正在加载图片...

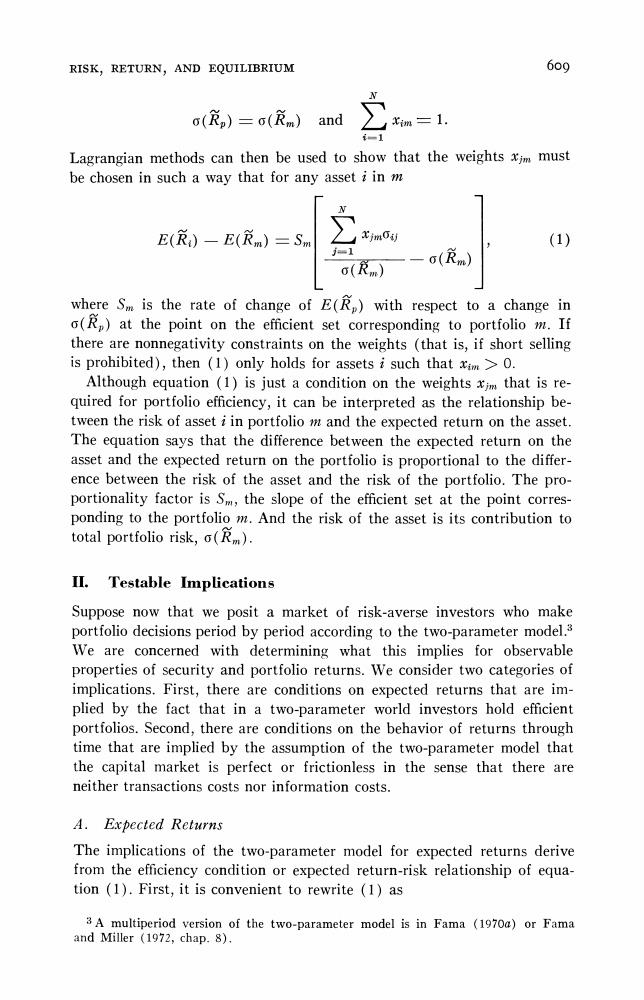

RISK,RETURN,AND EQUILIBRIUM 609 o(p)=o(rm)and ∑m=1 i Lagrangian methods can then be used to show that the weights xim must be chosen in such a way that for any asset i in m E(范)一E(n)=Sm (1) where Sm is the rate of change of E(Rp)with respect to a change in (R)at the point on the efficient set corresponding to portfolio If there are nonnegativity constraints on the weights (that is,if short selling is prohibited),then (1)only holds for assets i such that xim>0. Although equation (1)is just a condition on the weights xim that is re- quired for portfolio efficiency,it can be interpreted as the relationship be- tween the risk of asset i in portfolio i and the expected return on the asset. The equation says that the difference between the expected return on the asset and the expected return on the portfolio is proportional to the differ- ence between the risk of the asset and the risk of the portfolio.The pro- portionality factor is Sm,the slope of the efficient set at the point corres- ponding to the portfolio m.And the risk of the asset is its contribution to total portfolio risk,(m). II.Testable Implications Suppose now that we posit a market of risk-averse investors who make portfolio decisions period by period according to the two-parameter model.3 We are concerned with determining what this implies for observable properties of security and portfolio returns.We consider two categories of implications.First,there are conditions on expected returns that are im- plied by the fact that in a two-parameter world investors hold efficient portfolios.Second,there are conditions on the behavior of returns through time that are implied by the assumption of the two-parameter model that the capital market is perfect or frictionless in the sense that there are neither transactions costs nor information costs. A.Expected Returns The implications of the two-parameter model for expected returns derive from the efficiency condition or expected return-risk relationship of equa- tion (1).First,it is convenient to rewrite (1)as 3A multiperiod version of the two-parameter model is in Fama (1970a)or Fama and Miller (1972,chap.8)