正在加载图片...

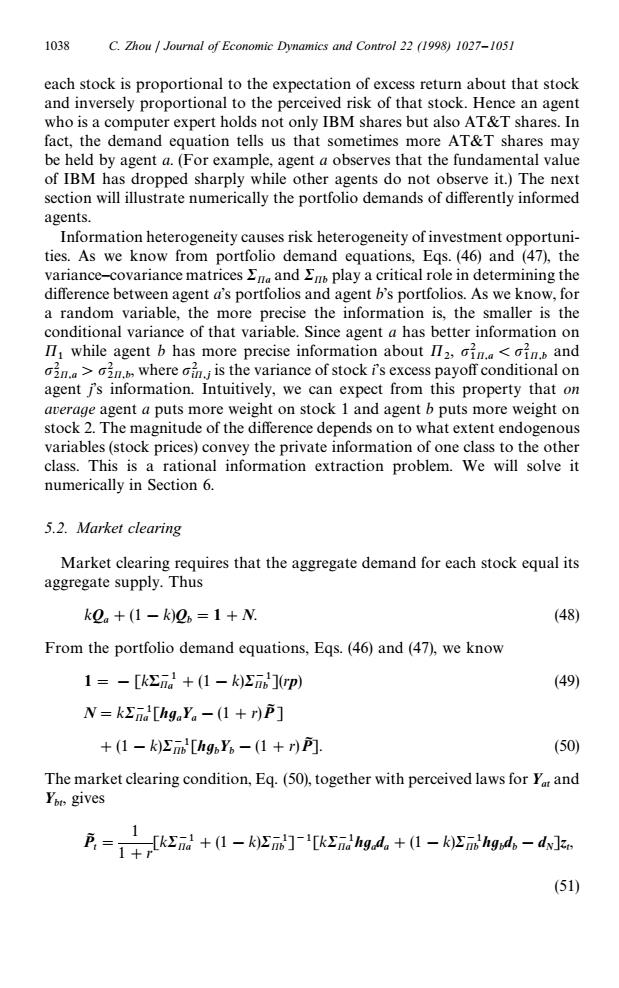

1038 C.Zhou Journal of Economic Dynamics and Control 22 (1998)1027-1051 each stock is proportional to the expectation of excess return about that stock and inversely proportional to the perceived risk of that stock.Hence an agent who is a computer expert holds not only IBM shares but also AT&T shares.In fact,the demand equation tells us that sometimes more AT&T shares may be held by agent a.(For example,agent a observes that the fundamental value of IBM has dropped sharply while other agents do not observe it.)The next section will illustrate numerically the portfolio demands of differently informed agents. Information heterogeneity causes risk heterogeneity of investment opportuni- ties.As we know from portfolio demand equations,Eqs.(46)and (47),the variance-covariance matrices En and Em play a critical role in determining the difference between agent a's portfolios and agent b's portfolios.As we know,for a random variable,the more precise the information is,the smaller is the conditional variance of that variable.Since agent a has better information on II while agent b has more precise information about I2,cin.<in and >where n is the variance of stock i's excess payoff conditional on agent i's information.Intuitively,we can expect from this property that on average agent a puts more weight on stock 1 and agent b puts more weight on stock 2.The magnitude of the difference depends on to what extent endogenous variables(stock prices)convey the private information of one class to the other class.This is a rational information extraction problem.We will solve it numerically in Section 6. 5.2.Market clearing Market clearing requires that the aggregate demand for each stock equal its aggregate supply.Thus k2a+(1-k)2=1+N (48) From the portfolio demand equations,Egs.(46)and (47),we know 1=-[kEnd +(1-k)](rp) (49) N=kEnd[hgaYa -(1+r)P] +(1-k)E'[hgY6-(1+r)P]. (50) The market clearing condition,Eq.(50),together with perceived laws for Yr and Yot gives 户=十与k2+-'[Egd+1-层g4-d。 (51)each stock is proportional to the expectation of excess return about that stock and inversely proportional to the perceived risk of that stock. Hence an agent who is a computer expert holds not only IBM shares but also AT&T shares. In fact, the demand equation tells us that sometimes more AT&T shares may be held by agent a. (For example, agent a observes that the fundamental value of IBM has dropped sharply while other agents do not observe it.) The next section will illustrate numerically the portfolio demands of differently informed agents. Information heterogeneity causes risk heterogeneity of investment opportunities. As we know from portfolio demand equations, Eqs. (46) and (47), the variance—covariance matrices RPa and RPb play a critical role in determining the difference between agent a’s portfolios and agent b’s portfolios. As we know, for a random variable, the more precise the information is, the smaller is the conditional variance of that variable. Since agent a has better information on P1 while agent b has more precise information about P2 , p2 1P,a (p2 1P,b and p2 2P,a 'p2 2P,b , where p2 i P,j is the variance of stock i’s excess payoff conditional on agent j’s information. Intuitively, we can expect from this property that on average agent a puts more weight on stock 1 and agent b puts more weight on stock 2. The magnitude of the difference depends on to what extent endogenous variables (stock prices) convey the private information of one class to the other class. This is a rational information extraction problem. We will solve it numerically in Section 6. 5.2. Market clearing Market clearing requires that the aggregate demand for each stock equal its aggregate supply. Thus kQa #(1!k)Qb "1#N. (48) From the portfolio demand equations, Eqs. (46) and (47), we know 1" (49) N"kR~1 Pa [hu a Ya !(1#r)PI] #(1!k)RP~1b [hu b Yb !(1#r) PI]. (50) The market clearing condition, Eq. (50), together with perceived laws for Yat and Ybt, gives PI t " 1 1#r [kR~1 Pa #(1!k)R~1 Pb ]~1[kRP~1a hu a d a #(1!k)R~1 Pb hu b d b !d N ]z t , (51) 1038 C. Zhou / Journal of Economic Dynamics and Control 22 (1998) 1027–1051