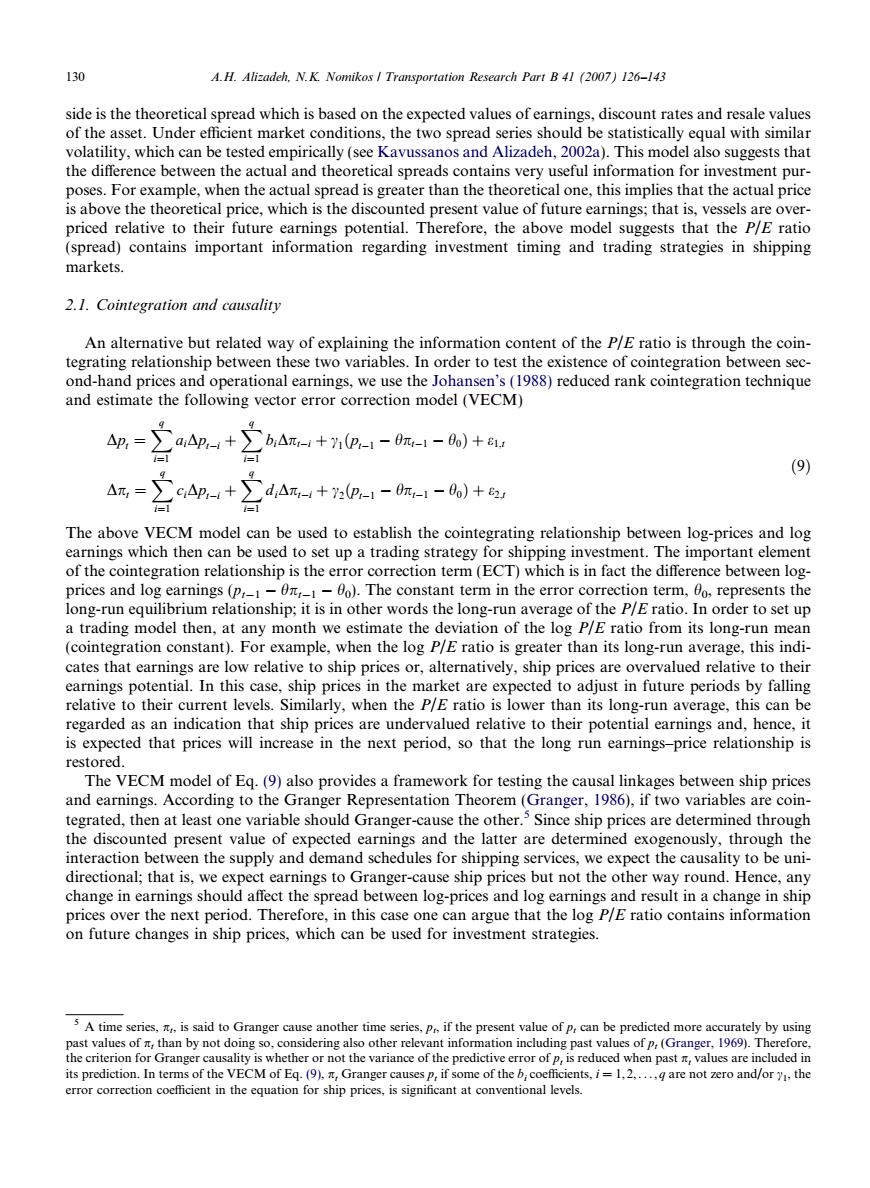

130 A.H.Alizadeh.N.K.Nomikos Transportation Research Part B 41 (2007)126-143 side is the theoretical spread which is based on the expected values of earnings,discount rates and resale values of the asset.Under efficient market conditions,the two spread series should be statistically equal with similar volatility,which can be tested empirically(see Kavussanos and Alizadeh,2002a).This model also suggests that the difference between the actual and theoretical spreads contains very useful information for investment pur- poses.For example,when the actual spread is greater than the theoretical one,this implies that the actual price is above the theoretical price,which is the discounted present value of future earnings;that is,vessels are over- priced relative to their future earnings potential.Therefore,the above model suggests that the P/E ratio (spread)contains important information regarding investment timing and trading strategies in shipping markets. 2.1.Cointegration and causality An alternative but related way of explaining the information content of the P/E ratio is through the coin- tegrating relationship between these two variables.In order to test the existence of cointegration between sec- ond-hand prices and operational earnings,we use the Johansen's(1988)reduced rank cointegration technique and estimate the following vector error correction model (VECM) 4g,=2a4p4+2A4+a-1-m1-)+ =1 (9) △m,=∑cAp-+d,Am-+zp-1-0m-1-0o)+ The above VECM model can be used to establish the cointegrating relationship between log-prices and log earnings which then can be used to set up a trading strategy for shipping investment.The important element of the cointegration relationship is the error correction term(ECT)which is in fact the difference between log- prices and log earnings(p,1-01-00).The constant term in the error correction term,00,represents the long-run equilibrium relationship;it is in other words the long-run average of the P/E ratio.In order to set up a trading model then,at any month we estimate the deviation of the log P/E ratio from its long-run mean (cointegration constant).For example,when the log P/E ratio is greater than its long-run average,this indi- cates that earnings are low relative to ship prices or,alternatively,ship prices are overvalued relative to their earnings potential.In this case,ship prices in the market are expected to adjust in future periods by falling relative to their current levels.Similarly,when the P/E ratio is lower than its long-run average,this can be regarded as an indication that ship prices are undervalued relative to their potential earnings and,hence,it is expected that prices will increase in the next period,so that the long run earnings-price relationship is restored. The VECM model of Eq.(9)also provides a framework for testing the causal linkages between ship prices and earnings.According to the Granger Representation Theorem(Granger,1986),if two variables are coin- tegrated,then at least one variable should Granger-cause the other.Since ship prices are determined through the discounted present value of expected earnings and the latter are determined exogenously,through the interaction between the supply and demand schedules for shipping services,we expect the causality to be uni- directional;that is,we expect earnings to Granger-cause ship prices but not the other way round.Hence,any change in earnings should affect the spread between log-prices and log earnings and result in a change in ship prices over the next period.Therefore,in this case one can argue that the log P/E ratio contains information on future changes in ship prices,which can be used for investment strategies. 5 A time series,is said to Granger cause another time series,P if the present value of p can be predicted more accurately by using past values of than by not doing so,considering also other relevant information including past values of p,(Granger,1969).Therefore. the criterion for Granger causality is whether or not the variance of the predictive error of p,is reduced when past,values are included in its prediction.In terms of the VECM of Eq.