正在加载图片...

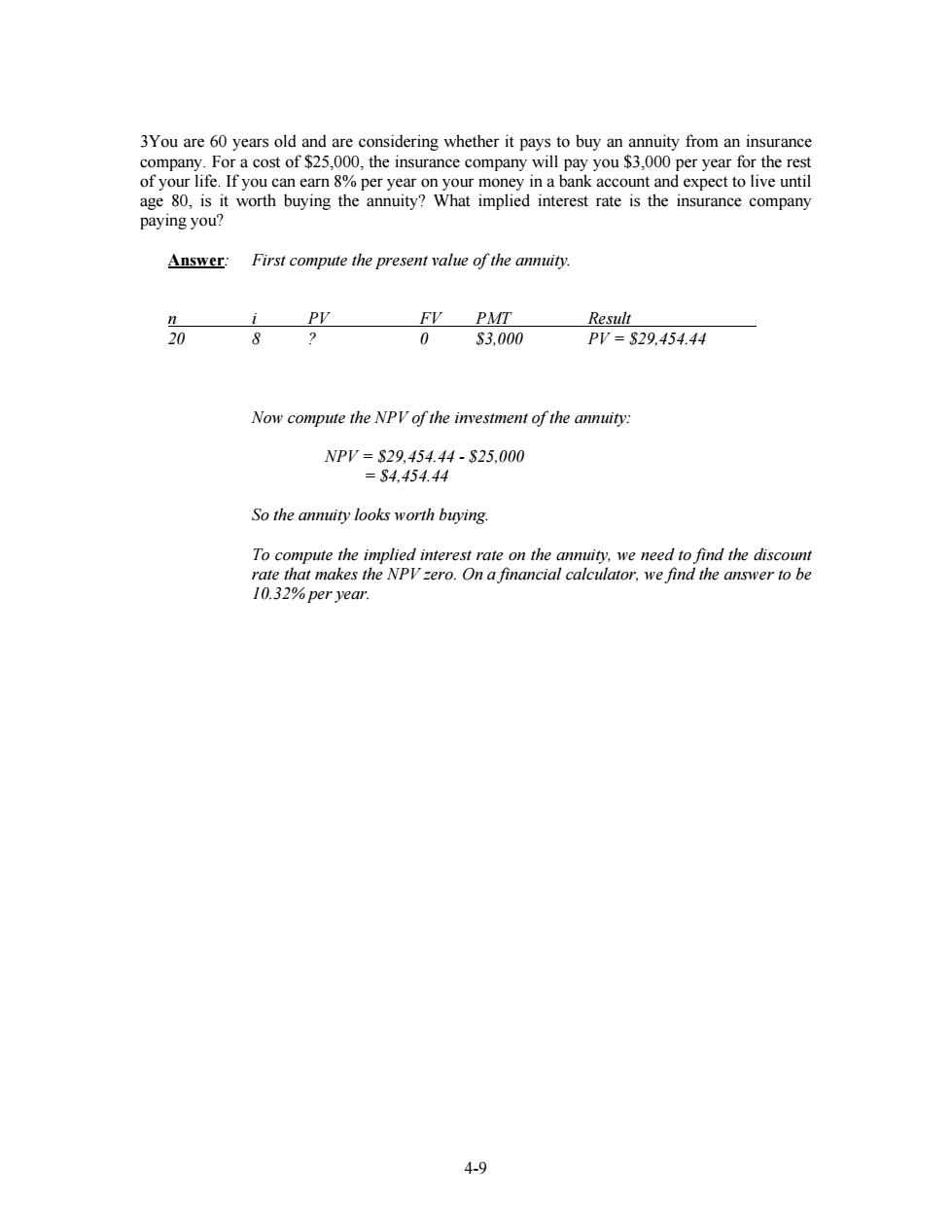

3You are 60 years old and are considering whether it pays to buy an annuity from an insurance company.For a cost of $25,000,the insurance company will pay you $3,000 per year for the rest of your life.If you can earn 8%per year on your money in a bank account and expect to live until age 80,is it worth buying the annuity?What implied interest rate is the insurance company paying you? Answer. First compute the present value of the annuity. n PV FV PMT Result 20 8 0 3,000 PV=S29.454.44 Now compute the NPV of the investment of the annuity: NPV=S29,454.44-S25,000 =S4.454.44 So the annuity looks worth buying. To compute the implied interest rate on the annuity,we need to find the discount rate that makes the NPV zero.On a financial calculator,we find the answer to be 10.32%per year. 4-94-9 3You are 60 years old and are considering whether it pays to buy an annuity from an insurance company. For a cost of $25,000, the insurance company will pay you $3,000 per year for the rest of your life. If you can earn 8% per year on your money in a bank account and expect to live until age 80, is it worth buying the annuity? What implied interest rate is the insurance company paying you? Answer: First compute the present value of the annuity. n i PV FV PMT Result 20 8 ? 0 $3,000 PV = $29,454.44 Now compute the NPV of the investment of the annuity: NPV = $29,454.44 - $25,000 = $4,454.44 So the annuity looks worth buying. To compute the implied interest rate on the annuity, we need to find the discount rate that makes the NPV zero. On a financial calculator, we find the answer to be 10.32% per year