正在加载图片...

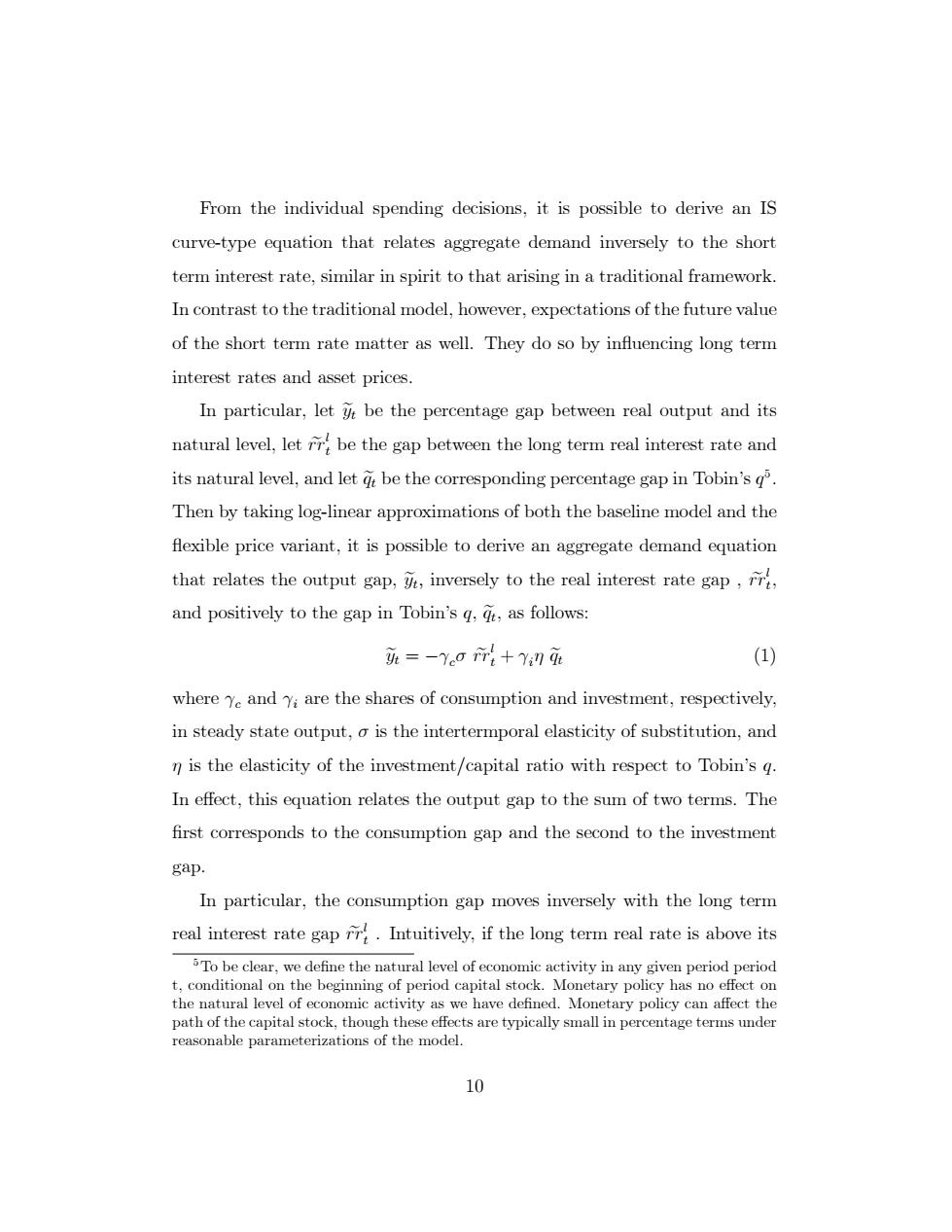

From the individual spending decisions,it is possible to derive an IS curve-type equation that relates aggregate demand inversely to the short term interest rate,similar in spirit to that arising in a traditional framework. In contrast to the traditional model,however,expectations of the future value of the short term rate matter as well.They do so by influencing long term interest rates and asset prices. In particular,let yt be the percentage gap between real output and its natural level,letrr be the gap between the long term real interest rate and its natural level,and let gt be the corresponding percentage gap in Tobin's g Then by taking log-linear approximations of both the baseline model and the fexible price variant,it is possible to derive an aggregate demand equation that relates the output gap,inversely to the real interest rate gap,r, and positively to the gap in Tobin's g,gt,as follows: 班=-Ye0m+Y初 (1) where Ye and Yi are the shares of consumption and investment,respectively, in steady state output,o is the intertermporal elasticity of substitution,and n is the elasticity of the investment/capital ratio with respect to Tobin's g. In effect,this equation relates the output gap to the sum of two terms.The first corresponds to the consumption gap and the second to the investment gap. In particular,the consumption gap moves inversely with the long term real interest rate gap r.Intuitively,if the long term real rate is above its 5To be clear,we define the natural level of economic activity in any given period period t,conditional on the beginning of period capital stock.Monetary policy has no effect on the natural level of economic activity as we have defined.Monetary policy can affect the path of the capital stock,though these effects are typically small in percentage terms under reasonable parameterizations of the model. 10From the individual spending decisions, it is possible to derive an IS curve-type equation that relates aggregate demand inversely to the short term interest rate, similar in spirit to that arising in a traditional framework. In contrast to the traditional model, however, expectations of the future value of the short term rate matter as well. They do so by ináuencing long term interest rates and asset prices. In particular, let yet be the percentage gap between real output and its natural level, let rre l t be the gap between the long term real interest rate and its natural level, and let qet be the corresponding percentage gap in Tobinís q 5 : Then by taking log-linear approximations of both the baseline model and the áexible price variant, it is possible to derive an aggregate demand equation that relates the output gap, yet ; inversely to the real interest rate gap , rre l t , and positively to the gap in Tobinís q, qet , as follows: yet = c rre l t + i qet (1) where c and i are the shares of consumption and investment, respectively, in steady state output, is the intertermporal elasticity of substitution, and is the elasticity of the investment/capital ratio with respect to Tobinís q. In e§ect, this equation relates the output gap to the sum of two terms. The Örst corresponds to the consumption gap and the second to the investment gap. In particular, the consumption gap moves inversely with the long term real interest rate gap rre l t . Intuitively, if the long term real rate is above its 5To be clear, we deÖne the natural level of economic activity in any given period period t, conditional on the beginning of period capital stock. Monetary policy has no e§ect on the natural level of economic activity as we have deÖned. Monetary policy can a§ect the path of the capital stock, though these e§ects are typically small in percentage terms under reasonable parameterizations of the model. 10