(9),n,Granger causes p,if some of the b;coefficients,i=1,2,...,g are not zero and/or y,the error correction coefficient in the equation for ship prices,is significant at conventional levels.side is the theoretical spread which is based on the expected values of earnings, discount rates and resale values of the asset. Under efficient market conditions, the two spread series should be statistically equal with similar volatility, which can be tested empirically (see Kavussanos and Alizadeh, 2002a). This model also suggests that the difference between the actual and theoretical spreads contains very useful information for investment purposes. For example, when the actual spread is greater than the theoretical one, this implies that the actual price is above the theoretical price, which is the discounted present value of future earnings; that is, vessels are overpriced relative to their future earnings potential. Therefore, the above model suggests that the P/E ratio (spread) contains important information regarding investment timing and trading strategies in shipping markets. 2.1. Cointegration and causality An alternative but related way of explaining the information content of the P/E ratio is through the cointegrating relationship between these two variables. In order to test the existence of cointegration between second-hand prices and operational earnings, we use the Johansen’s (1988) reduced rank cointegration technique and estimate the following vector error correction model (VECM) Dpt ¼ Xq i¼1 aiDpti þXq i¼1 biDpti þ c1ðpt1 hpt1 h0Þ þ e1;t Dpt ¼ Xq i¼1 ciDpti þXq i¼1 diDpti þ c2ðpt1 hpt1 h0Þ þ e2;t ð9Þ The above VECM model can be used to establish the cointegrating relationship between log-prices and log earnings which then can be used to set up a trading strategy for shipping investment. The important element of the cointegration relationship is the error correction term (ECT) which is in fact the difference between logprices and log earnings (pt1 hpt1 h0). The constant term in the error correction term, h0, represents the long-run equilibrium relationship; it is in other words the long-run average of the P/E ratio. In order to set up a trading model then, at any month we estimate the deviation of the log P/E ratio from its long-run mean (cointegration constant). For example, when the log P/E ratio is greater than its long-run average, this indicates that earnings are low relative to ship prices or, alternatively, ship prices are overvalued relative to their earnings potential. In this case, ship prices in the market are expected to adjust in future periods by falling relative to their current levels. Similarly, when the P/E ratio is lower than its long-run average, this can be regarded as an indication that ship prices are undervalued relative to their potential earnings and, hence, it is expected that prices will increase in the next period, so that the long run earnings–price relationship is restored. The VECM model of Eq. (9) also provides a framework for testing the causal linkages between ship prices and earnings. According to the Granger Representation Theorem (Granger, 1986), if two variables are cointegrated, then at least one variable should Granger-cause the other.5 Since ship prices are determined through the discounted present value of expected earnings and the latter are determined exogenously, through the interaction between the supply and demand schedules for shipping services, we expect the causality to be unidirectional; that is, we expect earnings to Granger-cause ship prices but not the other way round. Hence, any change in earnings should affect the spread between log-prices and log earnings and result in a change in ship prices over the next period. Therefore, in this case one can argue that the log P/E ratio contains information on future changes in ship prices, which can be used for investment strategies. 5 A time series, pt, is said to Granger cause another time series, pt, if the present value of pt can be predicted more accurately by using past values of pt than by not doing so, considering also other relevant information including past values of pt (Granger, 1969). Therefore, the criterion for Granger causality is whether or not the variance of the predictive error of pt is reduced when past pt values are included in its prediction. In terms of the VECM of Eq. (9), pt Granger causes pt if some of the bi coefficients, i = 1, 2,...,q are not zero and/or c1, the error correction coefficient in the equation for ship prices, is significant at conventional levels. 130 A.H. Alizadeh, N.K. Nomikos / Transportation Research Part B 41 (2007) 126–143����������������